I’ve been getting a lot of questions recently about the early retirement crowd and realize that many lawyers aren’t familiar with it (and, really, why should they be?). Those that have heard of it often have a hard time getting past the retirement gimmick – why would anyone want to retire at 35? And then what would they do?

So what’s this FIRE movement all about?

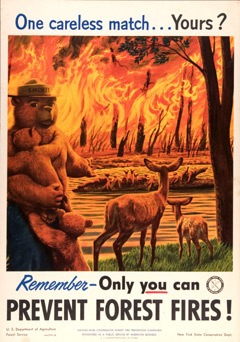

“FIRE” stands for Financial Independence / Retire Early. Someone had the great marketing idea to combine all the letters into FIRE because … well, I don’t really know. Fires have nothing to do with financial independence.

The PhysicianOnFIRE isn’t just fired up about early retirement, nor is he burning with desire to become rich. He’s probably only months away from quitting his day job and exploring the next chapter in life. He’s what you call financially independent. He just hasn’t retired early.

Financial Independence is pretty simple: it’s when you no longer have to work for money.

The current leader of the early retirement movement is Mr. Money Mustache, an engineer who retired in his 30s and is living off investment returns.

But the idea of financial independence is quite old and some might say tied to the story of America itself.

American individualism and independence is a core bedrock of society that shows up repeatedly, from Benjamin Franklin (perhaps the world’s first early retiree?) to thrift during the Great Depression through hippie culture and opting out of the system in the 1960s.

Remember communes? Yeah, that’s (partially) about financial independence.

The idea surfaced again when Vicki Robin and Joe Dominguez wrote Your Money Or Your Life in 1992 and again in the 1997 documentary Affluenza.

If you’re at all familiar with tiny houses, you’re also familiar with the same idea being reborn this decade.

The point is that the FIRE movement is hardly a new thing. Some percentage of Americans have always struggled to be independent from the system.

So while “FIRE” might be new to you, thanks to the power of the internet, suddenly a lot of like-minded have found each other and connected. As a consequence, you might see it popping up in your feed from time to time.

But does early retirement even make sense for a professional like a lawyer?

After spending six figures on your legal education and three years of training, would you really want to walk away from work?

And what would you do if you did?

Wouldn’t it be incredibly boring?

Let’s discuss.

Early retirement is absolutely attainable

If you’re making four times the nation’s average salary, shouldn’t you be able to retire four times as fast?

The simple answer is yes.

If you’re a high earner, you can achieve a middle-class retirement incredibly early thanks to the huge gap between your income and the amount of money it takes to afford a middle-class lifestyle.

The principles are simple: you save a ton of money as quickly as you can until you hit your FIRE number. Then you exit the system, like this lawyer.

What’s a FIRE number? It’s the amount of savings you need to be financially independent. The rough guide for calculating your FIRE number is 25 times your annual expenses. Twenty-five times your annual expenses is the same as withdrawing 4% from a portfolio to cover your living expenses.

Why 4%?

That’s the Safe Withdrawal Rate based on the Trinity Study (Texas, not Ireland) that basically says you can withdraw 4% from a portfolio over 30 years and expect the portfolio to last for the entire 30 year period.

Notice that calculating a number for financial independence is based on your expenses, not on replacing your current income.

Intuitively this makes sense.

If you save 50% of your after-tax income, then for each year you work, you also gain enough cash to cover a year’s worth of living expenses. If you save 80% of your after-tax income, then for each year you work, you gain enough cash to cover four years of living expenses.

But what about all the other lawyers that aren’t working in Biglaw? Is it possible for them to achieve financial independence?

Since financial independence is based on your expenses and not your income, it’s quite possible for lawyers of all income levels to retire early.

There’s an entire thread over at the Mr. Money Mustache forums with lawyers (high income and others) that are interested in retiring early, should that be your thing.

While it’s obviously easier to save more money with a high-income, it really comes down to the expense side of the equation. The Biglaw lawyer that’s spending $200K a year living in NYC is no closer to financial independence than the solo lawyer making and spending $30K a year.

Why would anyone retire so early?

Okay, so it’s possible, but why the heck would anyone want to sit around on a beach from the age of 35 to 90?

I have yet to meet anyone who plans on doing that.

Most expect to keep working, just on different projects than their current gig. Maybe they’ll take up woodworking or teaching or start a small business. The point is that they don’t have to work for money, so they can focus on finding the right project.

The right project might even be continuing doing exactly what you’re doing right now!

But wait a second – does that make them retired? They’re still working, so it’s all a sham!

Agreed, but don’t call the Internet Retirement Police too fast.

The whole “retired” thing is just a gimmick anyway, meant to attract a culture used to clicking on the latest piece of clickbait.

Sure, you could sit on a beach if you wanted to do that but it’s not like you’re required to join a shuffleboard club and to start playing bridge with your friends (unless that’s your thing, which is totally cool).

As many of you on the email list know, there’s plenty of options for the financially independent that involve all kinds of interesting activities. Most of the people pursuing financial independence are simply looking for more control over their life and how they spend their days.

Financial independence isn’t about sitting around twiddling your thumbs.

But I spent three years and six figures to get a law degree

The other general concern about early retirement is that after spending so much time and money obtaining a law degree, would you really walk away from it all to retire?

Well, what would you do if you won 10 million dollars in the lottery?

Would you quit our job?

The truth is, you really don’t know how you’d react. As I’ve written about before, humans are basically incapable of predicting the future. Remember when I asked you to choose between winning the lottery and becoming a paraplegic.

It’s the same with financial independence.

You might decide to stay in your current job.

You might quit and do something else.

