Many parents dream of their children becoming doctors or lawyers. They imagine a life of monetary stability, respect from society and the security that comes from being involved in a profession. The story that parents tell themselves about lawyers may have lost some of its sheen due to the recent popular press coverage of unemployed lawyers unable to repay massive law school debts, but I still suspect that most people believe deep down that lawyers are destined to be wealthy.

If that’s the case, then there must be a lot of wealthy lawyers out there.

Since lawyers are mainly responsible for writing our nation’s laws, including its tax laws, lawyers must have crafted special tax loopholes that lawyers take advantage of to increase wealth. They’re probably over represented in samplings of millionaires, too.

Lawyers have a high income

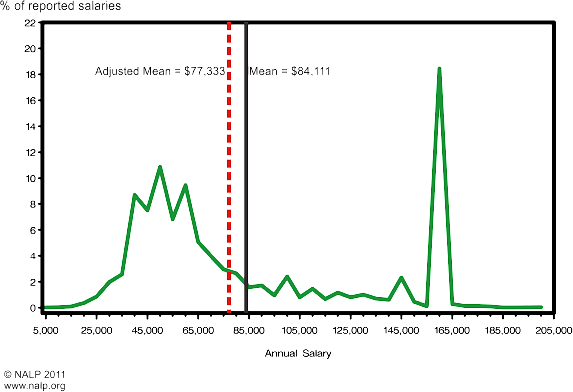

It all starts with the belief that lawyers have a high income. Compared to the national average, lawyers make considerably more. Pulling from the Bureau of Labor Statistics, an average salary for a lawyer is approximately $130,490. But averages can be misleading since they are skewered higher by the outliers on the top earning multiple millions each year. The median salary for a lawyer is a much lower $114,970. But even a median salary can be misleading when you have a salary distribution that looks like this.

The above chart is known as the bi-modal salary distribution curve and should be familiar to most lawyers (although I run into plenty of lawyers who have never heard of it). It shows the starting salaries for lawyers coming straight out of law school and also shows a much lower average starting salary than the report from the Bureau of Labor Statistics for all lawyers.

As many readers know, only approximately 18-20% of graduating lawyers end up in Biglaw with high salaries and many don’t last more than 2-3 years before moving on to other pursuits. The vast majority end up making significantly less. And while an average starting salary of $84,111 is significantly ahead of the average US salary of $50,756, it’s not as big of a difference as many people think.

Plus, there are plenty of my peers who earning significantly less than $50,000, either working for the public good or starting solo practitioners. Good luck convincing them that they have a high income, particularly when many are located in high cost of living locations.

Lawyers know all the tax loopholes

No they don’t. In fact, many will tell you that they don’t understand numbers because “I went to law school because I was bad at numbers.” Therefore, a lot of lawyers are missing out on the benefits of retirement accounts and taking advantage of concepts like tax loss harvesting. This seems strange to me given the lawyers wrote the tax code.

It’s even more disconcerting when I read about how my physician friends have developed multiple ways to take advantage of the tax code.

Here are a few of doctor gems:

1) Locum Tenens Work. Don’t be confused if you’ve never hear of this before. It is Latin for “to hold a place” and a popular method for physicians to fill in temporarily for other physicians who are on sabbatical or practices that have an increased demand. Doctors can take advantage of locum tenens work to increase their income. They have the time to do this because their full time jobs, while busy, have fixed hours and aspiring doctors can pick up extra shifts at other practices in their area.

2) They understand the benefit of Independent Contractors. Ever heard of a lawyer being an independent contractor and getting paid on a 1099 basis? I haven’t. Yet many physicians picking up extra shifts are paid as independent contractors. The downside is that independent contractors have to pay both sides of the self-employment tax (i.e. both the employee and employer portion). The upside is that as an independent contractor you can set up a solo 401(k) distinct and separate from the 401(k) at your current employee. While you can only make a total contribution of $18,000 as an employee, since you are both the employee and your employer as an independent contractor, you can take advantage of the tax laws to stuff more money into tax-sheltered space. Why aren’t some lawyers moonlighting for 1099 money?

3) They are more likely to become owners and will do so earlier. From what I can tell, many doctors will only spend a few years as an employee before becoming a business owner. There are many benefits to owning a business, but being able to contribute up to $53,000 to your retirement accounts is surely one of them (using a mix of employee/employer contribution). There’s nothing magical about this, since all of the money is your salary (it’s just that when you’re on both sides of the transaction it’s a semantics argument whether the money is coming from you as the employee or employer). Some doctors have figured out how to shelter $206,750 each year in tax-protected space. That’s a surefire way to become wealthy.

