I’m pretty busy these days trying to stuff as much money into pre-tax retirement accounts as possible. Living in a high tax environment with a triple combo of federal, city and state taxes makes me fairly confident that the taxes I’m paying today will be higher than the taxes I pay in the future. But can I be sure? Of course not.

But if I’m right, by taking advantage of the tax arbitrage of saving money today at my marginal rate (by contributing to a Traditional 401(k)) but paying it in the future at a lower effective rate (by withdrawing from a Traditional 401(k)), I’m effectively getting a free 401(k) government match.

If you’re still unsure over whether Roth or Traditional 401(k) contributions are right for you, one thing you may have considered is that you can effectively contribute more money to a Roth 401(k) than you can to a Traditional 401(k). Won’t that additional money result in greater savings over time? Should you take advantage of the loophole to save more money into a Roth 401(k) account?

Well, first, let’s discuss why you can contribute more money to a Roth 401(k) than a Traditional 401(k).

It’s because by making contributions with after-tax dollars to a Roth 401(k), those dollars are “worth” more than the money that you’re putting into a pre-tax Traditional 401(k) since those pre-tax dollars by definition have not yet been taxed.

Every dollar that you contribute to a Roth 401(k) account is yours to keep forever. That’s not the case with your pre-tax contributions to a Traditional 401(k). You get to keep most of each dollar but some part of that dollar is earmarked for the federal government.

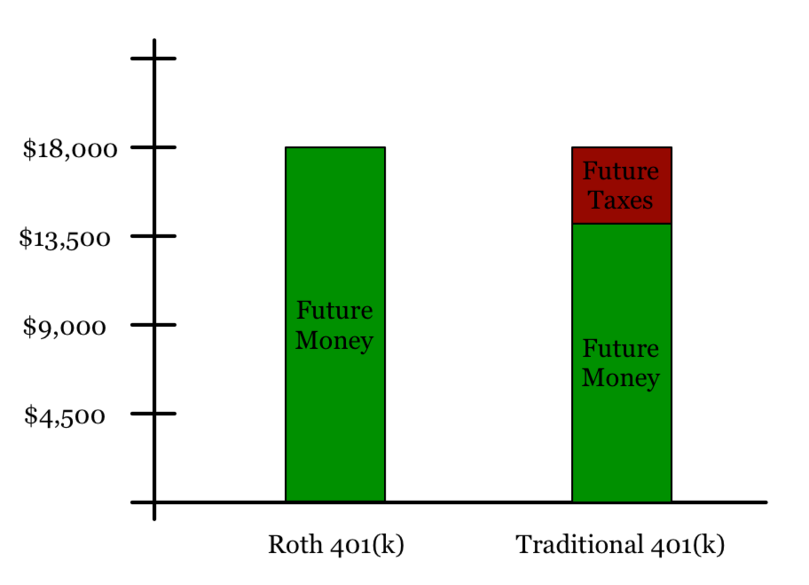

I made a little chart to illustrate this concept below:

Another way to internalize the concept is to think of the Roth 401(k) as an account you own entirely. Meanwhile, the Traditional 401(k) is really two accounts: (1) an account you own and (2) an account you’re managing on behalf of the government. The government account may fluctuate in size depending on your taxes in retirement but it’s likely that you’ll have to turn over some part of the investment to the government at some point.

When making the decision between Roth or Traditional contributions, you’d gloss over this difference in contribution amounts at your own peril. It really does matter that you’re contributing more “real” dollars to a Roth account than you can to a pre-tax account.

There are also several reasons (both behavioral and economic) for why you might prefer to max out a Roth 401(k) account.

(1) More Savings. As outlined above, you can effectively contribute more money into a Roth 401(k) than you can a Traditional 401(k).

(2) Human Behavior. In order to save a comparable amount in a pre-tax account, you must invest your tax savings in a taxable account. In other words, let’s say you save $7,000 in taxes each year by contributing to a Traditional 401(k). If you spend that $7,000 on cocaine and flights to the Caribbean, despite the additional fun, you’re definitely not saving the same amount of overall money as you would in a Roth 401(k) account. You have to be disciplined to save the additional tax savings each year. If you’re setting your own salary and banking the rest, this shouldn’t be much of a problem but it is easy to let money slip through your fingers. You need to be confident that you’re saving 100% of the tax savings.

(3) High Taxes in Retirement. If your tax rate in retirement is going to be the same (or higher) as your tax rate during your working years, the Roth makes more sense. In those scenarios, you aren’t taking advantage of any tax arbitrage. That’s why for some very high earners a Roth account makes the most sense. Imagine for example that you’re earning $3,000,000 a year and saving $1,000,000. By the time you reach retirement you’ll be forced by the RMDs to withdraw so much money that you’ll end up in the highest tax bracket anyway. It makes more sense to pay taxes today and withdraw is tax-free in the future than it does to take the chance on future tax rates (not to mention your Roth growth is entirely tax-free as well, whereas you’ll pay ordinary income tax on the growth in your Traditional 401(k)).