You might sit on the beach from age 35 to 90.

Either way, you’ll have a few options at your disposal, which makes the goal pretty attractive to most folks.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

I tell people at my biglaw firm that I’m close to my retirement number and they always look at me like I’m crazy. I offer FIRE advice to incoming associates and they have absolutely no interest on the subject. There are people my tenure who have law school debts, a mortgage, car loans and other bills. A 10th year told me recently that she can’t quit because she has bills to pay.

It’s like watching your colleagues drowning in a kiddie pool. But no one wants to do anything about it.

Do you have kids biglawfire?

I’ve had similar experiences. The most eye-opening one came though when I started talking to partners and found that some of them have similar encounters. While I totally understand someone who is only 1-2 years into their career having a hard time wrapping their mind around early retirement, it’s hard to argue that having the option to do so would be a bad thing. Why do you think the incoming associates you talk to have no interest in the subject?

You know, you are the first person I’ve ever seen reference hippy communes and fire in the same sentence. As someone whom is pursuing the independence part but maybe not the retirement part I will say the community comes from all walks of life. Doctors, lawyers, engineers , corporate executives, line workers, retail workers, and everything in between. The key is choices.

Agreed. The early retirement crowd spans the a wide range of careers. I’d even venture to say that most are not high income earners. It’s certainly not an idea that originated from them. I think the thread on the concept has been around for quite awhile and once understood in that context makes it a little easier to understand. I’m not a fan of “early retirement” and think it’s a gimmick that does a disservice to the concept of “financial independence” which is the term I prefer to use, but then again “retiring at the age of 33” and cute photos of kittens gets the clicks.

If and when you have kids, you start to value your time much differently than you did beforehand. I used to trade lots of time for money. Now, with my boys halfway to high school, I’m ready to start trading money for time.

Cheers!

-PoF

No kids yet, but this makes sense to me. I think part of it is getting older in general. No doubt I thought I worked pretty hard when I was 25 and had no free time but what I wouldn’t do to go back and recapture that time! I’m assuming at 45 I’ll feel the same when I look back at being 35.

Reminds me of something I tweeted a few months ago: Would you trade places with Warren Buffett today? You’d end up with billions of dollars but be 86 years old. I’m guessing you wouldn’t, which means you’re valuing your time on this planet at billions and billions of dollars. How’s that for perspective, huh?

Yeah, fast forwarding through 4 or 5 decades does not appeal to me for any amount of money. Excellent viewpoint.

Really clever way of putting the time v. money conundrum into perspective. I’m sure if I could to a middle-ground transfer and give up maybe a year for a few of his millions, I may be willing to make that trade 🙂

I’m not sure yet. It’s definitely interesting looking at the early retirement view from what you said: you aren’t necessarily retiring, just finding the right project.

I’m looking to be financially independent in the next 5-10 years. At that point, I will be able to pursue whatever I want (like you said). It may come sooner! I’m starting a few businesses… 2017 will be an interesting year!

So you’re basically calling me a hippy then Mr BigLawInvestor? 😉

Awesome! That gives me an excuse to grow a pony tail, buy myself a kombi van, and go join Nords for some surfing.

Seriously though I think you’re right when you say the retirement part of the FIRE myth is mostly bollocks, the real goal is gaining control over how you choose to spend your time.

It’s no coincidence that a lot of people in the early retirement community have pony tails and spend their days surfing! But yeah, I’m over the “early retirement” part. Plus, most lawyers are severe type-A personalities. I don’t think too many of them would be happy sitting on a beach all day long. However, to be financially independent and able to choose which projects to work on and when to work on them …

Good stuff. The FIRE movement is exciting for sure!

I’d be careful with the 4% rule specifically related to FIRE. That guidance is intended for people at normal retirement age – so in their 60s living until their 90s. Someone retiring in their 30’s or 40’s with potentially 50 or 60 years of life left need to draw more conservatively. Studies have shown that for a 50 year draw, 3% is probably more reasonable. So I’d recommend a target of 33x annual living expenses before someone considers retiring that early.

3%?! Can I be the beneficiary of your large estate? Lucky for whoever it will be!

In all seriousness, I don’t buy into the need to go lower than 4% for the safe withdrawal rate, although of course we all need to make our own calculations. Here’s the reasons why I think 4% is plenty:

(1) Lawyers are a bit lucky in that our professional degree insulates us somewhat from middle-aged unemployment. If it turns out you need to go back to work for a few years in your 50s, it should be easier for a lawyer to accomplish than perhaps an engineer.

(2) Lawyers are type-A personalities for the most part. The idea that they (or anyone?) would “retire” with a 50-60 year lifespan and earn no money strikes me as next-to-impossible. It’s just not going to happen.

Related: The 4% Safe Withdrawal Rate is Fine

Nice article! You hit on the strong premise for those who are passionate about FIRE……we want more autonomy in how we spend our time (lives). We tend to be a pretty independent bunch and are comfortable doing things differently. But it seems very strange to those that aren’t wired with such a strong drive for independence.

I’m glad I found your blog.

FIRE is about giving you choice.

It doesn’t mean you have to retire early, it just means you can if you want to. I retired at 55, I had never heard of FIRE, but for me I had enough money to leave work. I haven’t looked back, and had no desire to work as an IT professional again.

However my husband, and engineer, who retired at the same time as me was approached to work part-time. He accepted, he does his work he wants to, when he wants to, (no admin), turns up at the office about once a month for a couple of hours. He still has the freedom to travel for weeks / months if he wants (Laptop & wi-fi means he can work anywhere)

He’s happy he is working the way he wants. He knows he doesn’t have to. Choice!