Recently a reader wrote in asking questions about their portfolio. It’s not uncommon for a lawyer to find themselves a few years into a career with a portfolio position hacked together over time and now staring at the screen wondering what to do next. Let’s take a look at this person’s portfolio and see what can be done to improve it.

Understand what you own

A great tool for understanding your holdings is available from Morningstar and absolutely free called the “Instant X-Ray”. After you load your holdings and percentage of ownership, Morningstar will slice and dice the portfolio providing a helpful look under the hood to better understand your holdings.

Here’s a look at this investor’s portfolio once the details have been loaded into Morningstar.

You can see that Morningstar has categorized each fund by stock industry or fund category. The main categories are Growth, Value, Blend and Real Estate. There’s also a short-term government position invested in government Treasuries.

For those that aren’t familiar, a Growth fund is one that seeks capital appreciation through investments in growth companies. These are companies whose earnings are expected to grow at an above-average rate compared to its industry or overall market.

On the other hand, Value funds invest in value companies. These are companies that the investor believes the market has undervalued and that the current stock price does not correspond with the company’s long term fundamentals.

Blend funds are a combination of Growth and Value. Real Estate is typically REITs (Real Estate Investment Trusts) that pool together investor money and then purchase real estate assets, such as large buildings or developments.

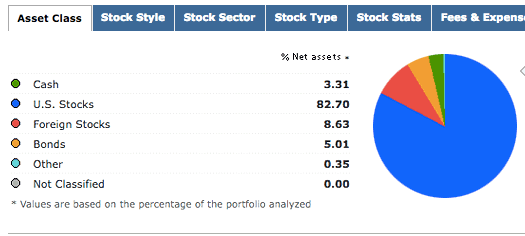

Morningstar will provide a equity/bond breakdown of the portfolio by sector as well, which can be helpful in determining whether you’re at your preferred asset allocation.

This portfolio is at about 91% stock (split 82.5% / 8.5%), 5% bonds and 3% cash. A 95/5 split between equity and bonds is an aggressive allocation but not particularly bad for a young investor with a long time horizon. Typically stocks provided the greatest growth potential while bonds provide less return but less volatility (the up and down swings) as compared to stocks.

It’s important to understand the asset allocation because simply looking at the 10 mutual funds doesn’t provided much information and you need to “aggregate” the data by looking at the holdings of the mutual funds to get an understanding of the asset allocation.

Morningstar can also give you a better look at the “Value / Growth” balance by breaking down the portfolio. As you’ll see below, most of the portfolio is in Large Growth and only a small percentage in Value.

Finally, let’s take a look at the fees for the portfolio. Fees are an important predictor of future success since they tell you right off the bat how much of your return you’ll be giving away each year. If you look at the expense ratio column you can see the expenses for each fund. Morningstar also helpfully calculates the average mutual expense ratio for the portfolio taking into consideration the weighting of your particular investments.

You can see in our portfolio that the fees range from 0.20% to 1.06% for an average mutual fund expense ratio of 0.70%. The mutual fund expense ratio does not take into consideration (i) any fees charged by your 401(k) administrator (for that you need to check your 401(k) documentation or ask your HR benefits department and (ii) any load fees charged by the mutual funds. Load fees are charged by some mutual funds when you purchase the fund, sell the fund or each year that you own the fund. If it’s not obvious, load fees should be avoided at all costs.

Taking the average mutual fund expense ratio of 0.70% we know that each year your returns will be reduced by 0.70%. In other words, if the funds return 8% in the next year, your actual returns will be 7.30%. This may not seem like much but fees can add up over time.

Example. Larry has a $100,000 portfolio and earns a 8% return. His fees add up to 0.70%, so his actual return is 7.30%. He makes no further investments in his account. In 30 years his account is valued at $827,926. If he reduced his annual fee to 0.20% (thus capturing more of the return for himself), his investment would be worth $951,837 in 30 years. That’s a difference of $123,911 saved if he reduced his fee by 0.50%.

Another way to think about how fees eat at your return is to take your expected return, which was 8% in our example. Let’s take the most favorable possible scenario and assume this money is in a Roth account which means it’s already post-tax and won’t be taxed going forward. If so, the 8% return is your nominal return (i.e. without taking into consideration inflation). If inflation eats 3% away of the return each year you’re left with 5%. The 0.70% fee further reduces the return to 4.30%. In other words, the 70 basis points represents 14% of your actual return (0.70% / 5%) that is paid out in fees.

The good news is that a a 0.70% fee isn’t even that high. As you may have noticed from the Morningstar report, the average expense ratio for this portfolio is 1.12%. It’s also not likely to be much of an impact when you’re in the accumulation phase. On a $100,000 portfolio the 0.70% fee represents $700 of fees paid each year ($100,000 x 0.70%). So while it’s not causing a lot of problems now, it will in the future as you lose out on the compounding growth. That gives you plenty of time to slowly move into a lower fee environment.

So, what could you do to improve this portfolio if this were you?

1) Simplify, simplify, simplify

Is there a reason for holding 10 separate mutual funds? One may think that this provides “extra” diversification but the reality is that the overlap in this portfolio is probably quite big. For example, most of these funds probably hold Apple at the end of the day. How many different times do you need to own Apple? And is it helpful to own Apple in several different funds or does that just confuse the situation and provide a false sense of diversification security?

