Credit reports play a large role in our lives but often contain inaccurate information. The inaccurate information can cause problems down the line when you apply for credit. While it’s annoying to routinely check your credit report, it’s the only way to make sure the information is accurate and to ensure other people aren’t using your identity.

If you’re interested in taking a deeper dive, Last Week Tonight with John Oliver covered the credit reporting bureaus on a recent show. It’s highly worth the 20 minutes of infotainment.

Requesting your credit report

Because of how important credit reports have become, in 2003 Congress made it mandatory for the big 3 credit reporting bureaus to provide free credit reports to consumers. You can obtain those free credit reports only at AnnualCreditReport.com. Note that AnnualCreditReport will not ask for any payment details, nor try to sell you access to your credit score (which is different from your credit report). They will also not try to get you to sign up to a monthly plan.

You can receive one free credit report from each agency per year. To keep it simple, I request a credit report once every four months by following the agencies in alphabetical order. In other words, Equifax in January-April, Experian in May-August and TransUnion in September-December. It takes a few minutes to request the report and another few minutes to scan through it to make sure the information is accurate.

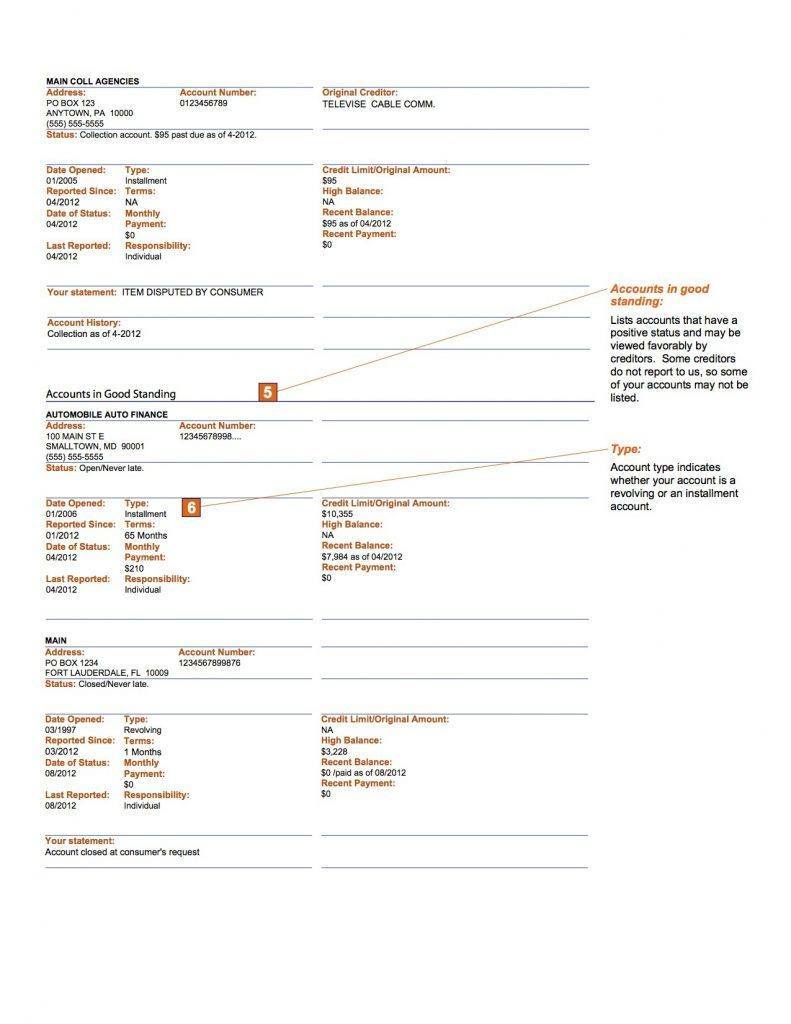

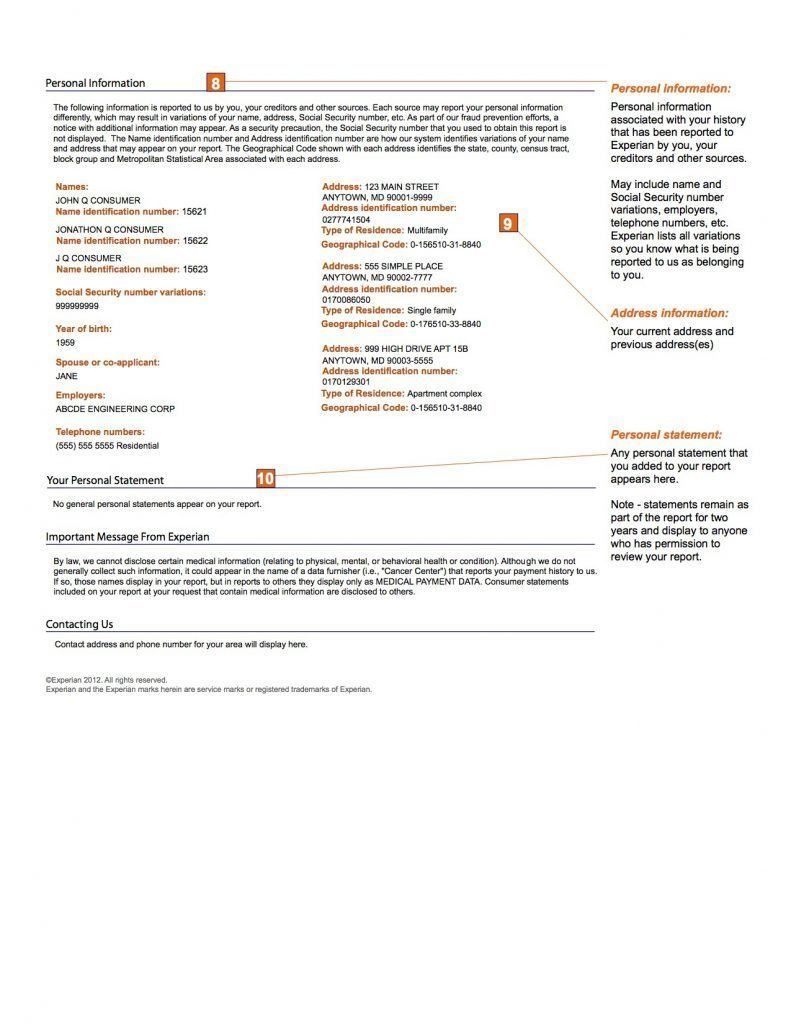

Below is a sample report from Experian to help you make sense of the information.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Great post! Credit freezes and fraud alerts are great free options for consumers to protect against identity theft.

I am a fellow attorney and wrote a recent article on this subject:

https://focusedfinancialfortune.com/credit-freezes-credit-locks-and-fraud-alerts-what-are-they-and-do-you-need-them/

Cheers!

Nice! Thanks for leaving the link on this article. Glad to see your site.