4) Doctors Believe In Owning Equity. Doctors recognize the value in owning equity investments in new drugs, medical devices and medical equipment. Some of them will own parts of the hospital where they work. This is another area where lawyers seem to differ dramatically. Lawyers rarely invest alongside their clients in business deals, nor do they seem to have equity stakes in business ventures related to the practice of law. The partnership model and ABA rules prohibit non-lawyers from owning equity in law practices, so there is no possibility for non-lawyers to join and grow practices since law firms can only offer them salaries and not equity positions. This is different than other countries, like Australia, where law firms are listed on the public exchanges.

Lawyers are over-represented as millionaires

We all know that slow and steady wins the race, so lawyers must be over represented in the ranks of millionaires, right? Not according to the work done in The Millionaire Next Door which pegged lawyers at just 8% of the country’s total millionaires.

We’re in good company here though, since doctors don’t fare any better. It turns out having a higher than average salary can really cause problems in accumulating wealth if you’re not familiar with lifestyle inflation.

I also think many lawyers aren’t in the millionaire camp because they don’t start with plans to become millionaires. Instead they are happy to have jobs and make reasonable spending decisions. When those decisions go unchecked, over time as their salary increases, it will be too late for them to form a plan until they’re in their early 50s and starting to seriously think about retirement.

It’s not all bad news

Obviously, lawyers do have a lot of advantages. Generally they make more than the average American, just like doctors, pharmacists, engineers, etc. They belong to a profession that is protected by serious borders since it takes three years of law school and passing the bar exam to be able to compete with lawyers.

Therefore, it shouldn’t be hard for most lawyers to become millionaires. It just takes discipline and time.

But yet I’m still perplexed as to what I see as a lack of rich lawyers? I’ve emailed back and forth with a few of you and plan a series of interviews to be published in the future (after all, we can all learn from how they’ve done it).

But where are the rich lawyers taking advantage of the tax code? Where are the lawyers that are getting paid on 1099 side income for their contract attorney work? Or the lawyers that are taking equity in their clients in exchange for legal services?

If that’s one of you, send me an email as I’d love to learn more.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is currently looking for additional lenders to add to Biglaw Investor’s JD Mortgage service which connects readers with lenders offering special mortgages for high-income professionals.

One of the things holding back lawyers from 1099 income related to law are issues with conflicts. I can’t really have a day job at one law firm, then do some of my own law on the side. Heck, I bet when I was in biglaw, my employer handbook probably prohibited me from doing any sort of side legal work.

In any event, like you pointed out, law doesn’t really have fixed schedules like a doctor. I can’t really know how long some sort of side law gig would take me to do. Contrast that to someone like my fiance, who is a dentist. She can easily work multiple gigs, if she wanted, since dentistry is very fixed work. You do the procedure, they come back for a checkup. Maybe you get some emergency calls, but it’s not anything like how law works.

But, even with all these problems, I still do try to take advantage of independent contractor work through these sharing economy gigs – like Uber, Postmates, etc. I first signed up for them just for fun and because I’m a tech junkie, but then learned that I could basically just take all of that money and save it away. Sure, I don’t make tons of money doing these 1099 gigs, but even the ability to put away $3k to $5k per year means I can essentially create myself an extra retirement account.

I’m glad you brought up conflicts, because it’s at the heart of my argument and concern. Lawyers created the very rules that tie us down and I wonder why that’s the case. It’s the identical concern I have with the partnership model where non-lawyers cannot own equity in a law firm (a rule created by the ABA).

The same is true of the second point – lawyers don’t have fixed schedules. Why is that? Lawyers will tell you it’s because we’re a service industry. That’s crazy. Everything is a service industry today and one doesn’t expect most services to be available 24/7 (and I live in NYC). Has has anyone ever emailed a dry cleaner at 11:00pm and expected a 10 minute response?

And it’s not like legal work is somehow inherently more important. How is it that doctors are able to switch out between treating patients when the outcomes are so much more critical? It must be because they’ve built a system that allows qualified people to pick up where others left off (and probably because they recognized that any one doctor cannot be available 24 hours a day, so an interchangeable system is mandatory).

