There’s a lot of basic terms in personal finance that are important to understand. Yet, as important as these are, we never learned them in law school (nor probably in undergrad!). I’ve put together a list of common topics. Browse through them and make sure they make sense. Most personal finance is based on these ideas.

Compound interest

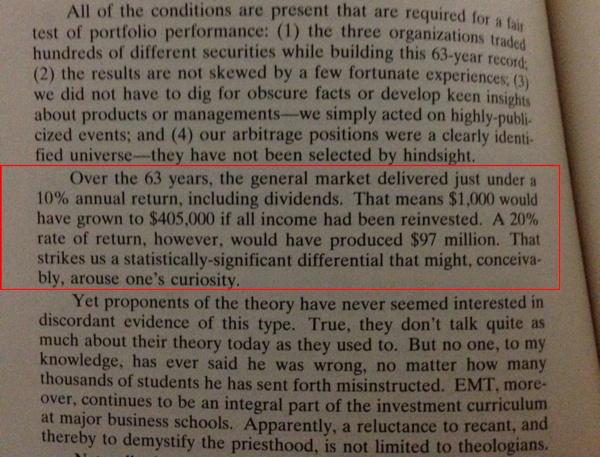

Compound interest is truly a magical thing. In order for it to create immense value, you need as much time as possible. Your rate of return matters as well, which means that you can’t get the benefits of compounding interest if you’re not invested in the market. Take a look at this passage I highlighted from a book:

But you know what’s more fun? When you play with the numbers yourself. Here’s a compound interest calculator I created for the site. Play around with the numbers and watch your returns grow.

Compound Interest

Results

Adjusted gross income

Your Adjusted Gross Income (AGI) is all the money you made during the year minus your Above-the-Line deductions. AGI is reported on line 37 of Form 1040 on your tax return. Your goal is always to maximize your total income while minimizing AGI. The income-driven repayment plans for students loans are based on your AGI, as well as the calculation of your taxable income, so it pays to have a lower AGI by potentially reducing your student loan payments and by definitely lowering your taxes.

Not all deductions are created equal

Above-the-line deductions

Above-the-line deductions are deductions you can use to reduce your AGI. They can be found on lines 23-36 of Form 1040 on your tax return. Above-the-line deductions are better than below-the-line deductions because (1) they reduce AGI and (2) don’t require you to choose between whether you should itemize your deductions or take the standard deduction.

Above-the-line deductions come straight off the top of your income, so they reduce the amount of tax you’ll have to pay (the “line” is line 38 of Form 1040 on your tax return).

So what are some above-the-line deductions? These are contributions to retirement accounts, health savings accounts, moving expenses, student loan interest, tuition, etc.

Below-the-line deductions (Itemizing vs Standard)

When calculating your below-the-line deductions, you have an option. You can either take the standard deduction or choose to use Schedule A to itemize your deductions. You want to go with whichever is larger.

For 2017, the standard deduction is $6,350 if you’re single or $12,700 if you’re married filing jointly.

It’s important to understand the subtlety in this calculation, because you’ll quickly realize that expenses you thought were fully deductible are in reality only partially deductible.

Example 1. Larry and his wife have itemized deduction totaling $14,000. Because $14,000 is larger than $12,700, he decides to itemize his deductions on Schedule A. Larry’s always thought of the $8,000 a year he spends on his mortgage as fully deductible. The reality is that it’s only the portion above the standard deduction (i.e. $1,300 ($14,000 – $12,700)) that is deductible. In other words, if he were to switch to the standard deduction, he’d only lose a $1,300 deduction.

On the other end of the spectrum, if you have a high income you’re subject to Pease phaseouts. For 2017, the Pease limitations start once your Adjusted Gross Income (line 38 of Form 1040) exceeds $261,500 if you’re single or $313,800 if you’re married filing jointly.

The Pease limitations reduce the amount of your itemized deductions by 3% of the amount your AGI is above the thresholds. The end result is that people subject to the Pease limitations pay an effective higher marginal tax rate, but it shouldn’t cause you to reduce your itemized deductions since the calculation is based on your AGI. If you haven’t heard of the Pease limitations, you’re not the only one! It’s certainly impacting biglaw lawyers though.

