Every lawyer, law student, professional and investor needs an Investment Policy Statement.

Investment Policy Statements don’t have to be long or complicated. In my opinion, some of the best Investment Policy Statements are less than two pages.

Remember back in law school when the Torts professor allowed you to bring one page of notes into the final exam? That’s exactly how your IPS should look. It contains only the essential facts. It’s everything you need to know about your financial life and where you’re going.

There are several benefits to having an Investment Policy Statement.

First, it’s the one document to answer all of your investing questions. By far, the most common post you’ll see on financial forums runs something like this, “I have $50K sitting in cash in my bank account, how should I invest it?”

The only reasonable answer is: Invest it according to your Investment Policy Statement.

There are too many circumstances specific to you for there to be one universal answer as to how you should invest your money, most of which would never be disclosed on an internet forum anyway.

That’s because an IPS is a rather personal document. It contains your values. You write down what you’re hoping to achieve with your (financial) life. It contains a lot of things most people aren’t comfortable sharing with just anyone.

For those reasons, it’s something you need to figure out. Whether you take the time to write it down or not, you’ll be grappling with the questions in life anyway, so you might as well write it down.

Second, it will keep you on the straight and narrow. You’re a high achiever. You’ve worked hard to get where you are and now you’re reading a personal finance blog directed at lawyers. I know your type. In a couple of years you’re going to still be thinking about this stuff and you’ll come across the latest trend in personal finance (peer-to-peer lending, robo-advisors, etc.) Should you invest? Your Investment Policy Statement will guide you. It will remind you of your goals and objectives and the best way to accomplish them.

Third, especially if you work with a financial advisor, your IPS will ensure that the advisor and you are working together to invest your money in a way that’s consistent with your goals. This applies to couples as well, which can benefit from having an IPS to confirm that they’re “on the same page” when it comes to finances.

I strongly believe that those investors that take the time write out an IPS are far less likely to make serious investment errors.

Luckily, your IPS only needs a few things:

- Goals

- Investment choices to achieve those goals

- Cheat Sheet with Tax/Insurance information

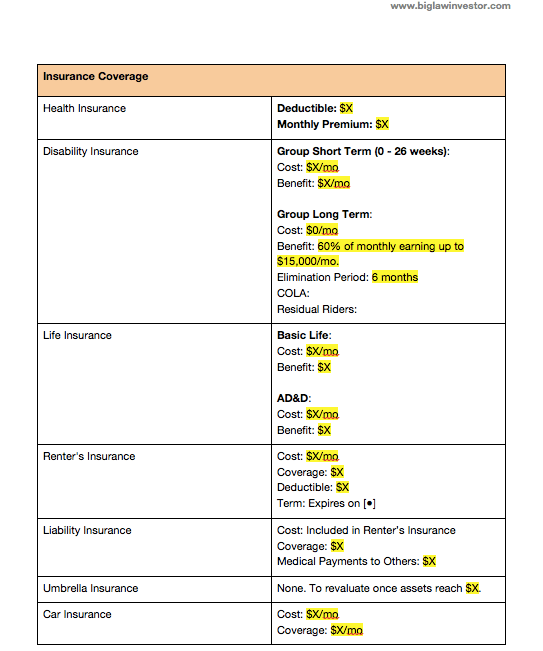

I especially like keeping the cheat sheet with my tax/insurance information in my IPS. It’s probably the part I use most frequently, since otherwise it’s difficult to remember things like your marginal rate, the amount of your renter insurance coverage or how much you’d get paid if you had a short-term disability. The cheat sheet lets me keep up with those important details at a glance.