I’m going to find the rich lawyers and highlight them on this blog.

On the conflicts argument – Obviously, moonlighting within the profession is forbidden by every attorney employment contract I have ever seen or heard of, but I wonder if this is simply an effect of concern with conflicts carrying forward from the olden days? Now that we have the ability to conduct at least a preliminary conflicts check with as little as a query to a well-established database of former clients, consults, and other relations, perhaps we can more reasonably moonlight and each firm can run an adequate conflict check without much trouble. If I ever start a firm, I’ll check with my state’s ethics committee and seriously consider the idea. I promise to get back to you 🙂

Also, on the point of taking equity from clients in exchange for services rendered: I often assist clients with entity formation, and the only thing stopping me is, again, my employment contract. If anyone with experience in such an arrangement contacts you, see if they’ll talk to me as well!

I know lawyers that take equity in their clients in exchange for legal services.

Totally – some firms, like Wilson Sonsini comes to mind – have reportedly done quite well working with technology startups and taking equity in lieu of fees.

Do you know how much a firm typically takes in the equity structure? I’d be curious to know what’s market.

I don’t have any first hand knowledge of how the equity structure works, though I would like to learn more.

I’ll add it to the list of future articles I plan to write.

And I will be back to read it!

I wonder how the equity arrangement typically varies from market to market? There is a big difference, I would imagine, between a boutique firm taking equity in a Silicon Valley startup, a BigLaw firm in New York taking equity in a large private equity fund, and a small-town generalist taking equity in a tractor supply shop. But I kind of want to see all three in action.

You’re right. I bet there is a big difference as well. I’m also curious if it breaks down the concept of the billable hour. Trading equity for legal services seems more like a fixed fee arrangement, but I’m also curious how you know when to draw the line. I’ll see what I can figure out.

Ah yes, the infamous bi-modal salary distribution curve. I think many in law school thought that even if they didn’t get a job in big law, it would be okay to get a slightly lower paying job. But there isn’t much in between. I remember seeing entry level attorney jobs paying $40k. I made more than that while working during law school with just an undergrad degree.

And with the 1099 income, Financial Panther makes a good point about conflicts…or alleged conflicts. I work in government, I do have fixed hours but they’re pretty strict about doing outside work.

If you were an employer and you could restrict your employees from taking on any additional work, I’d do it too!

I’m looking for a firm on lawyer that can’t be brought.

I’m glad I didn’t go the lawyer route. I couldn’t imagine $200K in student loan debt. I already feel like a corporate slave as it is. But when you are in school the cost of school doesn’t weigh as much as when you are actually paying for it. I thought I would be so rich when I graduated from grad school. While I live comfortably and have what I want and need, I’m no Paris Hilton or Donald Trump.

I remember pre-law school living with three other recent college graduates. One of the guys is a mechanical engineer and got a starting job making $66,000 a year. We all thought there was no possible way he’d be able to spend so much money.

My wife was deciding between a lawyer or doctor when we first met. She ended up deciding on neither due to the costs involved and unfortunately her lack of passion. Her parents were devastated at first but came around over time.

Her dad is a doctor though and definitely maximizes the retirement benefits that he’s afforded by the IRS 🙂

There’s no better decision than to NOT become a lawyer or doctor if you don’t want to do it. Law degrees are marketed as a degree that you can use for anything, which is true. You can be any kind of lawyer with one.

I’m pretty sure there’s a third spike somewhere to the right of the displayed salary range. I was chatting with a buddy of mine who has a law degree. He’s got classmates our age (40ish) who are buying million dollar homes with cash. Then there are the John Edwards of the world who prey on doctors and people’s emotions to win multimillion dollar lawsuits against the OB/Gyns who were in the unfortunate position of having delivered a baby with cerebral palsy.

I realize those lawyers are probably few and far between, but I know they’re out there. If I befriend any, I’ll send them your way 🙂

Best,

-Physician on FIRE

I always forget that when the general population thinks of lawyers the first thing that often comes to mind is personal injury and plaintiff work. As a transactional lawyer, I never think about that.

Did you know that John Edwards made the S Corporation tax loophole technique famous when he ran for Vice President?

Wow Big Law turnover is 2-3 years. Burn out? I feel like leaving a high-paying tech career for something more creative and probably lower paying. Keep going back and forth though. If I can wait it out, I’d be in better shape financially.

