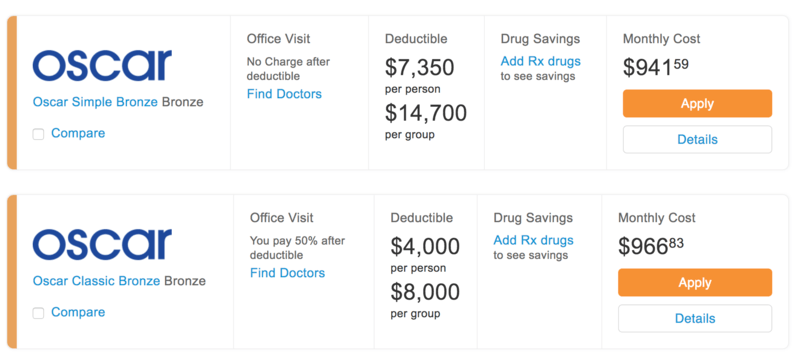

I’m generally optimistic about solving financial problems but health care has always been particularly problematic. Curious as to how much healthcare would cost on the open market, I found a site that compares policies, put in a few numbers, like our ages and zip code and the website spat back the following options:

Apparently, if we’re willing to cover the first $25,999.08 of healthcare costs ourselves, for the monthly price of renting a three bedroom home on the North Carolina coast, we can get a bronze health insurance policy. It’s clear that there are major flaws in the system where a healthy mid-30s couple is required to pay a small fortune in any given year before the “insurance” product kicks in.

I assume this has something to do with living in the most expensive state for just about everything possible (New York is number one!). This wouldn’t be a problem if the numbers made sense. However, it’s clear that the annual premiums of $11,299.08 are completely decoupled from our actual risk.

Having lived in the United Kingdom for a couple of periods of my life, I know how easy it is to get healthcare in other parts of the world – you just show up! I’m amazed that we tolerate such a broken system in the United States and can’t wait for the single-payer system that we all know is coming. The current system is the equivalent of walking into a post office and paying $437.50 for a first-class stamp while everyone else is nodding around you explaining that the postal system is expensive and that’s just the way it is.

Although maybe the problem is that I’m just a lawyer. Doctors seem to understand it better – you can listen to two of them discussing it here starting at the 43-minute mark. I get the impression that they think buying healthcare is “no big deal” like you’d pay for any other expense. Fortunately, I can’t think of any five-figure expense in my life that is completely out of whack with reality, so for me, the idea of buying health insurance is a “very big deal” because now I’m faced with the problem of evaluating the product and paying for it out of my own pocket.

So what does an early retiree or self-employed person actually do about health insurance?

First, it’s important to understand that health insurance isn’t really an insurance against your health. Like all insurance products, it’s an insurance policy to protect your assets from a financial catastrophe that results from a health problem. If you really want to protect your health, buying health insurance doesn’t help at all. Stick with diet and exercise.

Here the other available options:

- Self-Insurance

- Catastrophic Plan Coverage

- Medical Tourism

- Joining a “Healthcare Ministry” like Liberty Healthshare

- Expat Insurance

- Artificial Poverty (aka “Early Retirement”)

Self-Insurance sounds scary but is the cheapest and easiest option. Essentially, you decide not to pay for health insurance and start saving the premiums yourself in a separate account. There is a tax-penalty for that in 2018 but as part of the current government’s desire to “make things worse before they get better” the tax-penalty is going away in 2019, which means that starting in 2019 there’s no negative financial consideration when it comes to self-insuring. If you’re wondering how much money you’ll be spending on health costs yourself, the Healthcare Bluebook lets you search for procedures and see fair prices. Many of the costs are significantly cheaper than I expected, such as $12 for a simple cholesterol check. Without a health insurance plan though, a major disease like cancer will lead to financial destruction.

A Catastrophic Plan is the type of health insurance where you pay for nearly all everyday health expenses yourself but have insurance to cover a catastrophic disease, such as cancer or stroke. Catastrophic plans are non-compliant under Obamacare, which means you’re still subject to the penalty-tax. Because the tax-penalty is going away in 2019, these are now a reasonable option for an early retiree. A catastrophic plan is not cheap though and as you saw above would still run me nearly $1,000 a month for my family of two.

Medical Tourism is a phrase that doesn’t make any sense but accurately reflects the modern United States. Because we live in the country with most expensive medical procedures in the world, a viable alternative is to simply take our spending outside of the country. It’s a US-centric assumption that doctors and healthcare are “expensive stuff” since every other country spends less than us.

Health Sharing Ministries are insurance in another form. Members pool monthly dues together and collectively fund healthcare costs of members. They have reasonable monthly premiums for those between age 30-65 (such as $199 for a single person or $299 for a couple). The downside is that liability is capped at $1,000,000, so they can eventually be exhausted along with the fact that they can kick you out if you have a pre-existing condition (since they aren’t health insurance per se, they are not subject to the same level of scrutiny as health insurance plans). Also potentially problematic, health sharing ministries are generally tied to religious institutions and want you to reaffirm their values. Still, if you’re interested in reading about an early retiree’s experience, check out Steve’s experience with Liberty Healthshare.

