Every month, a few days after the 1st, we sit down on a weekend for a monthly financial meeting. It sounds formal but I can assure you that most meetings are conducted in pajamas with a hot cup of tea.

We call it “running the numbers” and it doesn’t take very long.

My wife and I didn’t start this ritual because we’re obsessed with personal finances. It’s not because each month we’re giddy to tally up our assets and liabilities and judge our progress. It’s just a simple way to make sure we’re on the same page financially and to visualize our progress. After all, it’s one thing to say you’re going to max out a retirement account in January and it’s another thing to watch yourself do it each month. Give yourself the benefit of visualizing your progress.

Here’s a few reasons why I think our monthly meeting has been so successful:

- What Gets Measured Gets Managed. Peter Drucker often gets the credit for that quote but I suspect it predates him. There’s a lot of power in the simplicity of measuring something. Even if you’re not actively trying to manage your finances, simply measuring once a month will go a long way to prompting you to make behavioral changes. It also helps you know how you’re doing. How can you know whether you’re making any progress if you’re not measuring yourself? A lot of people have truly terrible goals like “save more money” or “get out of debt soon”. When you have an impossible goal like “save more money” you’re setting yourself up for disappointment. Meanwhile, something simple like “save $10,000” is a lot easier to understand and implement. It’s even better if you write down and track your progress.

- No Judgment Zone. We may be measuring ourselves each month, but we’re not wasting time judging ourselves. There are no conversations about how we could of, should have or would have done better. This train only moves in one direction: forward. If things didn’t go as planned, we simply shrug and move on. We all lead busy lives. Checking in once a month on personal finances is barely a blip on the radar screen. Instead of agonizing (or celebrating), the goal is really just to be conscious about what’s happening. How much are we actually saving a month? What did we do with all that money from our wedding? Do we still need to do a Backdoor Roth IRA before the year is over?

- Implementation Takes Time. When we got married, I told you that we’d be shifting our income to take advantage of additional retirement accounts. That’s not as easy as snapping your fingers once. There are a lot of false starts, confirming that forms have been filed and then making sure appropriate amounts are being taken out of paychecks. Additionally, if you are the spouse that’s watching your paycheck getting cut in half it’s pretty nice to see your retirement accounts growing. We’re much more likely to make a slight adjustment during a given month and check back a month later as opposed to obsessing over details and hoping for a perfect implementation. Even if I wanted to, you usually can’t do it. Try getting FedLoan Servicing to respond in a timely manner. You’ll drive yourself crazy!

- It Prompts Bigger Discussions. Occasionally a monthly meeting will turn into a much bigger conversation about finances. Marriage? Kids? Parents? Home? Everything is tied to finances, so sometimes it’s nice to have a place where you can discuss everything else that’s going on in life. Although I make it sound like this monthly meeting is for couples, I had my own version of the monthly meeting long before I was married. And no, I wasn’t exactly talking to myself. Rather, each month I tallied up the numbers and then spent a few minutes reflecting on what happened and what I expected to happen during the next month.

The meeting: What actually happens

Here’s exactly what happens every time we “run the numbers”.

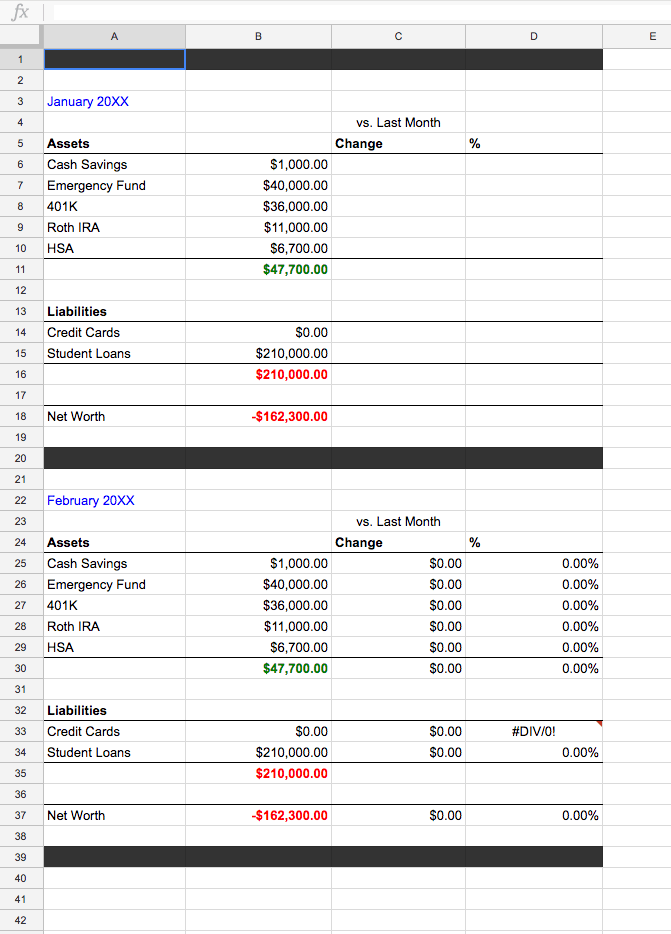

I spend less than thirty minutes every month on the 1st updating our net worth chart. It’s not a very fancy chart. I’ve been using it for over a decade. It looks just like the example below.

