Recently I’ve been writing about student loans, saving money, hacking 529s and other ways to tighten up your financial life. Those are great defensive ways to build wealth. But what about going on the offense? What can you do to grow your net worth? While index funds may seem boring, it’s where I keep the majority of my investments (particularly all of my retirement accounts). I’ve learned that by accepting the market returns and minimizing investment fees I’ll end up with “above average” returns over the long haul. But that doesn’t mean that there aren’t great opportunities out there to put capital to work and I want to explore those as well.

Thankfully we live in an age where technology is changing the playing field when it comes to investment opportunities. In the 1990s we took the first step when low cost brokers opened up the public markets and anyone with a computer and modem could trade stocks for a a few bucks.

But in addition to the public markets, there are trillions of dollars in the private equity and debt markets as well. Often you’ll need to be an accredited investor to access those markets but if you can clear that hurdle, why not take advantage of deals that look good to you?

Back in April, I decided to test the waters with real estate lending by opening an account at a company called PeerStreet. The rest of the article covers the reasons I jumped into this market, the amount that I’ve invested and the diligence I’ve done.

What is hard money lending?

Hard money lending is an asset-backed loan by which the borrower receives funds secured by real property. You can’t walk into a bank and get a hard money loan based on the strength of your income. Lenders are solely interested in the value of the property that secures your loan. If a borrower fails to pay back a hard money loan, the lender will seize the underlying property and sell it. The lender takes the proceeds from the sale to repay the principal and interest due on the loan. Any excess funds are returned to the borrower.

Therefore, the most important aspect of a hard money loan is what’s called the Loan to Value (LTV). If you own a $100,000 property and take out a $75,000 hard money loan, you have a LTV of 75%. The lender takes a first priority lien position with respect to the property, which means the lender will get paid its $75,000 before the property owner can realize the $25,000 of remaining value.

This means it’s critical to nail the valuation. If you “think” the property is worth $100,000 but it’s really worth $75,000, then your LTV is 100% which doesn’t leave a lot of room for error. But more on that later.

Now that I’ve described it, you might think a hard money loan is similar to a traditional mortgage. The difference is that a mortgage is a very specific type of loan that must meet federal guidelines in order to be resold in the broader market. On the other hand, a hard money loan is a portfolio loan, which means the lender expects to keep the loan on its books for the duration of the loan’s term. Because the lender is keeping the loan, the lender isn’t concerned with meeting federal mortgage guidelines and can instead create its own underwriting process for the loan.

So by now you’re probably thinking that hard money loans are fly-by-night mortgages created by an unregulated industry for subprime borrowers. If you’ve gotten this far, stick with me because you’re about to see the value in hard money lending.

Nearly all hard money loans are for terms of 1 to 3 years and are designed for real estate investors.

Rather than assisting a home-owner with a mortgage, a hard money loan is designed for a real estate investor that is looking to make a business investment in a property, typically for a rehab and resale situation. Once they improve the property, they’ll be looking to exit the investment and that’s when you get paid back.

Why choose a hard money loan?

Here’s a few reasons why an investor might want to take a hard money loan:

- Need for Short-Term Financing. A commercial real estate investor has a plan for the property that typically involves a short period of time. They’re not looking for a 30-year mortgage and so want to skip the headaches of qualifying for a more regulated product.

- Quick Closing. Conventional lenders may take 45-90 days to issue a loan. A real estate investor wants to take advantage of an undervalued property immediately and often can’t afford to wait 90 days to purchase a property. They’ve identified an opportunity and want to take it off the market as soon as possible.

- Better Than Using Equity. Paying an 8-12% interest rate on a loan wouldn’t be considered cheap money, however, it’s still better than the commercial real estate investor using equity. The investor gets to take advantage of leverage and captures all of the upside for himself (rather than partnering with another equity investor) while leaving his equity available to multiple deals.

- Nature of Property Itself. In a fix-and-flip situation, by definition, the property needs some work. Since that’s exactly where the local real estate investor sees value, it makes it problematic to borrow from conventional sources. Traditional lenders shy away from situations where there are flaws in the property precisely because they don’t want to take on the additional risk. However, that’s exactly why the real estate investor wants to purchase the property.

- No Cash Flow. If a property is generating cash, you may be able to convince a traditional lender to take the cash flow into consideration. If the property isn’t generating cash, the risk to the lender is considerably higher. This makes it problematic when the property in question has been trashed and abandoned by the previous tenants or is sitting unused after being foreclosed by a bank.

What’s the lifecycle of hard money loan?

Let’s talk through an example of a hard money loan’s life cycle. First, a local real estate investor will identify a property that seems priced below market. It could be a repossession by a bank, sold in an estate sale or a situation where the buyers just want to sell as quickly as possible so they can get started with their retirement in Florida.

