So, where are all the millionaire legal associates? I’m not sure, but maybe a few will send me an email after reading this article.

What I do know is that it’s perfectly possible to accumulate more than a million dollars before you’re up for partnership at your firm.

Here’s the back-of-the-envelope way to get that done.

Biglaw salary scale

First, if you’re not familiar with legal compensation at the nation’s largest law firms, it’s amazingly transparent. All associates are paid along a standard Biglaw salary scale based on seniority.

The Biglaw salary scale moves around from time-to-time. Currently, first-year associates are bringing home starting salaries of $225,000 and eigth-year associates take home $435,000.

The good thing about transparent salaries is that it’s very easy to discuss strategies such as budgeting and saving among lawyers working in Biglaw.

Unfortunately, only a sliver of lawyers ends up with “Biglaw” compensation. The vast majority of the legal workforce – including those that are busy prosecuting criminals – earn much less.

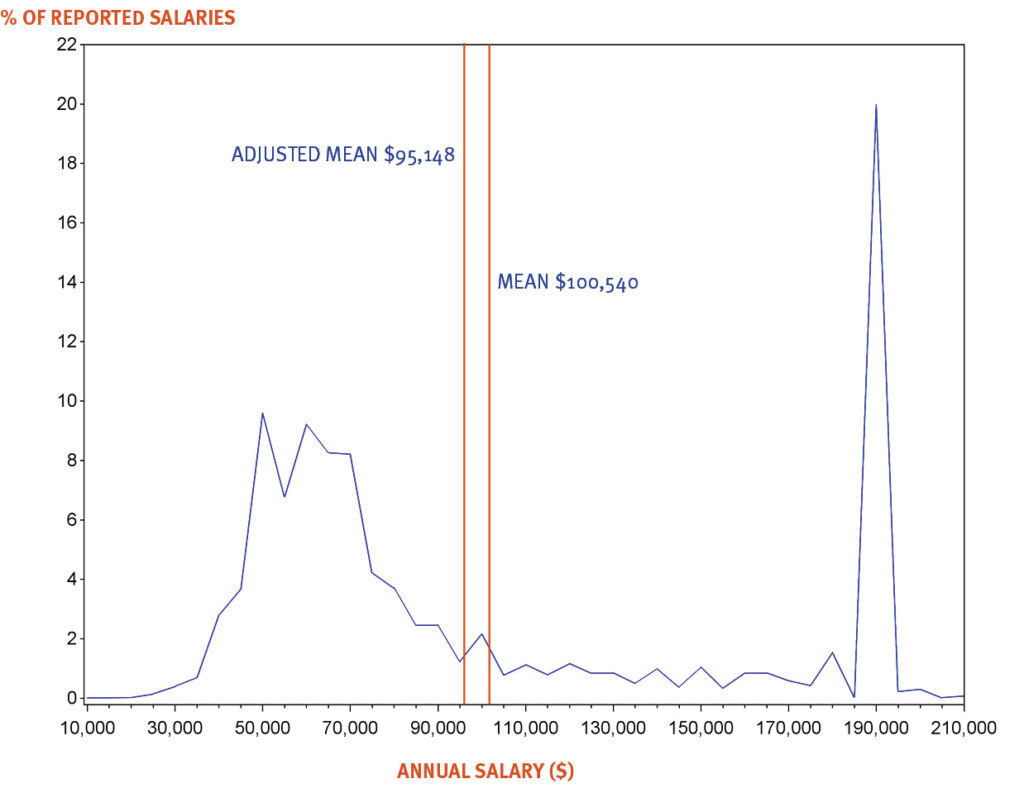

This quirk in the industry is reflected in what’s called the bimodal salary distribution curve, a phenomenon where starting salaries are clustered around two mountain peaks.

Bimodal salary distribution curve (2019)

How to get to a $1 million net worth

If you’re making $225,000 as your starting salary in law, chances are good that you’re living in a high cost-of-living city like NYC or San Francisco.

That will make it tougher – but not impossible – to accumulate over $1 million before you become eligible for partnership, typically during your eighth year as an associate.

As I’ve written about previously, a modest first-year associate budget allows for over $80,000 in savings your first year. That’s even accounting for punishing NY state and city taxes, and the reality that you’ll spend a lot of your time unwinding at bars and restaurants.

A frugal lawyer could do much better. Heck, I’ve even accounted for a $3,000 monthly rent. And, if you split a place with roommates much closer to work, you can save another $12,000 and probably be happier for it thanks to the companionship of living with people.

The key, of course, is starting your career on the best foot possible by hitting that $80,000 target in your first year.

After that, if you can hold your lifestyle inflation in check during the associate years, you’ll have nearly $1.3 million after your 8th year. (My calculations assume a nominal 7% investment growth each year.)

How to Save $1 Million as a Biglaw Associate

Step-by-step guide to save $1,000,000. You can do it.

| Year | Salary | Bonus | Total | 401(k) | Backdoor Roth IRA | HSA | Taxable Savings | Cumulative Savings |

|---|---|---|---|---|---|---|---|---|

| 1st Year | 215000 | 2120 | 2120 | 19500 | 6000 | 3600 | 41935 | 68835 |

| 2nd Year | 225000 | 2826 | 2826 | 19500 | 6000 | 3600 | 52935 | 153488 |

| 3rd Year | 250000 | 4239 | 4239 | 19500 | 6000 | 3600 | 77685 | 268818 |

| 4th Year | 295000 | 8126 | 8126 | 19500 | 6000 | 3600 | 99685 | 414220 |

| 5th Year | 345000 | 10599 | 10599 | 19500 | 6000 | 3600 | 121685 | 591800 |

| 6th Year | 370000 | 12718 | 12718 | 19500 | 6000 | 3600 | 138185 | 798311 |

| 7th Year | 400000 | 14838 | 14838 | 19500 | 6000 | 3600 | 154685 | 1035778 |

| 8th Year | 415000 | 16251 | 16251 | 19500 | 6000 | 3600 | 162935 | 1298118 |

Note: This table uses the salaries and bonuses from the previous year, since we have complete salary and bonus totals for the previous year. You can see the current Biglaw salary scale here.

