We have a saying around our household. It goes like this: All we need is a thousand 1,000s. In our quest to put together a $1 million liquid portfolio, it’s a refreshing way to think of the goal. I might not be making million dollar decisions every day, but I do often think in terms of $1,000 bucks. If there’s something I can do to get one of those $1,000s, I’ll probably do it.

Thinking in terms of saving up a $1 million is too large of a goal, even if we’re on track to hit it fairly soon. Humans are horrible at delaying gratification for some future benefit. But breaking up a big goal into several smaller goals? That’s not so hard.

So let’s see what we can do to put together a few of the $1,000 blocks we need.

Found money / the lazy approach

If you give me any unexpected money, there’s a 99% chance it’ll end up in my Vanguard account. It’s the benefit of a high income. Everyday expenses are covered with monthly cashflow which makes it nearly automatic (mentally) to deposit any surprise funds into the investment account.

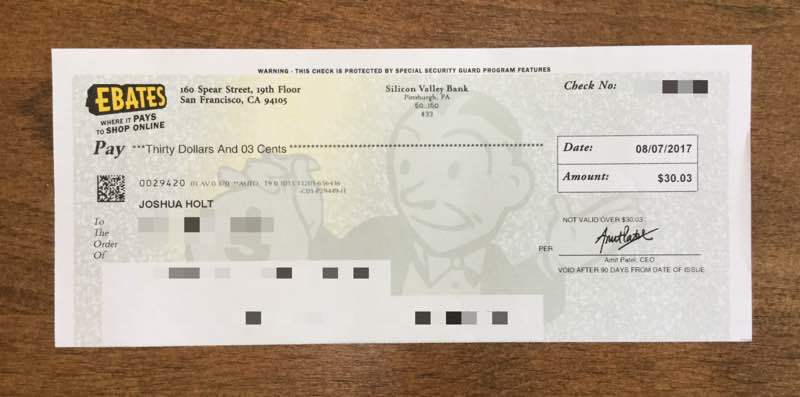

For example, from time to time these small checks show up from Ebates. I had to look up my history of the account for this article and it turns out these checks have been arriving since 2005. They’re never large amounts but they always represent unexpected money.

What’s a little strange is that I get a thrill depositing these checks and then manually initiating a transfer of $30.03 to my investment account. Sure, it’s not much but it adds up over time, particularly when you have a variety of these checks coming in.

I’m not very good at the active hustle these days (like Financial Panther getting 5% interest on his savings account by opening a small army of micro accounts) but I’m still a big fan of the lazy approach.

Ebates is the quintessential lazy approach.

There’s two ways that Ebates makes being lazy easy.

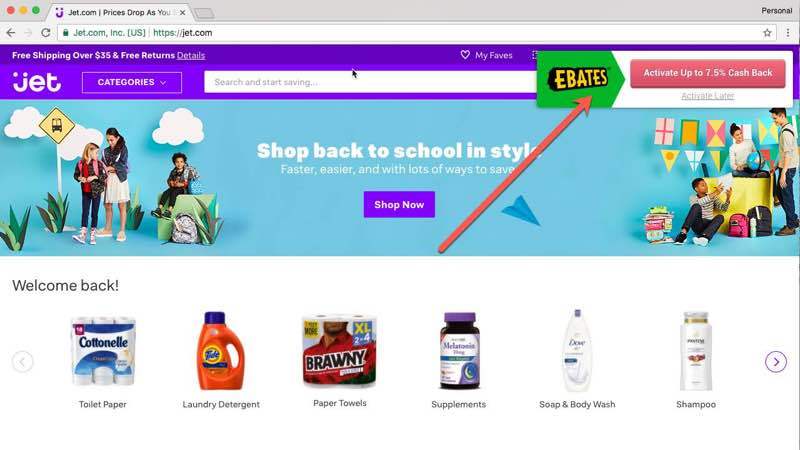

1) The Browser Extension. If you’re on a site where Ebates offers cash back, you’ll get a little pop up in the upper right-hand corner. Click that button and you’ll save a certain percentage on your order. Here’s me saving on household items from Jet.

