The most important number during a young lawyer’s early accumulating years is the savings rate. I say this because many investors focus on increasing or “chasing” high returns in the market. Both have a place, but your savings rate is more important now. Your rate of return is important after you’ve built wealth.

In other words, it’s not how much money you make, it’s how much money you keep. To build wealth, there’s only one path forward: sheer brute savings.

Hypothetical

Let’s take two identical people, Tom and Jerry. Both are 30 and both are just beginning to save.

Tom focuses on chasing performance returns. He’s able to put away $1,000 a month and somehow is managing to get a return of 12% in the market (let’s ignore that such a performance would make Tom one of the world’s great money mangers and that if he could achieve a consistent 12% return, he should probably stop practicing law and start managing money full time). Tom will have $210,588 in 10 years.

Jerry focuses on maximizing his savings rate. He’s able to put away $2,000 a month, wants to retire early and gets a healthy 9% return in the market through investing in index funds. Jerry will have $364,632 in 10 years. If he increases his savings rate to $3,000 a month, in 10 years he will have $546,947.

When you are in the accumulating phase of building wealth, nothing beats the raw force of saving as much as you can. It’s only later in life, once you’ve saved up a significant sum, that your rate of return kicks in as a more important contributor to building wealth.

Your rate of return is important later

After you’ve built wealth, your rate of return becomes more important because you need the wealth in the first place to get the benefits of compound interest. Warren Buffett summed it up well:

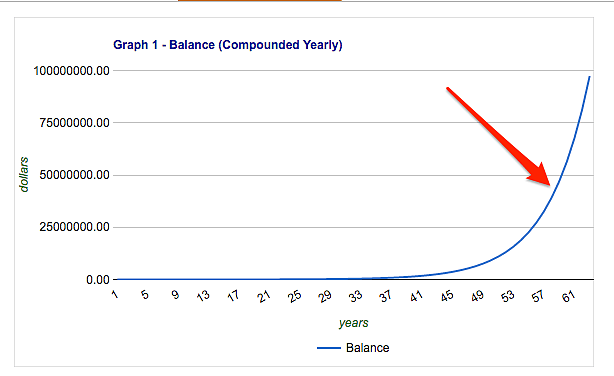

Over the 63 years, the general market delivered just under a 10% annual return, including dividends. That means $1,000 would have grown to $405,000 if all income had been reinvested. A 20% rate of return, however, would have produced $97 million. That strikes us as a statistically-significant differential that might, conceivably, arouse one’s curiosity.

When I came across this passage many years ago, I definitely wanted to know more. It’s still pretty amazing to see the difference and explains why Warren Buffett became so rich since his annual return approaches 20%.

But, they key factor in Buffett’s calculation is that he’s making it over a 63 year span. The significant growth in the investment occurs at the end of the chart between years 50 and 63.

During the first 50 years, the $1000 doesn’t grow that much even though it’s earning a 20% return. In fact, if you run the numbers again but over 50 years instead of 63 you end up with $9,100,438.

That’s still significant money, but it’s not the same as $97 million.

If you contributed $1000 a month, over the same 50 year span, you’d end up with $612,566,490. Now, that’s the power of a having a great savings rate and a great return.

But even if you achieve a more modest 10% return, saving $1000 a month for 50 years would net you $14,829,819. That’s significantly more than most lawyers will ever achieve.

Either way, the power of the rate of return is irrelevant for the first 10 years of accumulation (take another look at the chart).

Focus on increasing your savings rate today. Once you’ve built some wealth, you can take another look at trying to increase your rate of return.

How to calculate your savings rate

I calculate my savings rate as Amount Saved divided by Gross Income. Other people calculate it as Amount Saved divided by Gross Income minus Taxes. Because I want to incentivize myself to minimize taxes, I think it’s important to include taxes in your calculation.

Keeping track of money “spent” on taxes will make you more aware of the role that taxes play in your life.

After you have a savings rate, you’ll know what percentage of your income is being saved. From there, you can set targets like saving 20% of your gross income.

Steps to take to increase your savings rate

Calculate your savings rate. Studies show that what gets measured gets managed. The best first step you can take is simply making the calculation regularly so you can see your progress (or lack thereof).

Save your raises. Most lawyers receive predictable salary increases at the beginning of each calendar year. If you commit to saving your raises, you’ll be increasing your savings rate each year.

Audit subscription services. We live in a world where many products and services are now sold to us on monthly payment plans. It’s easy to allow these recurring expenses to continue. You only need to reduce these monthly subscriptions by around $80 a month to save nearly $1,000 extra a year.

Set your W-4 withholding exemptions to zero. Bank the fat return from the IRS in the Spring of each year.

Become a Budget Master. Budgeting your expenses and getting close to your targets will help you maximize savings. With a high income, it’s easy to get lulled into a false sense of security when you’re saving $3,000 a month. You can do better By reducing your expenses.

Be careful of the two biggest personal expenses: housing / cars. $3,000 a month in rent is $36,000 annually. There’s a lot of room to play in an annual expense of $36,000. The same is true for car purchases. If you live in NYC, you don’t need a car. If you live elsewhere, consider whether you can patch together all the benefits of owning a car for a fraction of the cost through services like Uber, Zipcar, short term car rentals, etc.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is always negotiating better student loan refinancing bonuses for readers of the site.

Nice piece!

I could not agree more. I wrote a very similar piece late last year: http://www.genyfinanceguy.com/2015/11/30/savings-rate-important-variable-wealth-building-math-prove/

The power of compounding is amazing, but like you said it takes a while to get to the elbow of the curve before the magic of compounding really starts to work.