Of course, that’s napkin math, and I assume there will be a few people who think saving so much isn’t possible (although probably not a lot of readers of this site).

Objection!

Think it isn’t possible to accumulate $1 million before reaching partnership status? Well, let me address some of the criticisms to get them out of the way:

You aren’t accounting for any lifestyle inflation.

True. I’m presenting the numbers, and it’s up to readers to decide if the lifestyle inflation trade-off is worth it.

If you’re interested in saving over $1 million, you could start by living more frugally (i.e. living with roommates) and eventually move into your own place after three years. You could also allow for some modest lifestyle inflation and end up with closer to $1 million. The point is to be conscious about the decision.

What about getting married? Kids? This would never work once “real life” starts.

There aren’t too many stay-at-home spouses in NYC. If you get married, you’ll likely have an even higher income plus the benefit of a permanent roommate, thus allowing you to save more.

Once kids enter the picture, saving so much might be tough. But, if you’re a “straight through” lawyer, you might start working at a firm at age 26. It’s not unreasonable to think you might not have kids until your early 30s, at which point you’ll have done the bulk of the savings anyway.

From personal experience, having a kid hasn’t been as expensive as we thought. Sure, certain aspects have been expensive but we spend a lot less on bars, restaurants and going out these days.

If you think kids are expensive and there’s nothing you can do about it, adjust these calculations downward accordingly.

Your tax calculations are wrong.

Tax calculations are one person’s guess as to taxable amounts today and in the future. They’re also based on personal circumstances (spouse, kids, etc.). Your situation will be different, so you may want to run your own numbers and see where you stand.

When you put your salary and bonus numbers in the calculator, make sure you’re backing out things like 401(k) and HSA contributions, as well as accounting for tax deductions and credits.

A 7% nominal growth rate is outrageous.

Fine. Run the calculations with your own numbers.

People in Biglaw burn out in 2 to 3 years, so this won’t work.

Burnout is common in the law industry, and many people leave after two to three years (in fact, here’s my three years and out plan). From my own anecdotal experience, barely anyone from my class year was still around after five years.

However, if you’re going to walk down a path, it might as well be this path, until such time as you exit the path.

I have student loans.

This is the biggest impediment to having the full million dollars before you become partner, but hear this: It won’t stop you from saving $1 million (even if your net worth ends up being slightly lower than $1 million).

Should I say that again? Even with student loans you can still save $1 million dollars, but you might end up with a net worth of $700,000 – $800,000.

If you want to accelerate debt repayment, it’s an easy decision to refinance your law school loans so less of your monthly payment goes toward interest fees.

After refinancing, I’d first fill up the tax-advantaged retirement accounts, and then go “nuclear” on the loans. You should be able to pay them off pretty quickly, especially if you decide to take a more frugal approach to your first three years in Biglaw.

Biglaw Budget Template

Convert income into wealth. Budgeting may seem unnecessary when you're making hundreds of thousands of dollars a year, but unless you plan to continue doing so forever (or, even if you do), a simple budget will help maximize the conversion of your income into wealth.

| Item | Price |

|---|---|

| Biglaw Budget Template | FREE |

Benefits of early millionaire status

Now that we’ve discussed and, I hope, overcome the objections as to why this plan wouldn’t work, let me tell you a few of the benefits.

The first is obvious: You’ll end up with $1+ million before you ever become partner. Having that financial cushion makes the annual reviews a lot easier (the time when you could be told that “it’s not working out”) because you no longer need to rely on the paycheck.

Second, even if you exit Biglaw and step off this eight-year path, you’ll be in a great position to do so.

Here’s what I mean: The third year is a critical time for most associates. Do you want to be the associate in the fancy one-bedroom apartment that still owes $100,000 on his students loans? Or do you want to be the associate with no debt, a little savings, and a low-overhead lifestyle?

The first associate feels stressed and obligated to push themselves through the next couple of years. The second associate laterals to go work for Spotify. Give yourself the option to go work for Spotify, even if you never take it.

Third, as every Biglaw Investor reader should know, it’s really not that hard to “live like a law student” for the first few years out of law school.

You’re already used to being poor and living with roommates. You won’t be able to control the fact that your peers are now spending time at fancy restaurants and bars, but you can control whether you’re spending a lot on rent and cars.

Take care of those big-ticket items and a lot of other little things will fall into place.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is always negotiating better student loan refinancing bonuses for readers of the site.

Could you please update this for the current salary scale ($215k+)? Thanks!

7th year law firm associate. By bonus time this year, will have reached $1.1 million net worth after paying down $340k of law school debt and getting married and having two kids. Discipline is key.

Awesome!

Hi Josh, love this post and visit it regularly for motivation! I’m a little confused by the bonus column. For exanple, wouldn’t the first year bonus be $20K rather than $2,120?