I’ve started to see some questions on asset location, both in the comments section and via email. There seems to be some confusion about whether to place certain assets inside tax-protected or taxable space.

The prevailing view is that you should put tax-efficient asset classes, such as stock index funds, inside a taxable account and put tax-inefficient asset classes, such as bonds, in your tax-protected accounts.

Unfortunately, this oversimplifies the analysis considerably. You also need to take into consideration the expected return of the asset class.

Tax drag is slowing down your portfolio

First, this is an advanced topic. If you’re accumulating assets and currently only investing inside your tax-protected accounts (like a 401(k), Roth IRA and HSA), then there’s no need to take a deep dive into worrying about asset location yet.

But, if you have a taxable account, you may want to consider where you should be putting different assets.

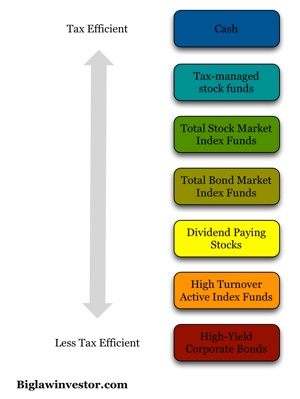

Different asset classes have different levels of tax efficiency. For example, some would say that bonds or bond funds are tax-inefficient because almost all of the return comes from the yield, which is taxed as ordinary income.

If you have a bond fund in your taxable account, all of the interest returned that year is going to be taxed at your ordinary income rate, even if you have no need or desire to receive the income. Over time, this can cause quite a drag on your portfolio as the taxes on the dividend yield eat away at your overall return.

A more tax-efficient asset class would be stock index funds. Most of the gains in a stock index fund are locked in as capital appreciation. Your index fund continues to grow and you only pay taxes when you sell, therefore reducing the tax drag to the dividends and capital gains paid out at the end of the year, many which may be taxed at the capital gains rate anyway. Only a small part of a stock index fund pays out as dividends or capital gains.

So at this point, it seems pretty clear, right? Tax-inefficient asset classes should go into tax-protected spaces. But the general rule breaks down when you consider the the expected return of the investments.

Bonds go in taxable

Let’s consider an investor that maintains an asset allocation of 50% in stock index funds and 50% in bond index funds. Our investor pays a marginal federal tax rate of 33%. Further, we’ll assume that the stocks have a 7% return while the bonds return 3%. Let’s calculate the return on these portfolios over 30 years, assuming no rebalancing.

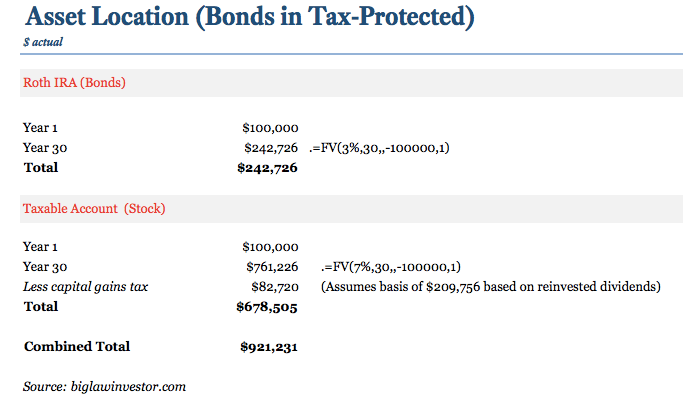

Example 1: Bonds in Roth; Stocks in Taxable

The total portfolio returns $921,231 over 30 years. Not bad. You keep the entire return on the bonds thanks to their tax-protected space and you pay minimal capital gains tax in the taxable account.