Investment Policy Statement Template

No plan? No problem. You can start with the same template I used many years ago to create my Investment Policy Statement. It's a simple document that will get you started on achieving your goals. My favorite part is how it acts as a cheat sheet of all your insurance and tax information.

| Item | Price |

|---|---|

| Investment Policy Statement Template | FREE |

Here’s a look at a basic IPS I put together for this post:

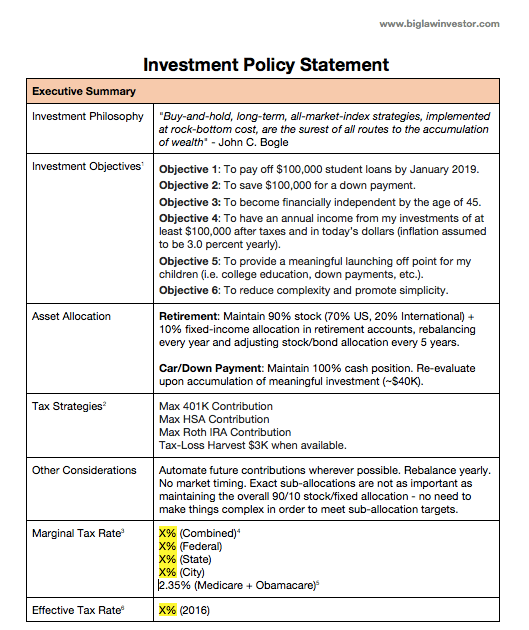

The first page functions as an executive summary. There are two important parts. First, there’s a simple reminder that I believe in the simple approach to investing. I want to buy-and-hold, get the market return and minimize fees and taxes. Second, I’ve listed objectives in order of priority.

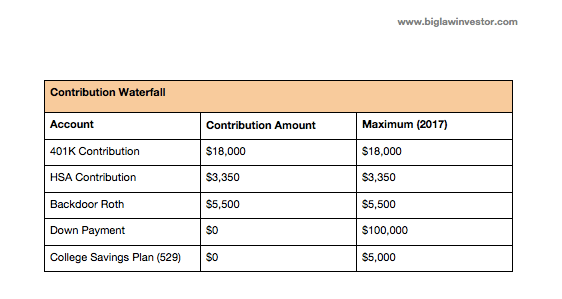

The second page contains a summary of accounts, contribution limits and various saving goals.

The third page contains an asset allocation:

And finally, the fourth page has your insurance coverage details:

As you can see, you could easily consolidate this to two pages if you want. But I like the simplicity of having each page contain a theme.

Precedent investment policy statements

Because I know lawyers like templates (we call them precedent), I’ve collected quite a few examples you can click through and use when making your own. Don’t worry – I’m just as lazy as you are and would never try to draft from scratch.

Here’s mine:

Some from around the web:

A few from the Bogleheads:

- Sunny’s Investment Policy Statement (Compact and Concise)

- Peter’s Investment Policy Statement (Company and Concise)

- White Coat Investor’s Investment Policy Statement

- Dale’s Investment Policy Statement (Comprehensive)

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Our asset allocation is similar, I’m at about 75% in domestic equities and 25% in international equities for my 401k. You and I are both younger, and stocks should be our main vehicle for building long term wealth.

Can an Investment Policy Statement include real estate?

Sure, the IPS is just a place where you write it down so you can refer to it easily. You can keep real estate, P2P, individual stocks in your “play” money account, whatever you think should be there.

Glad to see you’re in international equities. I think ignoring them is a form of recency bias given the fact that they haven’t performed very well recently.

One of the most important plans you can ever create. It’s not really for the times when everything goes right, then it’s easy to follow your plan. It’s for when the wheels come off the bus so to speak. With the market tanked fifty percent how do you force yourself to stay the course? Looking at this document and reminding yourself you planned for this.

That’s a sharp looking IPS BLI. Very well organized. Puts mine to shame, really.

Speaking of mine, it’s been nearly a year since I published it. Time for a review, revision, and an update!

Best,

-PoF

Wow have you got your future dialled in BLI 🙂

I am very impressed with the level of detail and thoroughness. For those that aren’t ready to dig as deep it still shows the importance of digging in t making a simple list of goals. The process of writing it down and thinking about it helps you visualize the path to success and increases your odds of doing just that.

Wow, this is mind blowing. I have never even thought of this idea. It really can help to keep one on track – and help to guide them on the way to financial freedom. Thanks for this article.