Prioritizing investments is more art than science. The decisions are highly personal. Some people hate debt. Others have strong feelings about future tax rates. To serve as a talking point, I’ll lay out my view of the proper prioritization of investments.

If you’re a high-income earner, prioritization is less of an issue. You should be maxing out all retirement accounts (as I’m doing). But I recognize that even new lawyers with high incomes need a starting point.

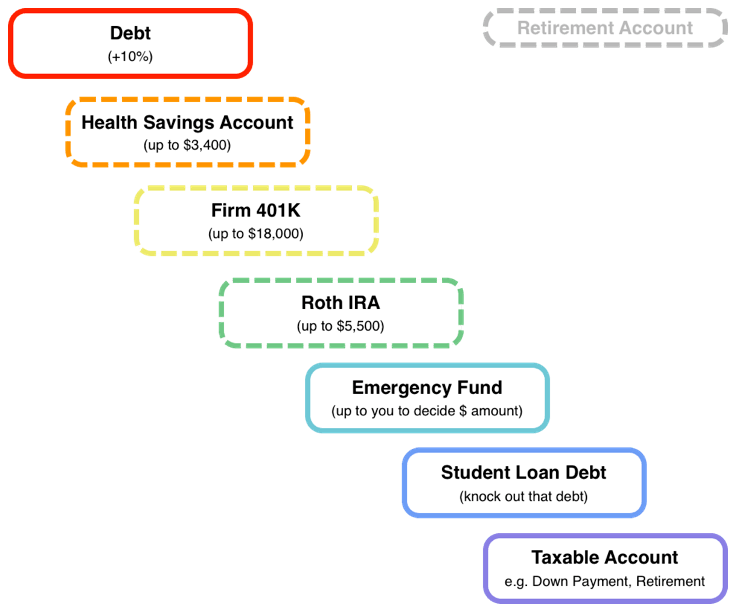

The following waterfall should work well for many lawyers:

1. Pay Off High Interest Debt. This is obvious and not worth much discussion. If you brought any credit card debt or other high-interest (above 10%) debt to your professional life, you need to eliminate it immediately.

2. Health Savings Account (HSA). If available to you (i.e. you are participating in a high deductible health insurance program), the HSA is a triple-tax-advantaged account with no income restrictions (sometimes referred to as the Stealth IRA).

3. Firm’s 401K Account. If you get a match, this should be your top priority, however most firms in my experience do not provide a match. Much has been written about whether to invest through a Traditional 401K or a Roth 401K. My opinion is to stick with the Traditional 401K and take advantage of the tax savings today.

4. Roth IRA. If your income is above $132,000 ($194,000 married filing jointly), you won’t be able to contribute directly to a Roth IRA. However, Congress has kept open the “backdoor” which allows you contribute to a non-deductible IRA and then roll it over to a Roth IRA. Roth IRAs act as great “emergency funds” because, if you absolutely had to, you can withdraw contributions at anytime without paying any taxes or fees. I wrote a Backdoor Roth IRA guide to show you how to do it step by step.

5. Emergency Fund. In the past, I’ve argued that you really don’t need an emergency fund in the traditional sense. However, it would be silly not to build up savings that can carry you if you need to leave your current job. If you have taxable investments, you can always sell some of those to cover living expenses in the event of a job loss, so you don’t have to keep this money in cash under the mattress. I have six months of expenses invested in a 60/40 mix of bonds and stocks which also fits into my overall asset allocation per my Investment Policy Statement. There’s a substantial peace of mind benefit to knowing that you could leave your current job and live for many months while you found a new gig.

6. Pay off Student Loan Debt. Student loan debt, even of the low interest kind, is not something wealthy people let linger (student loan refinancing only gets you so far; you still have to do the work and make the payments). Better to knock out the debt and stop paying interest to your lender than to effectively invest on margin with the hope of arbitraging the rate of return between your student loans and returns in the market. I can see in some cases where lawyers managed to lock in interest rates below inflation (i.e. 1.5% or 2%) where it might not make sense to pay off the debt. Still, consider that by paying off the debt you will significantly improve your cash flow position which allows for more choices in life and your career.

7. Car Savings Fund. Living in NYC, I don’t own a car. That may change in the future and when I do, I’ll be paying for it in cash.

8. Down Payment Savings Fund. If you’re thinking about buying a condo or house in the near future, it’s helpful to earmark a specific account or line item in your net worth calculation to keep track of this money.

9. Taxable Investment Account. If you still have money left over, now is the time to start piling it into a normal taxable investment account (in low-fee index funds obviously). This should only be after taking full advantage of all retirement accounts.

Two accounts I didn’t mention are: (1) 529 accounts and (2) the Mega Backdoor Roth.