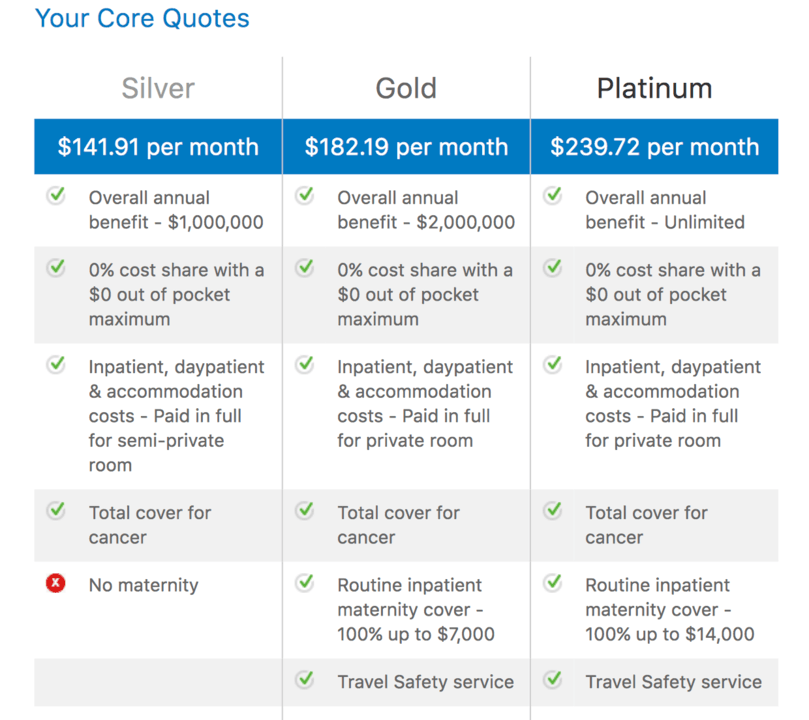

Expat Insurance from a company like Cigna underscores the crazy nature of US healthcare insurance. As an American citizen, you can get an American health insurance company to provide coverage at a reasonable cost. The catch? You need to leave America. Most intriguing about an expat plan is how much more attractive it makes the idea of leaving the country for a couple of years if you want to take a sabbatical (Costa Rica anyone?). Below are the quotes provided by Cigna for my family of two. The fact that you can get unlimited coverage for $239.72 is pretty attractive. Worried about health providers abroad? I wouldn’t.

Artificial poverty is controversial but perfectly within the rules of the current broken system. Since the Obamacare subsidiaries are based on income – and do not take into consideration net worth – it’s pretty easy for a wealthy retiree to qualify for subsidies thanks to a “low” income. Justin has written about this extensively, including how he budgets for health insurance despite having a $1M+ portfolio. Anita has also outlined how she’s spending $200 per month on healthcare but I’m curious if those numbers have gone up since they’re almost three years old at this point.

So, what are we doing about health insurance? As employed individuals, we’re currently enjoying employer-subsidized health insurance like most of the population. If you’re a self-employed lawyer, I’d love to hear about your experience. Perhaps I could convince you to write a guest post explaining how you approach the health insurance market.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He convinces the student loan refinancing companies to give you cashback bonuses for refinancing your student loans and looks forward to you discovering how easy it is to track your net worth with a free tool like Empower.

Not a lawyer, but I do buy mine on the open market.

One issue too many people don’t realize about health care is that it is expensive stuff. If it takes up 17.9% of GDP, you shouldn’t be surprised to see it take up 17.9% of your budget.

Expensive tech, expensive R&D, highly trained staff, lots of liability, 24/7/365 availability. It’s never going to be cheap.

If we as a nation want to spend less on health care, a major part of that solution is going to be consuming less health care. You can only do so much by improving efficiencies. The rest has to come from consuming/providing less of it.

This article was full of things I didn’t know. My favorite part was this paragraph below because I never thought of it like this. You are always told that going to the doctor keeps you healthy. In some ways I think that can be true, but I find half the time the doctors don’t know what’s wrong with you either!

First, it’s important to understand that health insurance isn’t really an insurance against your health. Like all insurance products, it’s an insurance policy to protect your assets from a financial catastrophe that results from a health problem. If you really want to protect your health, buying health insurance doesn’t help at all. Stick with diet and exercise.If you really want to protect your health, buying health insurance doesn’t help at all.

As a self employed attorney, I purchased insurance on the open market for my family prior to the Affordable Care Act, what you term “Obamacare” in your article. It was (reasonably) affordable and tied to the risk level that my family presented. I had good coverage.

As you note in your article, the premium is no longer tied to the risk. This is a feature of the Affordable Care Act. Insurance for my family is now between five and six times as expensive as it was the year before the Affordable Care Act started, and the coverage is nowhere near as good.