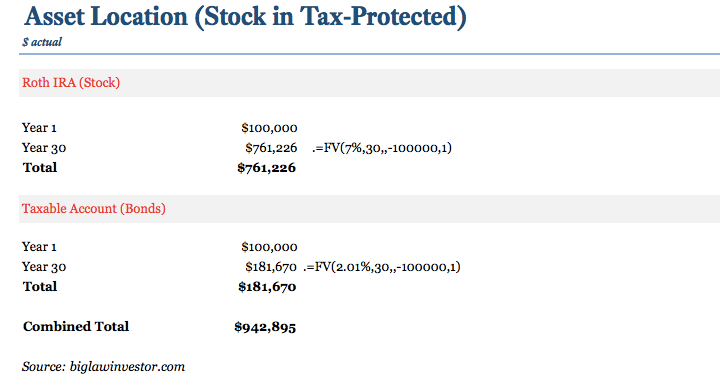

Example 2: Stocks in Roth; Bonds in Taxable

Bonds take the hit in this portfolio and only return 2.01% (since we must reduce the 3% assumed return by the investor’s marginal tax rate of 33% – this is a great example of the tax drag in action). Meanwhile, the stock portfolio climbs high and we get to take all of the profit without paying any capital gains taxes.

The second portfolio returns $942,895. That’s $21,664 more dollars than the first portfolio or an extra 2.35% return. And that’s when you placed the bonds – the more tax-inefficient asset class – in the taxable account.

But it makes sense. The expected return matters. If you put your stocks in a taxable account, you’re betting that the tax-free return on the bonds will be greater than the taxed return on your stock. If you switch positions, you’re betting that the tax-free return on the stocks will be greater than the taxed return on the bonds.

For that reason, it’s an incomplete discussion to only consider the tax efficiency of an asset class when deciding where to put it. You must consider both its tax efficiency and its expected returns.

The end result is that you need to run the numbers yourself. Changes to your expected returns on bonds, your expected return on stocks, tax rates, etc. will have an impact on the conclusions. The point is that there’s no reason to take a hardline view that all tax-inefficient assets belong in tax-protected accounts since that isn’t always the case.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Actually BigLaw, I prefer “preferred shares” in my taxable portfolio instead of bonds. They pay higher rates, and sometimes have big tax advantages over bonds, even though they carry similar protections as bonds.

Technically preferreds pay dividends (not interest) and qualify for the 15% qualified tax rate (usually). Sometimes it can even be better than that if the dividends are considered return of capital.

My post about preferred shares that goes into a lot more detail is here: http://www.mrtakoescapes.com/investing-in-preferred-shares-ftw/

Thanks for the link. I remember reading that article when you published it. Preferred shares sound great in theory, but I’m not sure you can always find the right preferred shares to invest in. Most of the private deals I see that involve preferred shares aren’t available to the general public. It’d be great if you have a more detailed post about some of the preferred shares you own. Let me know if you’ve already written that.

The part that really makes it complex, IMHO, is the impact on adjusted gross income and phase outs. The income from year to year for the bond may be greater then the stock dividends even though they have a lower return overall return. Thus there also may be something to consider there.

Yes, I agree. The point is that it’s not as simple as “bonds go in tax-protected” and “stocks go in taxable”. You really need to run the numbers for your particular situation and using your numbers.

I think this analysis is a bit incomplete….namely because it does not consider re-balancing/additional contributions, and assumes a world in which you are not limited in what you can put in your Roth/401k each year, etc.

I’d love to see an analysis involving rebalancing, with actual Roth/401k limits considered, over a long period of time. I imagine a portfolio that puts more/most/all bonds in tax-advantaged would definitely win in that case.

I’m not sure that would change the analysis, but I agree with you that the above is “incomplete” in so far as it’s one snapshot. You really have to run the numbers for your particular situation rather than accept the general advice to place bonds in tax-protected space. It’s definitely not clear cut and there are many circumstances where it’s actually bad advice.

The Bogleheads themselves have updated the asset location wiki due to these arguments (see the part about “criticisms of this tax placement strategy”).

https://www.bogleheads.org/wiki/Tax-efficient_fund_placement

In a pretax IRA with no additional investment going into the account and no distributions. Is there a tax liability drawback for investing corporate bonds that mature in less than 12 months?

It seems to me that in order to keep ready access to at least some of this money, a person could invest in corporate bonds shortly before maturity say 3-6 months. This seems like it would provide an interest payment and then you get your capital back to invest in another.