529 accounts are state-specific investment accounts for education savings. They are a good deal but only worth it if you have kids (which I don’t yet). The Mega Backdoor Roth IRA probably isn’t available to you, but worth looking into just in case.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

As usual, good stuff. For your situation I agree with your strategy. Personally, low student loan interest rate (1.25%) that I’m holding paying off for now, access to a Mini Backdoor Roth (2%) and four 529 accounts shuffles things around a bit.

That makes sense. 1.25% is below inflation and 529s can be a great tax break.

My priority is simple: to maximize my investment returns. Luckily, I am debt free so I focus on increasing my wealth.

I’m not a fan of government sponsored plans (401k’s rrsp’s superannuation funds, etc). All of these come with government restrictions and rules. I want to be able to buy/sell whatever I want and whenever I want.

We have ~$125k student loans left over (started around $400k for two lawyers ~8 years ago) that were refinanced into 10 year, 2.75% fixed loan. Would you ever pay extra on that?

It’s really up to you. You’ve done a great job paying off nearly $300K in debt, so I imagine you’re feeling a lot better than you did 8 years ago. When I was about 60% of the way through my loans I hit the pause button for a year and focused on other things. There were two reasons which convinced me to pay off the debt: (1) I just hated having the damn things around. It’s not fun to fork over money to pay them off each money and I wanted to be psychologically free from paying back debt (and wanted to just see all the money pile up); and (2) in my anecdotal experience, it’s pretty easy to convince yourself that you’re “investing the difference” between what would have gone to the loans, but in reality some of the money leaks out to lifestyle inflation. When I decided to finish off the last ~$80K, I buckled down hard to get them done in a year and I think that motivation helped me save more that year than I otherwise would have.

You’re definitely right. We actually had enough cash to pay them off in 2014 and then used the money for a down payment on a house instead (we were about to have a kid and wanted out of our cheap rental). It has since appreciated ~$200k (we’ve put $50-80k into it), but we also have a rental unit in the house that generates ~$20k/yr and our 30yr fixed mortgage is lower than you’d believe, so I feel pretty good about that decision. We’ve since re-saved and could almost payoff the loans today if we wanted, but we’re trying to figure out what we want to do with it (we may want to use it for down payment on a second house and rent out both units in our first house, which would easily cover expenses), so the money is sitting in an CapOne360 savings account. Basically I’m saying I agree – there’s always an excuse not to pay down the debt.

Sticking with the human psychology argument, I wouldn’t use the savings to pay off the debt either. Sure, you could do that and sure it’s good to be debt free, but if you’re still in the accumulating phase I’d invest the amount in the savings account according to your Investment Policy Statement and then harness the desire to pay off the loan (which you clearly have since you asked about it!) to make higher monthly payments. At least for me, this would probably result in a maximized net worth over a 12 month period.

Sounds like you are doing really well though. Many roads to Rome!

How would you recommend prioritizing the Mega Backdoor Roth if folks are able to take advantage of it? For context, I have about $150k of student debt refinanced down to 1.95% (which requires 20% of the principal to sit in an interest-free checking account), but the first year of the loan is interest-free (after early repayment rebate). Do you have any suggestions for how to best prioritize the Mega Backdoor Roth and paying off the loan (assuming I’ve maxed out my retirement accounts otherwise), especially given the way the markets are behaving with Covid-19?

Covid-19 shouldn’t be impacting your investment thesis when it comes to retirement funds. Either you believe in the long-term upward trend of the economy and the strength of low-cost index funds or you don’t. Assuming you do, your decision is the classic “pay off debt vs invest” question with the added mix of being able to shelter the “invest” money in a retirement account. Ultimately, it comes down to how you feel about debt. Ask yourself whether you’d borrow money at 1.95% to invest in a retirement account because that’s essentially what you’re doing. If that feels comfortable to you, you can maximize the Mega Backdoor Roth while taking a little longer to pay off the student loans. Personally, I’d work on maximizing the Mega Backdoor Roth while challenging myself to also pay off the student loans as soon as possible.

What vehicle would you recommend for a down payment savings fund?

I would use an online savings account. It doesn’t sound sexy but you don’t need the anxiety of trying to squeeze out a little extra return with the risk that you could lose some of your principal. Instead, just focus on knocking out as much savings as you can. For online savings account, I’d consider Marcus or Capital One 360.

Great content on this site.

Much different situation now with federal student loans paused and inflationary environment. Maybe a good time to check in with an update for this post?

This is awesome! Where would you place a mega back door roth on this waterfall? Do you have a sense of whether one can fully fund a mega back door roth through an employer-based 401k AND fund a back door roth through a separate IRA?

Thank you!