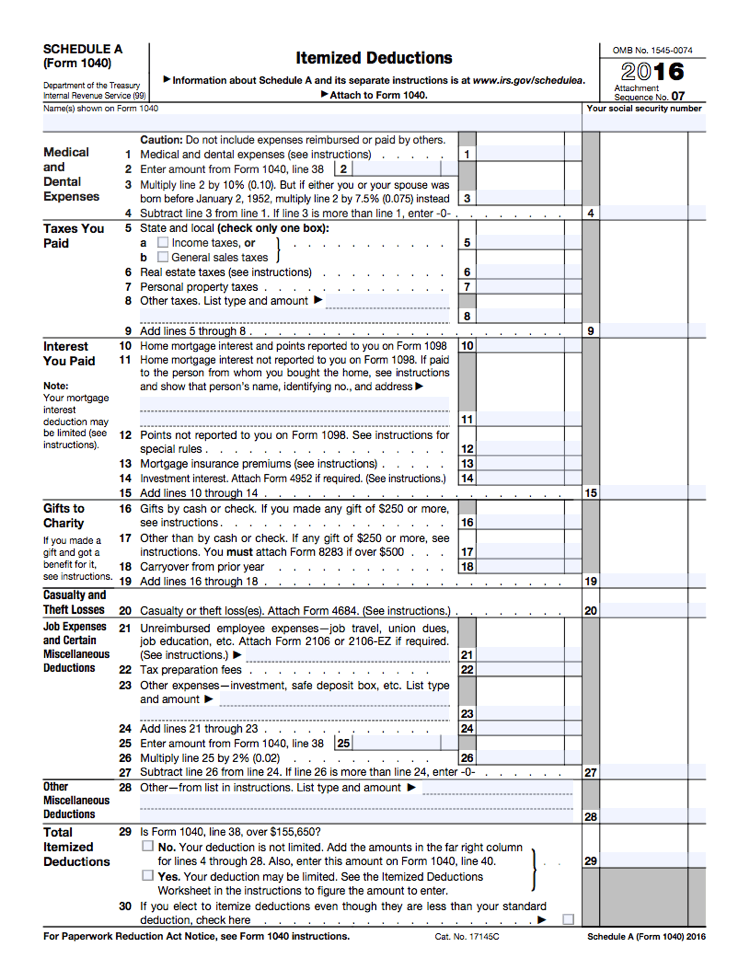

Here’s a copy of Schedule A so you can get a sense of the Itemized Deductions. For most, the “big” deductions that will count on Schedule A will be state and local taxes and mortgage interest.

Keep in mind that several of the deductions have a floor, which means that your total deductions must exceed a certain percentage of your AGI before they count (and even then, it’s only the part above the floor that counts). I’m looking at you Medical Expenses (must be above 10% of AGI) and Miscellaneous Deductions (must be above 2% of AGI).

Marginal taxes

Tax rates are marginal. This means that in each tax bracket you only pay the marginal tax rate on income in that specific bracket.

Occasionally people confuse how marginal taxes work and mistakenly think that if they go from $180,000 in income to $200,000 in income that their entire income will now be subject to the 33% tax bracket. That’s not how it works. Only the amount of income above the 28% tax bracket will be taxed at 33%. Therefore, you’re always incentivized to earn more money.

In other words, for a single person, taxable income between $0 and $9,325 is taxed at 10%. Taxable income between $9,326 and $37,950 is taxed at 15%. Taxable income between $37,951 and $91,900 is taxed at 25%. And so on.

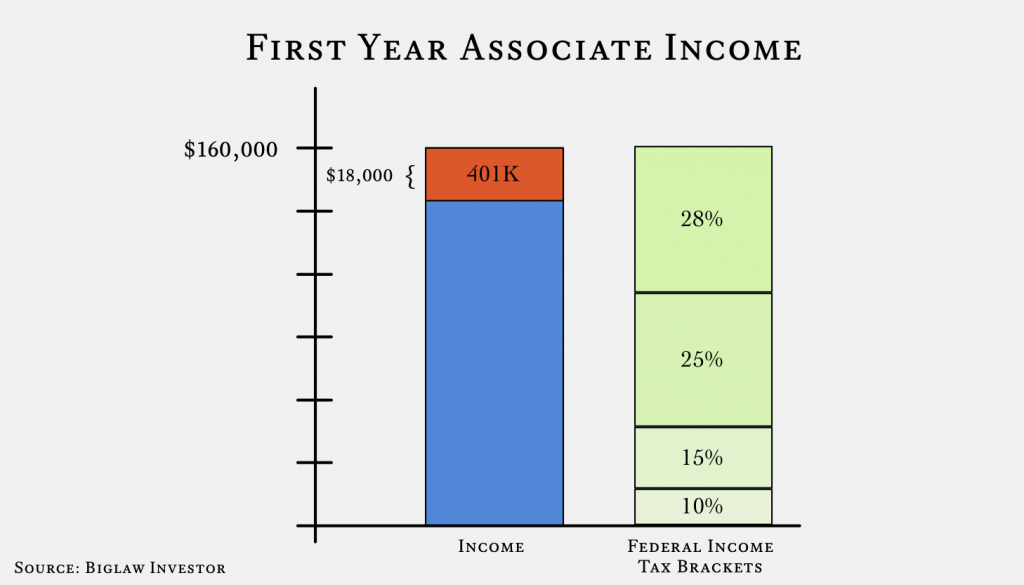

The flip side of this is that when you contribute to retirement accounts you’re reducing your AGI and thus saving money at the very top rate.

I created this graphic back when biglaw starting salaries were $160,000, but it still illustrates the point. When you contribute to a 401(k), you get the benefit of saving money at the highest marginal rate applicable to you. That makes retirement accounts a powerful way to save a significant amount of money on taxes.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He knows that the Bogleheads forum is a great resource for tax questions and is always looking for honest advisors that provide good advice for a fair price.

Please do include more calculators on the site! I’m a math/statistics guy and love those sorts of things.

As Albert Einstein said, “Compound Interest is the 8th wonder of the world.” 🙂

Thanks Erik. I love playing around with calculators too. Are there any that you have bookmarked and refer to frequently?

p.s. Hard to believe that the calendar year is already 1/6 over. Hope the book reading challenge is going well.

I like this one: http://www.finaid.org/calculators/scripts/prepayment.cgi

I’m constantly looking at my debt and the impact of prepaying. Sometimes I make a spreadsheet for myself, other times I’ll go online.

P.S. I know, it’s crazy… time flies when you are having fun. I’ve finished 14 so far!!

Cool post, Biglaw! Nice job on the calculator, too!

The only downside is that now I’m going to be forced to push friends to your page to try to help them understand the importance of compound interest. As if I don’t bother them enough already! 🙂

— Jim

I love compound interest calculators! There is just something very satisfying to see how entering a small sum every year, can give you a big lump sum at the end. It really shows how patience is key in investing and to always aim for the long term. Great job on marginal taxes as well! Too many people just make this mistake when they realized they are getting a raise.