If you have ETFs (or there are ETF versions of your mutual funds), it’s pretty easy to see the overlap using this ETF Overlap Calculator. Unfortunately it’s difficult to compare mutual fund holdings (if you’re aware of a good calculator let me know). I did a quick look at the top holdings of RGAFX and CHTVX from our portfolio and sure enough Alphabet, Inc. (the parent company of Google) showed up in both.

If you’re seeing a lot of overlap in your portfolio, then you should consider the value of reducing the overlap for your own sanity as you’re introducing unnecessary complexity without any real benefit (since your funds are ultimately the owners of the underlying assets it doesn’t matter much through what vehicle you own Apple or Alphabet).

In my own portfolio, I’ve essentially simplified this down to three specific funds in what’s known as the three-fund portfolio:

- Vanguard Total Stock Market Index Fund (VTSMX)

- Vanguard Total International Stock Index Fund (VGTSX)

- Vanguard Total Bond Market Fund (VBMFX)

You’ll notice that I have two funds to represent the equities market. One handles everything inside the United States while the other handles everything outside of the United States. Finally, I have a bond market fund for a small allocation of bonds.

That’s not to say that the three-fund portfolio is superior to a 10-fund portfolio with a different asset allocation. We can’t predict the future and only time will tell which portfolio will perform better over the long run.

What I can say is that the three-fund portfolio is simpler and easier to track and understand than a 10-fund portfolio. If you’re going to invest in 10 separate funds, you need to understand the tilt that you’re trying to achieve, since by investing in different funds you’re essentially trying to weight a certain percentage of your portfolio toward a particular asset class (e.g. foreign stock, mid-cap stock, emerging companies, etc.).

It’s quite possible that a portfolio with a tilt will perform better than a simple portfolio like the three-fund portfolio. However, when you’re in the accumulation phase I strongly encourage you to question whether trying to eek out a small extra return is worth your time when you could be focusing on ways to increase your savings rate.

2) Those fees matter

One area where you could immediately improve this portfolio is by reducing the annual fee. A fee of 0.70%, while lower than the industry average, is higher than you want to be. It’s questionable whether any advantage that might be achieved by tilting your portfolio will overcome the extra management fees.

VTSAX (Vanguard Total Stock Market Index Fund) is now charging 0.04% per year. That’s a savings of 0.64% compared to the portfolio we’re looking at today. Refer to the above example where reducing the fee by less than that (0.50%) resulted in a savings of over $120,000 over the course of a 30-year portfolio.

Given that this is a do-it-yourself portfolio, you’re really not getting anything extra by paying these fees anyway (i.e. you’re not paying for more financial advice, you’re simply paying more administrative fees). You can easily construct a portfolio to match the current asset allocation using low-cost index funds. I deconstructed the Harvard Endowment and created an index fund version in an earlier post. The result? The low-cost index funds beat the Harvard portfolio to the tune of billions of dollars (I’m still waiting for Harvard to give me a call – I’ll manage the endowment for a reasonable fee!).

3) Good things about this portfolio

The problems with this portfolio aren’t fatal. A little bit of tweaking could go a long way to improve its long-term performance. However, there are a lot of things the portfolio gets right.

First, the investor is using index funds! Let’s not understate the importance that the portfolio is a mix of index funds with fees below the average. This is a fantastic start, particularly as compared to a portfolio full of individual stock picks or mutual funds with higher-than-average annual fees. I have no idea how this portfolio was particularly constructed but it started with the right mindset. Find index funds and eliminate uncompensated risk.

Second, the ratio between equity and bonds is appropriate for a young investor at a split of 95/5. At this level it’s questionable whether you should keep the bonds at all, but this is much better than a portfolio of 50/50 which is not uncommon among risk-averse lawyers. Stocks are much more likely to outperform bonds over the long run.

So what’s next? The investor should draft an Investment Policy Statement if he or she doesn’t already have one. It won’t take too long and I provide templates you can download to make the work easier.

Next, the investor should take a look at the fees and see what can be done to reduce them.

Finally, take another look at the asset allocation and make sure the tilt toward certain asset classes is intentional and in line with your investing philosophy. Chances are good that the investor could benefit through simplification, accepting the market returns and instead focusing on increasing savings.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Very helpful post! I was suprised to see that I had a larger allocation to international stocks than intended. I am also doing the three-fund portfolio and using VTIAX. What I did not expect was that the Target Date Vanguard Funds (only funds offered by my work) also have a substantial international stock component. So now I can re-balance to a more domestic stock heavy portfolio.

You sound like a good candidate for Personal Capital. Have you heard of it? I’ve been trying it out for the past three months but haven’t written about it on the site yet. Like Mint for your investment accounts, you can link everything together and get an x-ray view of your asset allocation to see the underlying holdings in the Target Date Vanguard Funds. It even goes one step further and looks at the Vanguard index funds and breaks those down by holdings (e.g. VTSAX contains REIT holdings which you might not have known about until you do a deeper dive, so it’s good to understand that even in the three-fund portfolio you have real estate exposure!).

I’ve been very impressed with my testing so far.

Personal Capital is great if you like fancy charts and portfolio breakdowns