After the local real estate investor identifies the property, they’ll next look for a way they can add value. It might be some light rehab or it could be an entire gut job. Maybe it’s a rental property that needs better property management. Either way, the real estate investor will draw up plans for how to improve the property and how to achieve the desired exit opportunity, which is usually either selling it after rehab or finding long-term tenants.

Next, the real estate investor will secure some type of financing for the deal that will involve a mixture of the investor’s own equity and borrowing from a lender. The establishes the Loan to Value ratio that we discussed above.

Traditional banks are typically not interested in lending money in this situation, as the short-term loan isn’t a type of mortgage that the bank can liquidate into the global market so the real estate investor will need to look elsewhere.

In the past, the real estate investor worked with a group of private lenders (often wealthy individuals) that know and trust the real estate investor. He’ll take a short-term loan to purchase and rehab the property in exchange for paying a high interest rate of maybe 10-12%.

Assuming all goes well, the real estate investor will purchase and rehab the property. After a few months, he’ll either sell the property and pay off the hard money loan or he’ll find long-term tenants generating cash flow. Once he’s proven that the property is generating cash flow, he’ll refinance the loan using a more traditional approach to knock down the interest rate.

Technology and the changing nature of hard money lending

So we’ve established that hard money lending is short-term lending at higher interest rates backed by the value of the property. We also talked about the reasons why a local real estate investor would want a hard money loan. We also pointed out that these hard money loans are typically provided by small lenders or wealthy individuals in the same market as the local real estate lender.

But thanks to PeerStreet, that’s completely changed. Instead of local markets, PeerStreet is engineering a national platform that connects investors with local real estate investors. It does this by matching local originating lenders with a national capital market.

It works like this.

A local real estate investor sources a deal. He borrowers from a sponsor that he’s worked with previously. The sponsor then turns around and puts the loan on PeerStreet’s platform. Investors buy out the loan, often in amounts as low as $1,000 each, thereby returning the money to the sponsor who can now lend it again to the next real estate investor who finds a good deal.

When the real estate investor sells the property (or when the term of the original loan ends), the hard money lenders receive their principal and any unpaid interest.

In other words, unlike peer-to-peer lending, you make a short-term loan that’s backed by a real property asset. Your risk is measured by the Loan to Value ratio in that you should have a decent equity cushion that will shield you if there’s ever any problem with the property.

The downside of hard money lending for high-income professionals

Before we go any further, it’s important to point out the single greatest problem for high-income professionals is taxes. Any money that you make through hard money lending will be treated as ordinary income. This means those 10% rates could be more like 6% rates after factoring in taxes.

For that reason, it makes a lot of sense to open up a self-directed IRA for hard money lending. Although I haven’t done it, PeerStreet has partnered with a provider that can help you open a self-directed IRA.

Due diligence

When looking at any new platform, there are two concerns that immediately come to mind: (1) who is behind the platform and (2) the diligence on the underlying deal.

Starting at the top. Who is behind PeerStreet? What team dreamed up this blend of technology and a niche lending market? Well, you might be surprised to hear that it’s the brainchild of a former Biglaw real estate lawyer. Brew Johnson cut his teeth at Allen Matkins after graduating from UCLA law school. Meanwhile, Brett Crosby is the former founder of Urchin Software. You may not be familiar with Urchin but after Google acquired the company in 2005, they rebranded the product as Google Analytics, which is the industry gold standard in website analytics.

As far as I can tell, this is a powerful combination of technology and real estate skills with the added bonus of a cofounder coming out of Biglaw.

So if the team seems solid behind the platform, the next step is to get yourself enrolled so you can take a look at the actual deals.

