If you’re new to index funds – or have been investing in them for years – you might not have stopped to think about the asset allocation inside a particular index fund. What do I mean? Let’s say you own the Vanguard 500 Index Fund which tracks the 500 largest companies in the United States (i.e. the S&P 500). That’s great. You own a piece of each of the 500 largest companies. Essentially you’re making a bet on the continuation of civilization. As long as civilization continues to prosper, you’ll make money.

But among those 500 companies, how are your dollars split up? If you’re invested in the Vanguard 500 Index Fund, you’ll own the companies in proportion to their market capitalization. That means you’ll own a lot more of the largest company than you’ll own of the company that’s listed 472 (it’s GAP in case you’re curious).

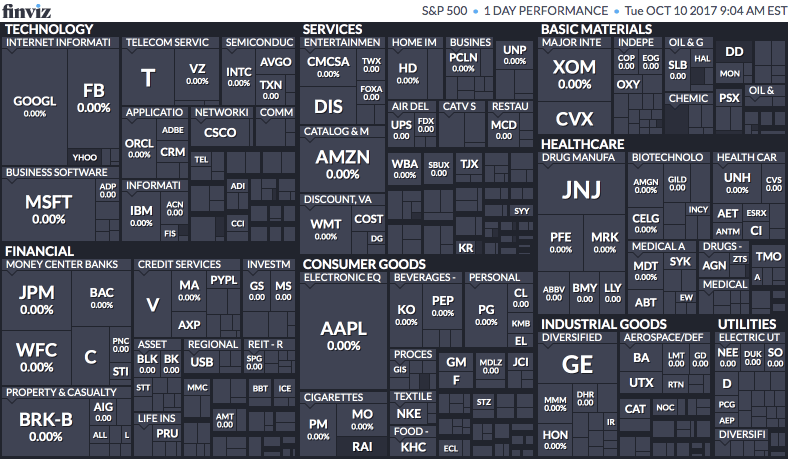

Here’s a visualization of how the S&P 500 looks on October 10, 2017. The stocks are categorized by sector and industry. The size of each box represents their market cap.

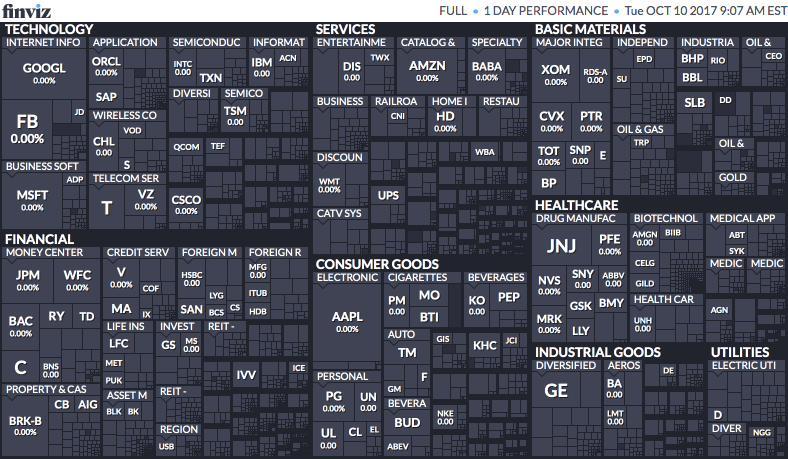

Here’s the same image to visualize the entire US stock market on October 10, 2017.

Some people are a little surprised to learn that many index funds are weighted by market capitalization and not equally weighted. If you thought that buying a slice of the S&P 500 meant that you owned an equal percentage of each of the 500 companies that make up that index, you wouldn’t be the first person.

In fact, several people have argued that equal weighted index funds perform better. The S&P introduced equal weight indexing on January 8, 2003 with the creation of the S&P 500 Equal Weighted Index. Each stock in the index makes up an equal weight in the index, so each company makes up .20% of the index (1/500). As compared to the market cap weighting, this gives the smaller companies more influence over the performance of the index while diminishing the influence of the larger companies.

So which index performs better? The market capitalization or the equal weighted index?