In addition, my choices have dwindled to nothing. Three years ago, I still had options. The year before last, my choices had dwindled down to only three options. Picked an insurer, but my insurer stopped selling individual plans in my area at the end of the year, so I had to pick another plan last year. Last year, there were two options, so I picked the lesser of two evils. At the end of the year, that insurer dropped out, and does not sell individual plans in my area, leaving only the greater of two evils. This year, there was only one option, and I hate it. It does not cover any of the doctors I have ever used and forces the use of doctors I would never choose. More importantly, it is more expensive to visit these doctors WITH insurance than simply going to my old doctors without insurance coverage and paying the full rate. We go to our old doctors, pay the full rate, and groan. We keep the insurance coverage in case of something dire, cancer, brain injury, or other catastrophic illness or injury, and to remain compliant with the law.

Oddly, you conclude that the cure is a single payer system. What’s wrong with going back to the way it was? Is there any surprise that when you cover prior conditions, do not adjust for health risk (other than smoking), and make everybody in broad age categories pay the same rate, that a guy who works out 5-6 days a week, eats mainly chicken breast, brown rice, broccoli, and spinach salad, is going to have to pay more to make up for the obese diabetics who eat processed, sugary foods and drinks and play video games all day as exercise?

It did not take a rocket scientist to see what was going to happen. If you made automobile insurance rates the same for everybody, and mandated that auto insurers had to cover those with DUIs and reckless driving charges and, hell, even cover accidents that happened BEFORE the insurance was purchased, would anybody be surprised to discover that you, with a clean driving record, would end up paying multiples of what you were paying before? Would the only good solution then be that of course the government must be the single payer auto insurance system? This makes no sense.

In your section titled “Artificial Poverty” you ask whether those numbers have gone up since they’re three years old now? The answer is yes, but not very much – and there’s a reason for the slight increase this year.

(Similar to the examples you cite, we have a pretty good nest egg.) My wife and I have been retired (pre-Medicare age) since 2010 and have been on Obamacare (ACA) since it’s inception. Health insurance through our previous employer’s early-retiree plan was costing us $700-$800/month back then. (We had budgeted for that, but we were certainly open to other less expensive alternatives.) Simply enrolling in the ACA and then tax-efficiently withdrawing from our assets (keeping our modified AGI as low as possible, but without approaching Medicaid eligibility), provided us access to a Silver plan for $300/month.

But, we made the mistake(?) of trying to “keep our same doctor” (as was promised) and found that was keeping us in the more expensive (with broader network) PPO & POS plans. After a couple of years of paying more than we needed to, we decided to bite the bullet (so to speak), drop our favorite doctors, and simply go with the network of doctors in the available HMO plans.

The result —> In 2017 we paid premiums of $85/mo for a Silver HMO plan w/$2,200 deductible; this year (2018) we’re paying a premium of $108/mo for the same Silver HMO plan w/$1,900 deductible. (It appears that the premium went up and the deductible dropped because of the termination of the CSRs; the insurance companies here in Ohio raised the premiums for their own profitability, but the ACA premium tax credit subsidy didn’t increase quite as much. We’re not complaining.)

(But there are risks. In 2016 we were enrolled in one of the co-ops (Inhealth Mutual) that went bankrupt, and then had to scramble and find a new plan mid-year during a special enrollment period. That was interesting. None of our out-of-pocket expenses the first half of that year under Inhealth counted towards the out-of-pocket expenses in the second half of the year under the new insurer.)

We plan to do this – that is, tax efficiently withdrawing from our investments for two more years, after which we’ll both be Medicare-eligible and can then move forward with whatever faces us there.

(For us, regarding anything that might be considered controversial, the moment the Court ruled that the ACA was about “taxes,” there was no longer any controversy. That settled it for us. Our mindset changed to one about taxes only, and how to best manage our income to pay the lowest amount of taxes we were legally obliged the pay – just as we had done throughout our working careers.)

Great summary article BigLaw. I am going to retire in a few months at 61. I will have the privilege of checking this out myself soon. As a physician I hope to take care of myself where possible. I will stay insured just in case I get a cancer or have a MVA. Uncertain times.

Health care in USA is a COMPLEX PROBLEM, layers after layers od compounded problems( probably all began around War World ll when companies were not allowed to increase salaries and began offering health insurance as a way to attract workers). Most of the people in USA (during working years ) have insurance from employers, mine was a wonderful one:PPO, deductible of $ 250, $ 0 per premiums: Asking for single payer system is silly, to say the least: have you ever heard that ,sometimes , the NHS hire french orthopedics to do surgeries during weekends because of shortages(hip/knee replacement) but on mondays are back to France, no follow up(true story).Obamacare showed that government intervention made things worse. The real problem is the slice of people that are self employed or early retirees. The Obama administration reduced the time for a short term insurance from 12 months to three, that’s the option I have been using after I retire, imperfect as it is.Two good news though: first short term insurance are going back to 12 months and then Association health plans in which small businesses qualify for the same pools as big businesses are almost ready to be implemented. Probably, still there are a lot of room to improve,but are steps in the right direction and believe me the GRASS IN NOT GREENER IN THE OTHER SIDE.