If you’ve grown up in normal American culture, you might believe that money is how you buy goods and services. It’s the thing you hand over to Amazon in exchange for the stuff you need. If you got an economics degree, you might think of money as a medium of exchange, a unit of accounting and a store of value. But if you’re aware of the financial independence movement, you think of money as freedom.

All of the above definitions are correct. Yet, sometimes I take for granted that people are familiar with the “money as freedom” concept. Only a few days ago I was having a conversation with a non-lawyer and, despite being knowledgeable about personal finance, he hadn’t heard of the concept.

I think this is because many of us begin our careers utterly confused about retirement.

There’s many reasons for this, such as: (1) a financial services industry determined to confuse you about how to invest; (2) a feeling that one should (but can’t) know one’s “retirement number”; (3) a feeling that your “retirement number” is $5M or more, which represents a number you can’t grasp or hope to achieve; (4) more pressing concerns than retirement, such as student loan debt, the desire to own a house and have a family; and (5) a sense that “retirement” isn’t a worthy goal because you are a productive member of society determined to keep working anyway.

If any of the above sound familiar to you, I’d wager to guess that you’re more likely to think of money as either a way to buy goods or services or somewhere along the traditional economic line of thinking of money a unit of accounting.

How to think of money as freedom

In the ‘80s and ‘90s, Joe Dominguez and Vicki Robin popularized a different way to think about money. Joe Diminguez is the original Mustachian. He saved $70,000 by the age of 30 in 1969 (about $485,011 in today’s dollars) and then called it quits forever. Joe and Vicky went around the country hosting seminars explaining that your money could purchase stuff or it could purchase freedom. As the popularity of the movement grew, MORE people began to host seminars spreading the message and the whole thing came together in the 1992 book Your Money or Your Life.

This is the core concept from the book: everything you spend in dollars can be translated into life energy.

To make this calculation, you first need to know how much of your life energy is needed to acquire dollars. This is simply the salary from your job (including benefits) divided by the number of hours devoted to your job (commuting, working, decompressing, etc.). From here, you know about how much each hour of life energy translates into dollars. When you make a future $10 purchase at Starbucks, instead of thinking about it as $10 you now instead think of it as 1/10th of an hour of life energy (or whatever it is for you). As lawyers used to billing our time, we should be very good at these calculations.

If you can make the leap to thinking of money as a medium of exchange for life energy, it’s not much of a stretch to start thinking of money as freedom from using your life energy to get the things you want.

How much freedom can money buy?

Let’s take a simple example of rent as a $1,000 monthly expense. If your life energy is worth $50/hr, it takes you 20 hours of life energy to pay your rent every month. If you’d rather not trade 20 hours of life energy for a roof over your head, you’ll need a significant amount of money to replace the money generated by your life energy. Using the 4% rule, we can roughly calculate that $300,000 will generate $1,000 a month more or less indefinitely ($300,000 X 4% = $12,000 a year or $1,000 a month).

So, if you have $300,000 saved toward retirement you’ve effectively paid your $1,000 rent for the rest of your life (or saved 20 hours of life energy a month). That’s pretty neat but what about all the other associated expenses with life? Or the fact that your rent might be three times $1,000 a month?

Well, the first piece of good news is that all of your expenses are variable. You may be paying $3,000 a month in rent today but that might not be a requirement going forward. It could be a temporary necessary expense. For those reasons, when you’re calculating how much freedom money can buy you need to keep in mind that it’s relative to your expenses. Spending $100,000 a year? You’ll need $2,500,000 to cover those costs. Can you live somewhere else and get by with $50,000? Now you’ll only need $1,250,000.

How to visualize money as freedom

All the math is wonderful but it’s still a bit esoteric. How do we make this easy to understand? With charts of course!

If you want to know how much freedom you’ve purchased, look no farther than a pretty simple chart popularized by Your Money or Your Life.

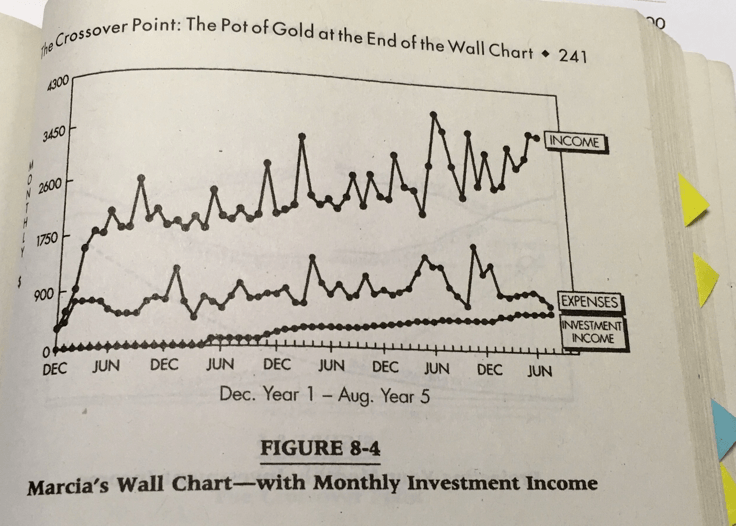

There are three things to plot on this chart: (1) your monthly income; (2) your monthly expenses and (3) your investment income.

The first two are pretty straightforward. If you’re not tracking these numbers, now might be a good time to start. The third only takes slightly more work. Take the amount you’ve saved toward retirement and multiply it by 4% and then divide by 12. Saved up $100,000? That’s $4,000 a year ($100,000 X 0.04) which comes out to $333 a month.

As you save more money for retirement, your investment income will go up. If you cut expenses, your expense number will go down. When those two lines meet, you’ve purchased freedom from needing to exchange your life energy for your life expenses. Some call this “retirement” or “financial independence” but the principal is the same. Working for money becomes optional.

If you haven’t seen this chart below, give it a shot. The investment income may not be much at first but over time you’ll get used to watching it grow at a steady clip.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He convinces the student loan refinancing companies to give you cashback bonuses for refinancing your student loans and looks forward to you discovering how easy it is to track your net worth with a free tool like Empower.

I have thought about retirement and how long (in years) I have to give in order to reach FIRE. I used an app, Financial Calculator and it shows how in beautiful graphs and amortization chart (amortizing / paying your retirement fund is a fun concept too) Right now it appears I have about 12 years to go. The one thing that can change is an exponential increase in salary and this may speed up the timeline! Oh I’m a lawyer too by the way. Glad that this blog is updated!