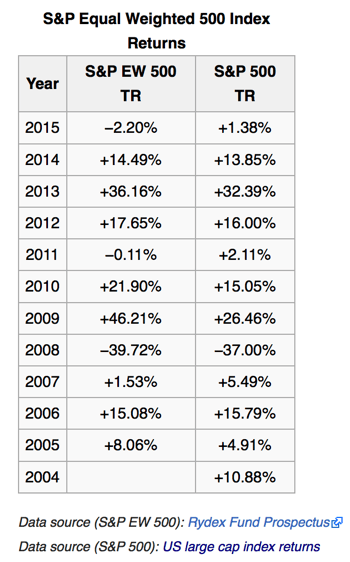

Here’s a look at the annual returns from the Bogleheads wiki:

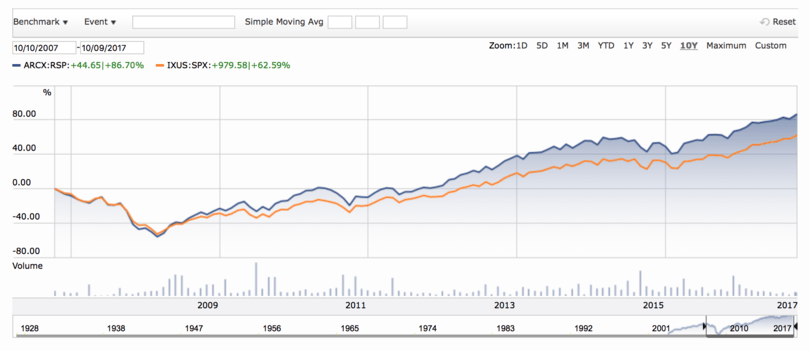

As you can see, the two indices run neck and neck. Here’s another comparison. The blue line represents the Guggenheim S&P 500 Equal Weight EFT and the orange line represents an ETF tracking the S&P market capitalization return.

In this last chart it looks like the equal weighted S&P index fund is performing better than the market capitalization.

So, which should you own and why?

First, let’s make sure the differences between the two indexes are clear. On it’s face it looks like the only difference is the weighting of the various companies but there’s a lot more going on under the hood.

Differences between market cap vs equal weighting

Market Cap vs. Equal Weighting. As discussed, this is the headline difference between the two types of weightings. In equal weighting, the smaller companies have more influence on the total return as compared to small companies in an index weighted by market cap.

Sector Weighting. The sector weight of an index is typically calculated by adding up the market capitalization of the companies representing a particular sector. An equal weighted index therefore is not subject to fluctuations in sector valuations. In other words, if energy stocks are the hot commodity of the moment they will represent a greater portion of the market cap weighted index vs the equal weighted index. On the other hand, an equal weighted index will tend to over weigh sectors comprised of smaller (but numerous) stocks and over weigh sectors comprised of larger (but fewer stocks). For example, there aren’t many companies that make airplanes. An equal weighted index will only count Boeing as representative of 1/500th of the fund regardless of the size of Boeing.

Turnover and Rebalancing. A market capitalization weighted index has very little work to do in order to maintain its intended purpose. Company valuations increase and decrease while the market weighted index continues to hold the stocks. An equal weighted index will need to rebalance its portfolio as certain stocks over perform while other underperform. The usual strategy is to rebalance every quarter. As such, an equal weighted index will have higher transaction and maintenance costs associated with maintaining the equal weighting.

Pros vs cons

Now, let’s brainstorm some of the pros vs cons of the two indices.

Pros

Proponents of equal weighted index funds use back-tested data to claim long-term benefits of equal weighted index fund performance. Looking at the chart above, it does seem to suggest that an equal weighted index will perform better based on historical data. Perhaps they’re avoiding the “bubble effect” of capitalization weighted index funds. After all, if you own an index and Apple represents 2% of the entire market’s capitalization, you own 2% of Apple. Maybe that’s a good thing or maybe Apple has reached its peak influence. It’s hard to say.

The other problem is that historical data for equal weighted funds doesn’t go back that far. The PowerShares FTSE RAFI US 1000 Portfolio, which follows an index of the 1,000 largest companies and is weighted based on factors such as book value, cash flow and sales, has data that goes back to 2005. Comparing it to the Vanguard Large Cap Index Fund (VCLAX), which tracks the largest 750 companies by market capitalization, shows a slightly less compelling result. It would be helpful if we could look at this data all the way back to the beginning of the 20th century but we can’t.

In the chart below the blue line represents PowerShares FTSE RAFI US 1000 Portfolio and the orange line represents Vanguard Large Cap Index Fund.

Just small value tilt?