A lot of people realize it’s not for them within a few months. The other factors are that the firm will push you out if you’re not being productive for them (it’s a numbers game since billable hours directly links to your profitability for the firm). Finally, many lawyers are just now finishing 7 years of schooling and going through the same stuff their peers did when they were graduating college at 22-23. That means making lots of decisions about marriage, where you want to live, etc., so plenty of new recruits will leave following spouses or deciding they want to live somewhere else.

#3 for doctors is rapidly going away. Regulatory burdens are driving doctors rapidly toward employment and W2 income.

http://www.nejmcareercenter.org/article/understanding-the-physician-employment-movement-/

Dennis – Thanks for linking to that article. Very interesting read. Makes me wonder if lawyers historically have been self-employed but recently moved into a W2 employee structure similar to what’s happening to doctors now.

I have had the opportunity to run digital marketing campaigns for a number of the top law schools in the US – both for their JD and LLM programs. There are some really interesting trends that highlight how demand for law degrees are changing. First, interest in JD programs has dropped considerably over the past 5 years. JD applications are down about 60% since recession highs, but interest in one Law Masters programs are increasing – primarily driven by practitioners outside the legal industry who want to get a foundation in law, but have no interest in practicing. More law schools are also starting to offer shorter and shorter courses – almost like Executive Education for people interested in specific legal topics. So if you want to learn about one area of law you can now do so in 6-10 week programs that don’t require going back to school full time. It will be interesting to see how these demand patterns change the big law firms over time. I love your blog BTW – I am not a lawyer, but I am a high net worth Millennial and appreciate your viewpoints.

Yes. It’s a great thing that JD applications are down. There are more lawyers than there are legal jobs. For a long stretch of time (including while I was in law school) the schools were graduating more lawyers than they should have been. After the recession hit the legal industry, there was a lot of backlash against the law schools for how they marketed themselves and particularly how the law schools reported their employment and salary data to US News and World Report.

Great to hear about these shorter courses. I am not familiar with them, but it makes sense. Any lawyer will tell you that you probably only need 1-2 years in law school and that the third year is a waste.

Glad you’re finding some value in the site. I’m about to head over to Millennial Money to see what you’ve been doing to create that high net worth.

So why do so few trained lawyers stay in the field?

It’s not so much the field as it is the Biglaw model. The model is based on a pyramid (great start, right?) where there are a lot of 1st year associates at the base and it gets more narrow as you move up the height of the pyramid until you are the sole equity partner (aka rainmaker) at the top. There just isn’t room in the model for everyone to continue on, so attrition is a normal part of working in this particular sliver of the industry.

I would venture that most trained lawyers stay as lawyers, although I’m making that up based on my anecdotal evidence and reading. Some leave, but it’s been pretty well documented at this point that a law degree is really only useful for being a lawyer.

Do you happen to have any info on lawyers’ net worth? I want to know how I stack up against my peers in BigLaw, but I haven’t been able to find this data anywhere.

Meg, I haven’t seen any of that information but I might be able to find it, although what I’d look for is for all lawyers generally. Sounds like a good topic for a future post! Thanks for the idea.

I don’t recall seeing that distribution in my stats textbook in college? What do they call that one, NYC Big Law and Everybody Else? Lol

Many ideas in this article are delusional. Why ask why they are doing what with their money? They don’t have any money!!! Lawyers aren’t rich because many of them are unemployed, or go through periods of long term unemployment. The median salary is only true for those actually working. The legal field is completely saturated and highly competitive.

Lifestyle inflation is a major cultural problem with lawyers, and it can start in law school before you even have much of an income. It is especially troubling in bigger cities like Seattle, where I practice. I recently wrote my own blog post on this.

When I started my solo practice in 2010, I used geographic arbitrage (although I did not know then what to call it). I lived in Spokane and took cases in both Seattle and Spokane. I now live in Tacoma where my personal overhead is much lower than it was in Seattle.

SaraEllen, sorry that your comment got caught in the spam filter. I have no idea why.

I didn’t see the specific blog article on your site that you were referencing, so feel free to come back and leave a link.

Is most of your practice virtual? Given that Seattle and Spokane are about 4 hours apart, I’m curious if you ended up driving the distance very often or instead just handled everything remotely?