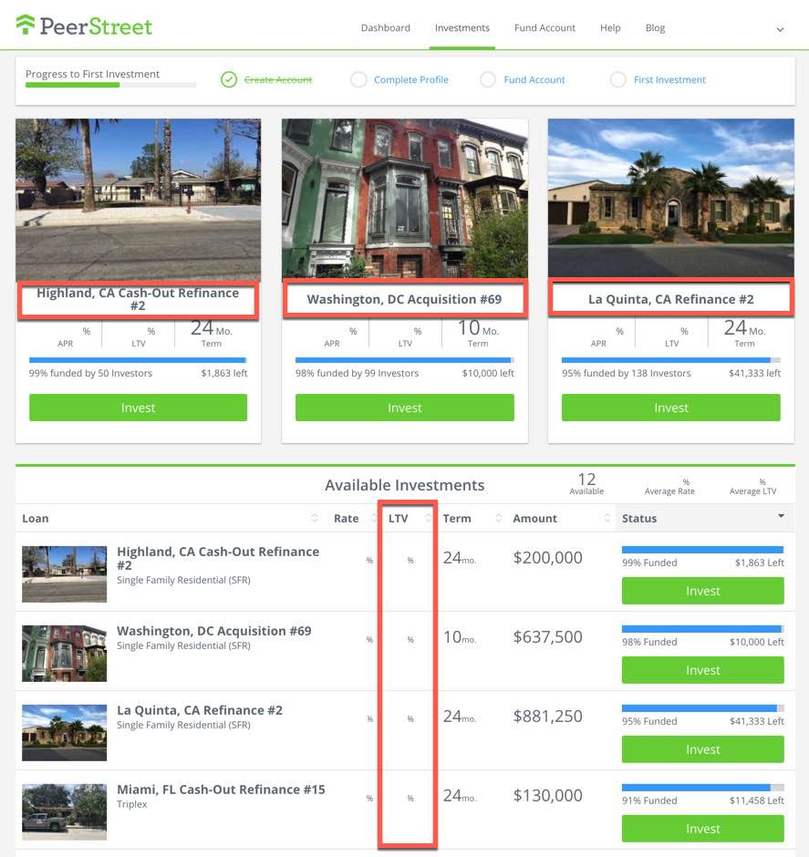

Here’s an example of the deals page. Once you click on a property, you’re given a lot of detail about the investment opportunity including a few things I found interesting (noted in the red boxes), such as: (1) the LTV or loan-to-value ratio of the property, which includes the amount of the loan compared to the amount of the most recent third-party appraisal (which you can download and review) and (2) the purpose of the loan, which in this example is a long-term rental.

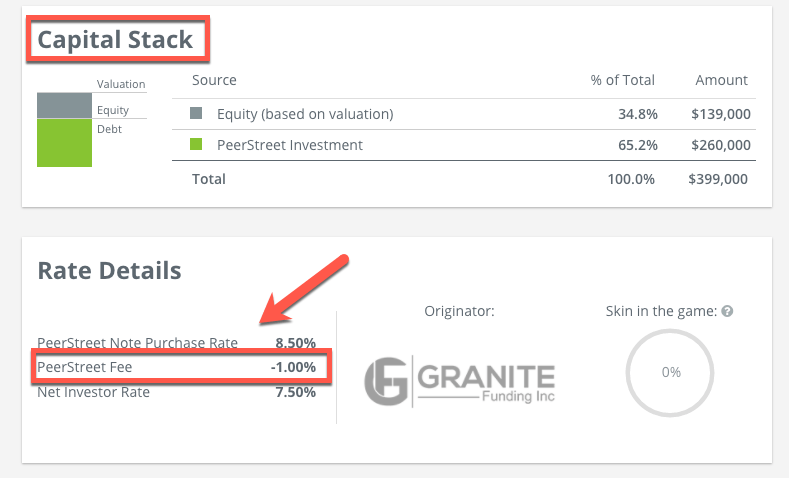

Next, you can take a look at one of the reasons why I’m excited about investing in PeerStreet: the Capital Stack.

If you look at the Capital Stack in the below screenshot, you’ll see that 34.8% of the property’s valuation is in equity with the remaining 65.2% allocated to debt.

Oh, and if you want to know how PeerStreet is making money in this, they show you that they’re taking 1% of the debt return off the top which is nice transparency.

So, theoretically, the property would need to see a reduction in value of 34.8% before the lender (that’s you) started to incur any losses in the principal invested. As Warren Buffett would say, this is the ideal place to be in an investment since it’s inherently less risky than the equity.

Of course, the flip side is also true, the equity stands to gain a much greater upside (potentially unlimited) since the house could be sold at an unknown high dollar amount, whereas the lender is limited to a return of 8.5% with 1% going to PeerStreet and 7.5% going to you.

I started with $5,000 in April but liked the platform so much that I put in another $5,000 about a month ago. I’ll probably keep this $10,000 investment steady for the next six months as I don’t anticipate having any additional cash flow to invest in PeerStreet, however, I will look at it again in 2018 and possibly consider increasing my position then.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

I’ve been hearing about Peer Street, so thank you for the review! I’m curious to see how the investments pan out for you in a year or so. Keep us posted on the progress!

So based on BGI reviews, it looks like Peer Street is the enemy of the high income professional. After all, the taxes he pays on returns from Peer Street are higher than taxes you pay on qualified dividend stocks. And he believes that qualified dividends are the enemy of the high income professional already..

DGI

Agreed. As I said in the article, it’s a pretty big downside to a high income professional to be involved in something generating ordinary (and unnecessary) income. I suggested a self-directed IRA if you get serious about it. On the other side, if you wanted to generate income in retirement this looks like a pretty good option.

I’ve invested with them for a little over a year. So far it’s been okay, but at the moment I have a few properties that Peer Street is foreclosing on, and other properties where “the lender is working with the borrower to cure the loan.” I’m a little nervous about how those will shake out, but Peer Street’s track record has been good, so I’m optimistic.