Cheers!

Awesome, thanks for linking up to your post. Couldn’t agree more with your analysis. I need to start building excel charts like you do. It’s a great way to make the point in an easy-to-understand way.

I think you’re dead on and I also agree with how you are including taxes in the calculation of your savings rate. I’ve gamified taxes as well although I’m having trouble as I keep phasing out of certain deductions because of income limits (first world problems I know). I’d be interested in reading about high income tax strategies if you know of any good articles?

I haven’t written about the Pease Limitations yet, but I assume that’s what you are referencing although there are plenty of other deductions that fall away as you make more money. And yes, it is a first world problem for sure, but since the United States uses tax law to craft policy, I think ultimately the government would be very happy to know we’re learning and adjusting our behavior based on tax incentives.

For those readers that aren’t familiar, the Pease Limitations work by reducing the value of a taxpayer’s itemized deductions by 3 percent for every dollar of taxable income above a certain threshold ($254,200 single; $305,050 married). This is particularly brutal for taxpayers in high state and local tax environments, as they see a reduction in their itemized deductions.

Here’s a quick and dirty overview of Pease Limitations:

http://taxfoundation.org/blog/pease-limitation-itemized-deductions-really-surtax

As for my own writing, I put together a piece on 7 deductions often overlooked by lawyers:

https://www.biglawinvestor.com/7-tax-deductions-lawyers-overlook/

Very good points. Too often people focus only on the rate of return and ignore the savings rate. I know some who get enamored with getting a high rate of return whether it be with chasing hot stocks or other types of investments yet is in credit card debt. I’m pretty sure whatever rate of return he can get from his investments will not beat the rate of return his credit card companies are getting from him.

Interesting read about pease limitations…I had never heard of that. Fortunately…but maybe unfortunately it doesn’t affect me since we’re way below that income! haha I do find it somewhat unfair that income limits for tax incentives don’t take into account cost-of-living because “high income” really depends on where you live. Though I guess if they did take it into account, it would complicate matters further, plus there would be many opposed to that as well.

Wow, that’s the ultimate fail – credit card debt and chasing investment returns. I think it’s the lottery effect at play. People would love to see a 3x, 5x or 10x return on their investment, so they spend all their energy chasing the return rather than just increasing their savings rate.

I completely agree with you on “high income” being relative to where you live. It’s one of the negative aspects of lawyers, since most of us live in high cost-of-living environments. It’s not our fault, that’s just where the jobs are! I’m always amazed by the doctors who are deciding between making $300,000 in Wichita, Kansas or making $300,000 in NYC. Sure, Wichita probably isn’t for everyone, but at least they have options!

My friend’s wife is a doctor and he says that many hospitals in lower cost areas may even pay more than high cost of living areas because there is more demand, especially for doctors in certain specialties. They’re moving to a lower-cost area and my friend is able to telecommute keeping his NYC salary…getting the best of both worlds!

That’s a pretty incredible deal. It’s strange that more lawyers aren’t offered the ability to telecommute, given most of what I do is over the phone and on a computer. With all the pressure on law firms in the market, I’d think one area they’d consider downsizing is their massively expensive shiny midtown offices, but it doesn’t seem to be on their radar.

Hey BI, nice article and very true. I thought ‘but return is more important at the end’ and then I saw you covered that as I kept reading. Nice 🙂

Tristan

Agreed! If you don’t have any money saved to invest then you should even bothered about thinking on ROR. I wrote a post about investing (https://www.ajourneytofi.com/keep-calm-start-investing-now/) and it boils down to 3 elements, time, interest and more importantly some present value or starting investing money. The one thing I’d disagree is setting your W-4 with 0 deductions. I know some folks do that to force themselves to save; however, If you have the discipline you should stay away from lending money to the IRS at 0% IR. Thanks for a great post.

Saving has been a challenge to many of us, its a character one need to develop for a better life tomorrow. It doesn’t matter what you earn but saving should come first.

Investment choices are important, especially once you’ve accumulated a sizable chunk of savings. I like helping people choose their investments, and I enjoy checking my own spreadsheet to see how close I am to my goals and whether I need to rebalance.

I am a biglaw associate with over 100k just sitting in a checking account. Obviously this is not ideal. I read your blog, maximize all of my 401k options, backdoor Roth, etc. (generally in a vanguard S&P 500 fund or something similar) and have a mortgage on a condo with a pretty low interest rate, but I never really knew how to start investing my other “savings.” A lot of it is from bonuses, which come in a big lump sum, but I get nervous not knowing whether I am just supposed to dump a large portion of it into index funds all at the same time, or what, especially if there is fear that the market will take a slump soon. I am pretty good at saving money, but I feel like the blogs never go into the nitty gritty details of how they invest the savings (for example, I automate 2k a month into a vanguard fund, or put a 15k summer bonus entirely into the same fund at the same time).

This is a great idea for article. Your question is pretty common. Have you seen my post on an Investment Policy Statement? I always know what to do with each additional dollar for my “other savings” because I follow my written plan. It might sound like overkill to write it down but life gets busy and our goals (or wants/desires) are shifty, so by writing it down I can refer to it in three months, six months, etc.

https://www.biglawinvestor.com/how-to-write-an-investment-policy-statement/

I think the rate/frequency of investment can change depending upon the containers. I would ideally invest on MF and 401k on a monthly basis but I won’t do it for long-term containers where the ROI is calculated yearly. A diverse portfolio would give me better ROI regardless of how frequently I save and invest.

Having multiples sources of income helps in that regard. Right now I;m at 3 but they say 5 is a good mark if you aim for FIRE.