I often wonder why more lawyers aren’t working remotely, particularly when firms are paying big bucks for overhead at fancy buildings in the heart of urban centers. Legal knowledge work seems like the perfect service to move to remote access. I assume there’s a big shift happening with solo and small firms right now but that’s mainly based on anecdotes than any actual data I’ve seen. I wonder where we’ll all be in 10 years.

There’s so much focus on the bimodal salary distribution on legal salaries early on in a legal career but not the long haul.

Focusing only on the years after law school is like looking at a doctor’s salary in residency without looking at their income at age 40. Martin Simkovic has emphasized looking at the entire law career for pay-off rate and concluded it adds PV of $1mil to one’s career earnings.

Martindale Hubble came out with a study saying solo/small firm (1-3) lawyers average $198k and the median rate is $150k. Bureau of Labor Statistics says lawyer salaries at the median are $120k (though it varies based on geography). I’m guessing this info only refers to salaries and not partner draws, so if you own a firm you probably do much better.

Anecdotally, I know a general practicing solo lawyer (doing mix of personal injury, worker’s compensation and entitlements) that clears on average $160k a year with some down years around $90k and great years around $300k. I know a late career insurance defense lawyer in 3 person law firm clearing ~$120k a year consistently. I know partners in small metros at 20 person law firms clearing close to a $400k a year. A high volume personal injury TV lawyer who recently got started I know cleared that much in one contingency case recently.

The best way to get rich in the law is to sue corporations with deep pockets on behalf of injured individuals or represent corporations and leverage yourself by hiring associates. But I think other attorneys in private practice can do so by saving/investing well over the long haul. Unfortunately, most tend to get caught up in lifestyle inflation b/c most get lost in status games.

I wonder if legal tech is promising for equity investment like med tech is for doctors? ABA rule 1.8(a) permits business deals w/ clients though heavily regulates it. If lawyers took bigger risks with their careers I think they’d see more profits though most are risk averse as it’s the most useful mindset in a profession that deals in risk allocation.

This article confuses me somewhat. I am a lawyer who has always been a 1099 worker, ever since starting practice (as a solo) in 2014. My wife and I have been able to take advantage of the tax code, mainly through real estate, effective tax planning, and the home office deduction. In 7 years we have added about 700K to our net worth, despite basically always being in the 12% tax bracket. We expect to hit 1M net worth around age 40. Basically, the stuff you say you’ve never seen in lawyers is precisely how I live.

Amazingly naive and misguided. Once you start quoting salaries, you have already gone wrong — because any lawyer with an ounce of ingenuity or entrepreneurship is seeing his gains on a Schedule K and 1065. Only the lowest-earning attorneys would be reflected in the BLS salary stats. My closest friends typically earn about $5 a year in a prosperous county (Palm Beach) and yes, I know for sure. No lawyer could live like a human being in D.C. on $100K a year – the thought is absurd. These days (2022) anyone with a crappy house on Long Island is a millionaire, but a lawyer with decades of tenure is either a multi-millionaire, or not competent to handle financial affairs. Do you think the folks paying 80K a year for tuition alone at Columbia Law are expecting 100K jobs? EVER? Ridiculous.

Make that $5 million a year, mostly in direct compensation, some in growth of “inside share.” NB: Email is for a client. Sorry folks, I don’t need a lot of spam. Old hippies will allow it.

And BTW:

https://www.abajournal.com/news/article/how-much-do-partners-make-the-average-at-larger-firms-tops-1m-survey-finds

1 year makes a partner at a big firm a millionaire — maybe two years after expenses and income tax. This from the ABA.

You couldn’t find this? Seriously?

What point are you trying to make?

From the second paragraph of the article you quoted:

Average compensation for equity partners was $1.39 million compared to $432,000 for nonequity partners, according to the survey by legal search firm Major, Lindsey & Africa.

So you must be talking about equity partners because nonequity partners (the vast majority of “partners” in biglaw) are making $432,000.

And for those making $1.39 million (which is an average, so there’s plenty of equity partners making less than a million), it’s obviously a small number that make it to the equity ranks.

So your point is that a handful of equity partners at the nation’s biggest law firms are multi-millionaires? Not exactly surprising news but I guess we agree then.

I found my income tax law and personal finance courses to be most helpful and so would recommend any JD take them. Of course, the tax code changes faster than you can take a coffee break so keeping up with updates/working with CPAs is also important. Basically, good lawyers and investors will always need to be autodidacts – there’s no way to shirk that duty of care to one’s own affairs.