I like peer street much better than other peer lenders . Particularly the asset backed nature of the investment. However I don’t like the cash drag and the fact that the deals go so quickly its impossible to do due diligence.

I’ve been an investor with Peer Street a little over two years. While I was still a high income earner, it did suck for my tax situation, but I wanted to experiment with it and figure it a out because now that I’m retired, I love it as an investment vehicle because I have a predictable stream of income every month which is meeting my cash flow needs nicely.

Yes, some payments go late and I factor that into my predicted cash flow, but now that I have a sizeable account, that is well diversified with a bunch of $1000-$3000 loans, it doesn’t really matter too much.

I also have some general lending rules I like to follow – I don’t like unguaranteed deals as a rule of thumb, and I also stay away from low personal credit scores. My portfolio is pretty solid, on the surface. The test will come though the next recession, and I will get to see if this is correlated to the stock market or not.

How do you implement your rules? It seems like the loans fund too quickly to really do any diligence. Do you try to look to see whether the deals are guaranteed and backed by higher personal credit scores during the few minutes the loans are live?

Sorry for the delay… I don’t due a ton of due diligence other than to check out how much skin in the game the Borrowers have on the transaction, quick check of the lender to see if they have any defaulted loans on Peer Street or ones with issues (I have a few lenders I don’t like for one reason or another, if a loan goes late early on or some other sketchiness, I have a little list on my desk of ones I don’t like), check the loan to value at inception, loan to value stressed, personal credit score and whether or not they have a guarantor. On a rare occasion, I might do a bit of additional due diligence in the region. All this can be done within 60-90 seconds (short of the additional due diligence). I was in the commercial real estate lending industry for 20 years (just retired) so I have an advantage that way though it’s safe to say lending money isn’t as complex as law, medicine or rocket science. I have a tad bit of knowledge of a lot of metropolitan real estate markets (only enough to be dangerous). Basically, I stick to sound lending principles. Peer Street now emails you to tell you when the new investments will be released, so you can stick around and get a shot at the investments if you want. But, I am not typically on my computer at the time they are released. I use the automated investing and I have 24 hours to cancel my investment if I don’t like it – and use the quick checklist above to do so. At the risk of making my reply too long, today I happened to be here before the loans were released so I jammed through the automated investments and cancelled one, and then was able to get into a different one I did like by refreshing my page right at 12:00 pm (PST) and checking the metrics quickly. I don’t stress too much about this piece of it – only about 5% of my investments have been done this way. Sorry for the lengthy response but happy to answer any follow up questions.

Thanks for the long reply. This type of experience is exactly what people love to read. Lots of good ideas in here, particularly doing diligence on some of the lenders in advance and coming up with a list of those that you want to work with and those you want to avoid. I can see that making it more efficient as review options and make quick decisions about whether to invest or not.

I like this site, and have recommended it to others. But this Review is beyond misleading. Before anyone invests a dime in these platforms, you need to understand exactly what you’re buying. These loans are UNSECURED. Even though Peerstreet’s Note to the borrower is asset-backed, the loans that PeerStreet sells to investors on its platform ARE NOT asset-backed. It’s right there in it’s FAQs:

“No, the Notes issued through the platform are not secured. The loan underlying each Note issuance, however, is secured by the underlying real estate.”

So the loan underlying the Note is secured. But the Note itself isn’t secured. You, as an investor, have no security in the property.

So if you’re lending through this platform, understand that you’re simply making a regular commercial loan to Peerstreet. You’re not buying a secured Note.

Peerstreet is now doing some squirrely stuff with their Pocket product.

I requested a withdrawal of 100% of my Pocket funds in early January. On January 31st, the day they should have released my funds, they shut down the program and stopped withdrawals. On February 10th they released 5% of my funds. To date, they still have 95% of the money that was in my account. Every 2 weeks or so they send an update.

NOTICE OF (I) FILING OF BANKRUPTCY PETITIONS AND RELATED

DOCUMENTS AND (II) AGENDA FOR HEARING ON FIRST DAY PLEADINGS

SCHEDULED FOR JUNE 28, 2023 AT 2:00 P.M. (ET), BEFORE

THE HONORABLE LAURIE SELBER SILVERSTEIN IN THE UNITED STATES

BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE2

This hearing will be conducted in-person. Any exceptions must be approved by

chambers.

Parties may observe the hearing remotely by registering with the Zoom link below no

later than June 28, 2023 at 11:00 a.m.

https://protect-

us.mimecast.com/s/LbTtCBBnAoFRRlzGizRpkG?domain=debuscourts.zoomgov.com

After registering your appearance by Zoom, you will receive a confirmation email

containing information about joining the hearing.