You’ve probably heard that you should keep between 3-6 months of “emergency” funds in cash. But, is a cash emergency fund necessary?

Not immediately. But later you should establish a reasonable amount of money in a conservative growth vehicle to: (1) cover the gap between becoming disabled and disability insurance payments; (2) give you peace of mind if you need to quit your job; or (3) handle transitions between firms or other jobs.

Three reasons to delay building a cash emergency fund

- If you’re just starting out, you may have high interest credit card debt from law school. It makes more sense to pay off all high interest debt before building a cash cushion. You can always use the available balance on your credit cards for an emergency.

- If you’re controlling spending, you likely have thousands of dollars in free cash flow every month. That is – you have thousands of unallocated dollars that should be used for saving but could easily handle a small emergency. The rationale for an emergency fund is that you need the pile of cash to prevent incurring high interest credit card debt. However, in your situation, if something happens, you can simply pay for it out of current cash flow.

- If you’ve been working for a few years, you likely have other investments, such as a Roth IRA or house down payment, which could be liquidated in a true emergency.

Building a lawyer’s emergency fund?

The emergency fund concept developed in personal finance as a response to the cycle of living paycheck to paycheck. People who live paycheck-to-paycheck can be devastated by an unexpected expense. You shouldn’t be living paycheck-to-paycheck.

For a high-income professional, the traditional concept does not make sense. However, there are several reasons why a high-income professional might want an emergency fund:

Disability Insurance Elimination Period. Your disability insurance likely has a 6 month “waiting period” (called an “Elimination Period”) before it begins payment. If you become disabled, and are unable to work, you will need to cover 6 months of expenses before you begin to receive disability payments. Six months is a long time to go without income and could be a serious problem if you do not have an emergency fund.

Changing Firms (or Jobs). This can either be planned or unplanned. Either way, your emergency fund is a perfect amount of money to assist in the transition period. I take great comfort from knowing I have money specifically set aside to handle a transition should I leave, or be asked to leave, my current position.

Taking a Break. An emergency fund opens up the possibility of taking a substantial amount of time off when exiting Biglaw. If I wanted to do this, I’d save up money for traveling and to cover living expenses during my time off. Then, upon return, I’d consider using my emergency fund to pay for expenses as I settled back into the real world and began looking for employment post-travel. Knowing that you have a runway is liberating.

How big is your emergency fund?

It’s really a matter of risk tolerance. Since I look at my emergency fund as part of my larger asset allocation, I consider how much of my assets I’m willing to invest in a conservative growth vehicle. I usually keep about 6 months, but you may be comfortable with anything from 3-12 months. One thing to consider is that in a situation where you are using your emergency fund, it’s fair to consider that you will likely be spending less money than normal (e.g. less on eating out, entertainment, etc.).

Because the elimination period for my disability insurance policy is 6 months, I consider this the minimum for myself to feel comfortable. I can’t see much purpose for holding 12 months in an emergency fund but some will disagree. It’s a question of being comfortable with risk, which will also impact how you choose to invest the funds.

Where should I invest my emergency fund?

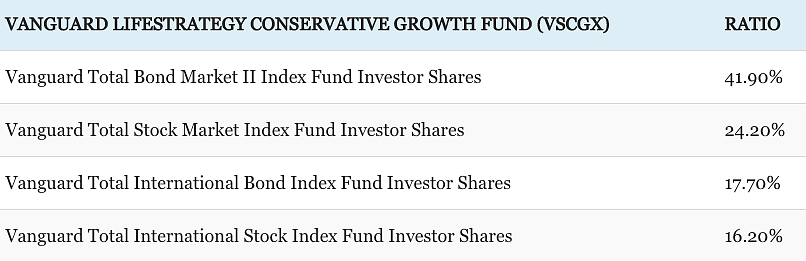

I have my Emergency Fund invested in the Vanguard LifeStrategy Conservative Growth Fund (VSCGX). It contains a 60/40 split between bonds and equities broken down as follows:

The expense ratio for Vanguard LifeStrategy Conservative Growth Fund (VSCGX) is 0.13%, meaning that for every $10,000 invested, I pay $13/year in fees.

Some people argue that keeping an emergency fund liquid in cash or treasuries is the only appropriate solution. I reject this advice for several reasons:

- I’m not comfortable earning 1% interest on cash, which means my purchasing power is eroded due to the effects of inflation.

- I’m comfortable taking the risk that I would need to call upon my emergency fund during a bear market like 2007-2009 when my emergency fund might be worth 40% less than its current value.

- I would like to see the emergency fund grow over time. Such growth will correspond with an increase in living expenses (thus maintaining harmony as a 6 month reserve).

- At this point in my life, I have other cash reserves (both a down payment and car payment fund) which can be drawn upon in dire circumstances.

- This fits with my risk tolerance.

For these reasons, I’m happy to have my emergency fund parked in the Vanguard LifeStrategy Conservative Growth Fund.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is always negotiating better student loan refinancing bonuses for readers of the site.

We currently have a 3 months emergency fund in cash. But as we live in Australia, we can still earn 3% interest on that, so we don’t mind having a larger sum of money in that option.

Our expenses are really low for a couple living in an Australian capital city, so as long as we base our fund on expenses, I’m okay with this.

Tristan

A 3% return is pretty good on a cash emergency fund. Definitely nothing wrong with have 3 months of an emergency fund in the bank. Makes it a lot easier to sleep at night.

I’ve debated reducing or eliminating my fully liquid emergency fund at times. For those with higher incomes and a bigger gap between their income and expenses, it can make sense if you want to live a little on the wild side. If I were to lose my job at a minimum I’d get a few weeks of PTO paid out, but most likely I’d get a decent amount of severance as well. I’ve weighed the pros and cons, but keeping $10k liquid in a savings account earning 1% a year just gives me peace of mind which is very important to me.

Thank you for another great post. Your blog is tremendously informative and helpful.

I’m curious: If your VSCGX emergency fund presented a prime tax-loss harvesting opportunity, would you do it? What would you exchange it into – i.e., what would be your VSCGX trading partner for tax-loss harvesting purposes? Or, do you see all of that as antithetical to holding VSCGX as an emergency fund in the first place?