Sitting in the middle of a large conference room, I remember filling out my W-4 with no idea of how many allowances I should be taking. Didn’t I want to put down a high number so less money would be going to the IRS? Should I put down a low number to get a nice tax refund? Here’s some financial steps I should have taken that summer.

First: don’t spend all your money

As a summer associate, you can expect to make between $30,000 – $36,000 depending on the length of the program. I remember my fellow summer associates and thought about this in two ways: (1) it seemed an absurd amount of money for 10 weeks of work; and (2) it was a drop in the bucket compared to my student loans.

Because both statements are true, it’s easy to not take the salary that seriously. After all, it’s summer and you’re having a fabulous time. Everyone is telling you to enjoy it because real work is nothing like being a summer associate. So why not spend some money? After all, you’ve worked incredibly hard to get a coveted summer associate position. It makes sense to live a little?

Well, good news! You can live a lot without spending a dime. The firm’s summer program is going to treat you to a lot of food and entertainment. You shouldn’t be paying for anything. On days when there are no events, go home and sleep. Sleeping is free.

The key is that you’re trying to build good habits now when it comes to protecting your income. This means being smart about taking advantage of the firm programs and being defensive about spending your own cash.

Second: spend as little on rent as possible

One way to be defensive on spending is to pay as little money as possible on housing. I slept on a floor mattress in a bedroom of a converted warehouse that more resembled a warehouse than whatever it was converting into. We had an industrial exhaust fan that kept us cool. We road bikes inside at night. A dance company used the space to practice during the day. I’m not making this up.

It was fun, cheap and practical. I spent so little time there, it didn’t make sense to have a nice place. When I was there it was an adventure.

I knew fellow summer associates living in dorm rooms. Given the summer exodus of college students, it makes a lot of sense to find a cheap dorm room for the 10 weeks you are in a summer program.

Biglaw Budget Template

Convert income into wealth. Budgeting may seem unnecessary when you're making hundreds of thousands of dollars a year, but unless you plan to continue doing so forever (or, even if you do), a simple budget will help maximize the conversion of your income into wealth.

| Item | Price |

|---|---|

| Biglaw Budget Template | FREE |

Third: Contribute the maximum to a Roth IRA

Another benefit of being a summer associate is that you’ll have some earned income this year. Take advantage by making a Roth IRA contribution. If you don’t yet have a Roth IRA account, it’s a great time to get one started. I recommend Vanguard. We have no financial relationship.

You can contribute up to $5,500 to the Roth IRA. You’ll pay minimal income taxes today in exchange for tax-free growth and tax-free withdrawal after you reach 59 1/2 years old. The great thing about Roth IRAs is that your contributions can be withdrawn at any time after five years, so if you absolutely have to get the money back later you can.

Another reason to open up a Roth IRA account is you want to get started training yourself to save money. Once you’re a full time associate you should be maxing out this account each year. By creating the account now, you’ll make it that much easier for your future self to make the $5,500 deposit (assuming the Backdoor Roth IRA remains an option).

Should you contribute to a Traditional IRA instead of a Roth IRA? I don’t think so. With a Traditional IRA, you pay with pre-tax dollars, but the savings will be minimal with your summer associate income bracket (about 15% of $5,500). Plus, there’s a benefit to having access to both pre-tax (i.e. 401K) and post-tax (i.e. Roth IRA) in retirement, so it’s good to have a mix of both.

Fourth: the money that you save does make a difference

During my summer, I was guilty of looking at $35,000 as a drop in the bucket compared to my law student loans. That’s because it can seem insignificant in the grand scheme of things.

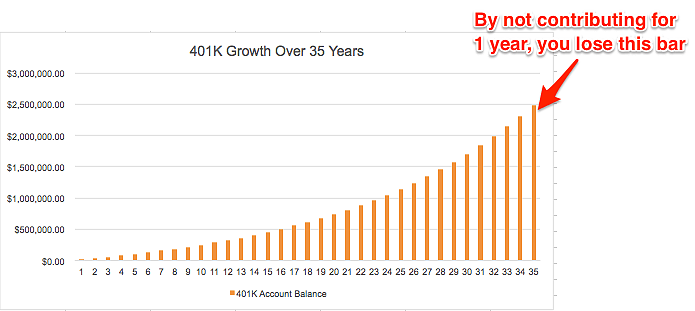

There’s a few reasons why the money is more valuable than you think. First, as you probably already know, for the magic of compound interest to work you need a long time horizon. The hardest part to grasp is that for every year earlier you begin saving, the benefit you get is the growth in the last year. Below is a chart to illustrate the point, but you can think of each year you delay saving as chopping off a bar on the far right of the column because each year you don’t save you compress the time for compound interest to work.

Another reason is the inverse of saving. By reducing the amount of your student loans, you lowering the amount of time it will take you to repay them. Believe me, there is a big difference between $220,000 of student loan debt and $210,000 of student loan debt. It may not seem like much when you have no income and are dealing with astronomical numbers, but that $10,000 difference could cost you two months of working. When you start your career, you want options – using money from your summer associate internship will give you options down the road.

Fifth: you can claim as many W-4 allowances as you want

Around this time of year, there’s always conversations about W-4 allowances. The worksheet will tell you to put down only a few. Some summer associates will ask if you can list 40 allowances. HR doesn’t care. You can do whatever makes sense to you. I recommend leaving it at two allowances and taking the big IRS refund in the spring of the next year.

Why? Because it takes so much more energy to be disciplined while you’re a summer associate. Why not let the government take a little extra? You’ll appreciate the $3,000 that shows up in the spring more than you’ll appreciate the extra $600 in your paycheck.

If you want to dial in your W-4 allowances just right, it’s as simple as running your numbers through the IRS Withholding Calculator.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is currently looking for additional lenders to add to Biglaw Investor’s JD Mortgage service which connects readers with lenders offering special mortgages for high-income professionals.

Assuming the money isn’t otherwise needed directly for tuition or living expenses, would it be a good idea for a summer associate to pay off $2,500 of their student loan interest and claim the Student Loan Interest Deduction on their taxes? Absent other immediate needs of the summer pay, this seems like a good idea to (1) lower your tax burden and (2) pay off $2,500 of loan interest that would otherwise keep growing during 3L. (This also assumes a student has accrued this much interest from two years of law school.) Thoughts?