Tax arbitrage advantages of Roth vs Traditional 401(k)

I’m not going to spend much time going over the benefit of saving taxes at around 40% and paying them later in the future at 20%. Clearly that’s a winning proposition you should take every chance you get and the reason why the Traditional 401(k) is going to be the right answer for most lawyers. The reality is that most lawyers won’t be making enough money to make a Roth 401(k) the better choice.

It’d be great if you could figure out how much the extra space in the Roth 401(k) is worth vis-a-vis the benefits of taking advantage of the tax arbitrage of saving today at your marginal rate vs paying tomorrow at a lower effective rate.

Luckily for us, The Finance Buff has done the math and put together a spreadsheet to help you make the decision.

Based on his calculations, the higher effective contribution limit of the Roth 401(k) is worth about 7 percentage points.

In other words, if you expect your marginal tax rate at retirement to be around 7% (or more) less than your marginal tax rate today, the Traditional 401(k) is going to perform better.

Today my marginal tax rate is 45.6%. If my marginal rate in retirement is 38.9% or less, the Traditional 401(k) should be the better choice.

Don’t forget that we’re still talking about the marginal dollar too. I’m ignoring the fact that I will have to fill up the lower tax brackets before I even approach a marginal rate of 38.9%.

I feel confident that I’ll be withdrawing funds in the future at a rate of 38.9% or less. For one, I probably won’t still be living in NYC when I retire (instead, I’d prefer to be living in a sunny climate with no income tax like Texas or Florida). Second, if I didn’t have any state income tax to pay, I’d need an income of over $418,400 to hit the marginal federal tax rate of 39.60%. If my income is less than that in retirement I would be taxed below 38.9%.

Now don’t get me wrong. I’m not ruling out an income of $418,400+ in retirement. I’m just saying that should that happen, life went extremely well. Paying higher taxes would be a good problem to have. One that I would be happy to accept.

It’s much more likely that my retirement income will be substantially below the top tax bracket, which will move upward from today’s number with inflation anyway. If I play my cards right, I’ll be using tax diversification in retirement to reduce my overall federal income tax burden. For those reasons, I think it’s obvious the best path is to save money today at a high tax rate and pay it tomorrow at a much lower one.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

I’m all-in on Traditional 401k, and plan to be for some time, for a variety of reasons:

1. Traditional positions you well for retirement while also giving you more disposable income now (which is nice, with things like daycare/kids/vacations/etc. to pay for right now); doing Roth 401k would mean a smaller take-home paycheck, and maybe a little less fun now.

2. The downside for going traditional 401k is that in retirement RMDs mean you pay more in taxes than you would have if you had gone Roth — in essence, that you have too much money and pay more taxes as a result. That’s not really all THAT bad, IMHO. The downside with Roth 401k is that it maybe takes you longer to save up enough or that you don’t have enough saved up.

3. You need to fill all the lower brackets with sources of income first to even approach worrying about whether a Roth 401k might be better on the top marginal dollars — using the 4% rule, you probably need to have or be on almost certain track to have in the ballpark of $1.5-2.5 million to have this start to be a problem (I didn’t do the exact math, but that works out to $60k-100k in withdrawals per year being taxed, which would get you into those higher brackets when you add on Social Security). I’m still WAY far away from those numbers (though totally on track to do it with my current balance even without contributions, and sure to reach it if I factor in contributions), so I stick with traditional 401ks for now.

4. If you DO the responsible thing and invest the tax savings from a Traditional 401k in a taxable account, you then can build up a nest egg for living expenses in early retirement that will allow you to do large Roth conversions over the course of multiple years in early retirement on your traditional balances.

5. Lots of people already have Roth IRAs (backdoor or otherwise), so they have tax diversification that way in retirement already. (For the record, and I know this makes me a bad Boglehead, but I don’t have a Roth IRA yet….although my resolution is to get around to doing it this year — I need to roll old traditional IRAs for me/my wife into our 401ks to make the backdoor Roth possible).

Also, one more thing:

6. While you may be a big law attorney with an awesome paycheck now, that may not last forever — plenty of people end up with jobs in government/smaller firms that pay less down the line, or as stay at home parents, etc. Going Traditional 401k makes more sense given this possibility down the line, as it gives you more take home pay to build up an emergency fund/taxable accounts/pay down debt, and takes advantages of avoiding higher marginal tax rates when your wages may be at their peak in your entire career.

Chadnudj, thanks for leaving such an awesome comment. This is almost a full post itself. I agree with all of your excellent points. The tax benefits today are just too great to pass up. A lot of people don’t have Roth IRAs set up for the reason you mentioned since it is a bit of a pain to do the reverse rollover thing to clear up the old traditional IRAs. Don’t let the paperwork get in the way of building up that tax diversification benefit you discuss in point #5!

Great post! I like the 7% rule of thumb for marginal tax rate.

My marginal rate is currently 43.6, so I would need to be above the 35% tax bracket ($416k) in retirement for a Roth to make sense. At 4% SWR, that would mean over $10M in the bank. Unless I discover a diamond mine in my back yard, I will retire on much less than that! So, I will stick with the Traditional 401(k)

Thanks,

Dr. C

Exactly the same as my thinking. And if you do find the diamond mine? Well, that’d be a great problem to have.