Critics of using an equal weighted index claim that all they’re really doing is tilting toward small capitalization companies. All things considered, you would expect small cap companies to perform better over the long run, thanks to the additional risk associated with smaller companies. There are cap-weighted indexes of small stocks and growth stocks. They generally outperform indexes of larger and growth stocks. By giving more influence to smaller stocks, an equal weighted index is simply tilting to small stocks and growth stocks. I didn’t find any detailed studies showing that you can achieve a greater return by investing in an equal weighted index vs simply tilting your asset allocation to include small stocks and growth stocks. So why not just tilt your portfolio if that’s what you want to do?

Fees matter

Since equal weighted index funds need to be periodically rebalanced, fees will naturally be higher either through management oversight or, more likely, increased trading fees and taxes. The research is compelling that fees matter, since they’re the only thing guaranteed each year. I generally don’t want to increase fees for the promise of a better return.

Disguised active investing?

Equal weighted indexes don’t seem that different from active managed funds. Many active managers pick allocations based on all kinds of fundamental metrics (such as book value, cashflow, sales, etc.). It’s hard to see how choosing to equally weigh the S&P 500 is much different than actively deciding that some companies should contribute more (and other companies should contribute less) to your overall returns. When it comes to active managers picking an allocation or accepting the market return, I know which side I want to be on. Very few actively managed mutual funds outperform their market capitalization weighted peers. Critics of equal weighted indexes or what’s sometimes called the “smart beta” argue that it’s simply active management in disguise.

The market is capitalization weighted

Perhaps one of the most compelling reasons to accept a capitalization weighted index is that the market itself is capitalization weighted. If you’re familiar with the Gotrocks Family, then you know that collectively we own the entire capitalization weighted market anyway. To slice it up any differently is to change the natural allocation of the market. Given that a fundamental belief of index investing is accepting the market returns, I see no compelling reason to try and beat the market.

For those reasons, I’ll be sticking with market capitalization index funds.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Interesting read, thank you for the analysis. Just curious, would replacing an equally weighted index with a market cap index be excluded from a wash sale for capital loss harvesting? I’d have to imagine they would be “substantially similar” since it’s just a weighting measure, but I’m interested!

I would think they wouldn’t be considered “substantially similar” but the IRS hasn’t provided guidance about what that means, so it’s just guessing. The question is whether you’d feel comfortable sitting across from an auditor explaining why you thought they were different.

I wrote more about this here:

https://www.biglawinvestor.com/tax-loss-harvesting-substantially-identical/

GREAT overview of the difference between Cap Wgt vs. Equal Wgt! I’m tipped heavily toward Cap Wgt, and have thought for some time about investigating to see if it’s worth shifting into Equal Weight. Since I have a “value bias” via my Asset Allocation weighting anyway, your post gives me comfort that it’s probably not worth the effort to pursue Equal Wgt.

Congrats on the Rockstar Award for this one, well earned!

Thanks Fritz! I think tilting for “value” or “small cap” or “international” or whatever you want is a better approach than pursuing equal weight. I’m not convinced the trading fees and taxes required to keep an index equally weighted are worth it.

Love it… This is such a straight-forward easy explanation of Cap vs. Equal. I’ve tried to explain this many times, and it always seems difficult. Great job BigLaw.

Extremely worth of the Rockstar. I too will be sticking with market capitalization.

Thanks Nick. I find this is a topic that most people don’t think about but when someone does grab ahold of it they can quickly convince themselves that equal weighting is the better approach. I wanted to explain why I didn’t think it was.

My 401k is limited on options so I’m stuck with the default market cap weighting. I don’t think it’s bad to be market cap weighted. Over the last decade we’ve been in more of a winner take all market. Look at the largest companies like Apple, Google, Facebook, Amazon (sure Netflix too so we can just say FAANG). It’s going to be really hard for a smaller company to unseat them so to me this seems to tilt the scales more towards a market cap weighting instead of equal waiting. It’s kind of a bet on monopolies in a way?

I would ask you to have an open mind and take a look at the RSP Invesco S&P 500 Equal-Weighted Index. RSP has been around since 4-24-2003. It has an expense ratio of 0.20%. If an investor purchased RSP instead of the SPY- S&P 500 Cap-Weighted Index the returns are 258.96% vs 172.73%. Performance returns do not reflect dividends Returns do not reflect potential transaction costs.