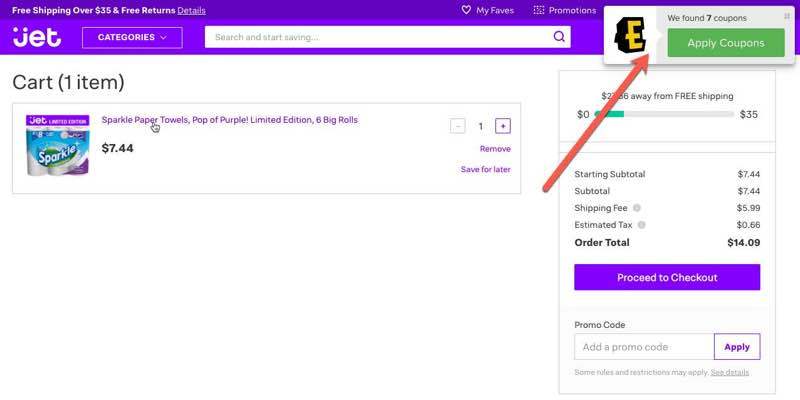

2) Applying Coupons. Most of the time, I’m too lazy to search the internet to see if there’s a coupon available for my purchase. Thankfully Ebates does this for me. When you get to the checkout, another little pop up shows up. You click the button and Ebates will try to apply a few coupon codes to see if it can save you money. I’m surprised at how often this works. There’s nothing for you to do but sit back and let it do its thing.

If you’re interested in signing up, you’ll get a $10 welcome bonus (and I’ll get $5).

Everyday spending / the lazy approach part 2

You’re probably using a rewards credit card and paying off the balance each month if you’re reading this blog. But if you’re not, for only a few small tweaks in your spending habits you can begin to collect a little cashback over time. Surprisingly, it adds up and could easily count as a few of your $1,000s.

Here’s how I do it.

First, I’m no longer a master of travel hacking. Sure, I have a couple hundred thousand Chase Ultimate Reward points and about the same in the American Express Membership Reward points. These mainly come from taking advantage of 100,000 point offers when I see them (like the Chase Sapphire Reserve 100,000 point offer that ended earlier this year). The points are valuable and I’m game to scoop them up when it’s easy.

But, when it comes to redeeming miles I no longer have the interest in finding the perfect route on a partner airline to score a first class ticket across a magical three leg journey following somebody’s guide on Reddit. It just isn’t as fun as it used to be.

When I redeem miles, I usually take one of two approaches: (1) when planning a trip, I’ll check and see how many miles it would take and, if reasonable, book the trip with miles or (2) buy tickets through a site like Chase’s travel portal where you can redeem 1 point for 1.5 cents worth of travel (side note: Chase allows you to consolidate points across family accounts, which is super helpful).

I figure if I can get 1.5 cents per point I’m doing pretty good, particularly if I use a Chase card for dining purchases since you’ll get 3 points per $1 spent (i.e. an effective cash back rate of 4.5%). I recently booked two upcoming trips using Chase Ultimate Reward points and like that using their portal is like buying tickets through a site similar to Kayak except for the fact that you don’t pay with dollars at the end.

Now, of course if you’re a hardcore travel hacker there are ways to extract much more value from miles/points. But the point is that there’s no need to let the concept of “travel hacking” turn you away from pursuing a travel rewards credit card. If you stick with either the Chase or American Express programs, you can acquire a lot of value for very little effort on your part.

On the other hand, if you’re not interested in accumulating miles/points and just want to stick with cashback, there are plenty of credit cards that will give you a certain percentage back in cash automatically.