Each month I copy and paste a new month below the old month. I add up the various accounts and then the spreadsheet does the rest, including telling us how much our net worth has increased or decreased each month. I’ve seen charts that are ten times fancier and more complicated. I’ve considered adopting those in the past. In the end, I prefer my simple chart.

Once we go through the net worth update, we have a good idea of whether it was a successful month or not. Did our net worth increase as much as it normally does? If it didn’t, why not? Are we on track to hit our savings numbers? How much longer will that take?

Seeing our net worth increase gives us satisfaction. It lets us know that we’re saving the right amount (although in a bull market, a lot of your “increase” will be due to your investments generating more money than you do). It reminds us why we’re saving and gives us peace of mind that we’re more financially secure today than we were yesterday.

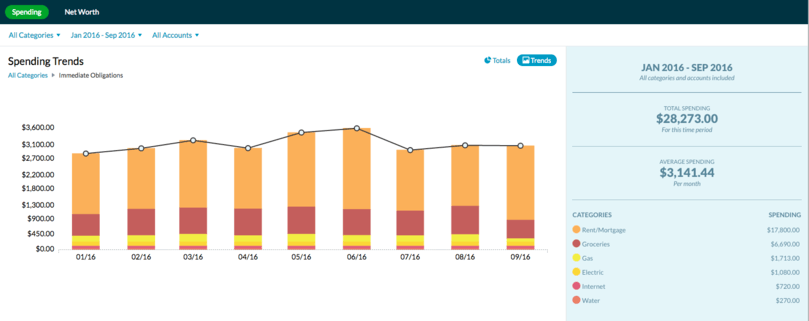

The next step is to review the monthly expenses. I use YNAB to put together a few pretty charts, since budgeting is for professionals (or maybe just beginners). Those mainly look like this (not my numbers):

The monthly expenses allow us to see if we’ve spent more than normal on a given category. Again, we’re too tired and busy to waste time judging ourselves. We simply shrug and move on. Yet, simply being “aware” has a powerful impact on your subconscious when it comes to future spending.

I see these expense reports like bumper rails in a bowling alley. They keep us from veering too far to the left or right and ensure that we’ll at least knock down some pins.

All this magic is captured and presented using an Apple TV to project a laptop screen on to the TV. The whole process takes about 30 mins of prep time and 20-30 mins of going over everything. That’s it and then we’re off to the rest of Saturday!

It’s surprising that something so low key can have such a big impact but if you’re anything like us, six months can fly by in the blink of an eye. Much better to catch and correct mistakes early rather than doing something in fits and starts. We’ve used this strategy for several years to ensure that we constantly have good, solid months. And what are good financials years if not simply a string of good financial months? Slow and steady wins the race.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is always negotiating better student loan refinancing bonuses for readers of the site.

We may or may not go over the bills monthly, it usually depends on the credit card bill — we put EVERYTHING we can on the credit card (and pay off obviously) so if the bill is more than expected, we may sit down and go over things. However, we do have a quarterly meeting to go over all finances. Rather than do a month-to-month net worth, I do it quarterly (although I have a good idea where everything stands during the quarter). I do this because by and large, the net worth does not change all that much month-to-month and also quarterly will help smooth out the blips of income and expenses for a more accurate picture.

I can see a lot of value to doing it quarterly. Checking once a month has the unfortunate side effect of making you more attuned to investment performance which is ironically the opposite of my goal. Thanks for sharing how you handle it!

My wife and I need to get around to doing this. We’re still doing the separate accounts thing, and while I’m obsessive about tracking my accounts, she’s not so much.

For example, the mortgage gets paid out of my wife’s bank account, so every month, I shoot her half the mortgage payment via square cash. I found out just a week ago that her debit card had expired, and thus, Square wasn’t automatically sending her the payments – instead, it was just sitting in her square cash account. The mortgage was getting paid every month, but her bank account was getting oddly low. And it was only after I checked her square account that I realized that she had 5 months of money I’d been sending over to her that was sitting in a random square account.

So this is a reminder to myself, probably time to do an inventory of our various accounts to make sure we’re not missing anything.

Hah, that’s a funny story. I guess the silver lining is that you probably could have sent the 5 months of money straight to an investment account. It’s almost like you tricked yourself into saving more money.