As I’ve acquired more and more points, the straight cashback offers are more attractive. Lately, I’ve been using USAA’s 2.5% Limitless Cashback card for most non-dining purchases. Rather than deal with converting the points into actual dollars, there’s not much you have to do when you get cashback since it’s already in dollars for you! This card is available with no annual fee, so it’s a no-brainer. USAA is only offering it in a limited number of areas (AL, AR, AZ, CO, CT, FL, GA, HI, ID, IL, IN, KS, LA, MD, MI, MN, MT, ND, NM, NV, NY, OR, PA, RI, SC, TN, TX and WA). To find it, click on this link, scroll down and select “return to all credit cards” and then click on “cash back cards”. If you’re not eligible for the USAA card, you can find plenty of 2% cashback cards with a quick Google search.

Other options

Rather than go in depth on all the other ways that you can shave a few percent off purchases or save a bit more money, I thought I’d round out the article by listing a few more options worth exploring:

- Buy Gift Cards. There’s several active marketplaces where you can buy gift cards for less than face value. If you’re making a purchase with the retailer anyway, you might as well save a bit, right? For example, as of the date of this article Raise is selling Ride Aid gift cards for 6.8% off. Rite Aid happens to sell some quality craft beers at the lowest prices I’ve seen in the city. Another example is Sephora gift cards, which are currently going for 5.6% off. It’s up to you if you think this is worth your time. I mostly skip over stuff like this now but nice to know the option exists (ironically, Ebates let’s you stack another 1% cashback on any purchases made on Raise, so there’s another 1% for you).

- Sell Gift Cards. I’m definitely a fan of this. If I end up with a gift card that I don’t want, it’s gotten pretty easy to sell it and convert into cash. Converted cash goes straight into the investment account.

- Law School Loans. Don’t forget that you can get $200-$400 in cash when you refinance your law school loans, which is a pretty healthy portion of a $1,000.

- Surveys. Have you ever received a marketing email at work from someone looking for your opinion on a law related product in exchange for $200? I have! If it’s a slow week, I’m more than happy to be interviewed for an hour in exchange for a couple hundred bucks.

- Sell Things on Amazon/Ebay/Craigslist. All three have great marketplaces where you can list and easily sell items for not a lot of work. If you have things around the house that you no longer want (that isn’t sparking joy), why not list it and sell it? You’ll benefit both from having less stuff around the house and some extra cash.

- Pick up a Side Hustle. There’s one side hustling lawyer that’s making several thousands a year through the gig economy. Are any of these appealing to you?

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is always negotiating better student loan refinancing bonuses for readers of the site.

One of my lazy ways: One of our local grocery stores has its own gas station chain; the gas is always competitive with other gas stations but slightly more than Costco, BJs, Sams. As part of this, for every $50 in gift cards you buy, you get $0.10 (and sometimes more, like this week when its $0.20) off per gallon — its saved on your store card which you swipe before you ump (you do not have to use the discount, you can roll it over). Basically, if you have $0.20 saved you will be getting the best price available.

So, when we go to the grocery store, I simply grab another $100 (or whatever) for Amazon, Target, Lowes/Home Depot or whatever I need for the chores coming up. Yes, you front load your expenses, and you do have to make sure you dont lose the gift card, but its a real easy way to save. I usually get a free tank every other month, which is a savings of almost $40. Its not much, but it is also limited to no effort. That said, we had some new windows put in our 3 seasons room a few years back and I went and bought $3k in home depot gift cards which I then used to pay for the windows. This was extra good because I have the Chase freedom card and “grocery stores” was 5% that quarter AND I got 4 or 5 free gas fill ups.

Another great example of a lazy approach that easily helps you build $1,000. Thanks for sharing! The fact that your grocery store lets you buy gift cards with a credit card is great so you can take advantage of those rotating 5% categories. If I were going to purchase something for $3K from Home Depot, I would definitely take the time to figure out a way to shave a few percentage off the top just like you did. The gas trick is even better.

That’s a good way to think about accumulating $1MM. That number does seem astronomical, but if you break it down, it is achievable.

My lazy way has been selling off stuff I don’t need anymore, through Craigslist or Facebook. Especially when I am trying to have more of a minimalistic lifestyle. This is a win-win.

Another not so lady way would be Rover, but I do enjoy being around dogs.

I’ve thought about signing up to Rover. It’s probably something we should do. Would be great to have dogs around on the weekend!