Every time you lose credit for a month toward PSLF or another loan forgiveness plan, you’re dealing yourself a double blow: (1) the payment made during the month is money thrown down the train never to return again; and (2) you’ve obligated yourself to work for an additional month at a qualifying employer, whether you like it or not.

The problem is that ensuring that you’ve made – and keeping track of – 120 qualifying payments for PSLF (or a staggering 300 payments for IBR/REPAYE) is no easy task. Based on my anecdotal survey of friends, most people are just making payments “in the system” with the hope and expectation that it’ll all work out in the end.

This strategy has a lot of flaws. As my interview with someone who actually received PSLF forgiveness showed, it’s pretty common and easy to “lose” a month or two of payments.

If you want to ensure that you receive credit for every qualifying payment you’ve made, I suggest you spend the hour or two to set up the records as I did on a Saturday morning (the initial setup is painful but the ongoing maintenance should be easy). I wanted to make sure I had accurate records of the following information:

- Each and every loan that’s been taken out.

- The total amount paid on each loan (because I’d like to know precisely how much PSLF is saving us).

- The number of payments we’ve made.

- Any special circumstances or potential points of dispute.

Our PSLF journey / creating a student loan payment tracker

My wife is a public-service lawyer with a low six-figure student loan balance. Over the past year, particularly since we got married, we’ve been waffling back and forth as to whether we should pay off the loans or continue on the path of forgiveness. Obviously it makes sense to seek forgiveness from the math perspective (so that’s the path we’re on for now) but there’s a strong argument to be made that the forgiven amount won’t be as big as it seems since we’ll be making substantial payments toward the loans once our income is combined (or paying substantial tax penalties if we choose to file separately).

After a couple of false starts, I eventually decided that the only sensible way to make this decision is to organize all of the information into a spreadsheet. This is the story of only half of the journey (i.e. the part where we get granular on what’s happened). You’ll have to wait until our taxes have been filed to hear the rest, since calculating how much we’ll eventually pay on the loans in part rests on the actual tax details of whether we file our taxes jointly or separately.

To start gathering the information, I set up a Google sheet to organize the loans via one master document with a tab for each loan. In our case, we had seven loans, so the spreadsheet has seven tabs to track each loan.

Thinking about the loans separately is the only logical way to keep the details straight. Since each loan is separately forgiven after making 120 qualifying payments, we need to track the loans individually to see if each loan is on the same track for forgiveness (as you’ll soon see, that wasn’t the case for us).

Not all of my wife’s loans were eligible for forgiveness either, something I think is quite common when lawyers start sorting through the student loan mess. Three of her loans are FFEFL loans (only Federal Direct loans are eligible for PSLF forgiveness). Because my wife didn’t consolidate the three FFEFL loans into a single Direct consolidation loan years ago before I met her, our option is to do the consolidation now. The “new” Direct consolidation loan would be eligible for PSLF forgiveness but we’d need to make 120 payments to get the “new” Direct consolidation loan forgiven.

Luckily, these three FFEFL loans only amounted to about $6K in student loans. It didn’t make sense to consolidate and put them under the PSLF umbrella given where are (roughly halfway through the PSLF process), so we paid them off instead.

For the remaining four loans, the balance is significantly higher and it’d be great if they were forgiven since my wife has been (and plans to continue) working at a qualifying employer.

These four loans were originally were serviced by Navient. Now that we’ve filed an Employment Certification Form, the loans have been transferred to Fedloan Servicing, since it’s the only company that handles PSLF. The end result is that our payments have been spread across two servicers: Navient and FedLoan Servicing.

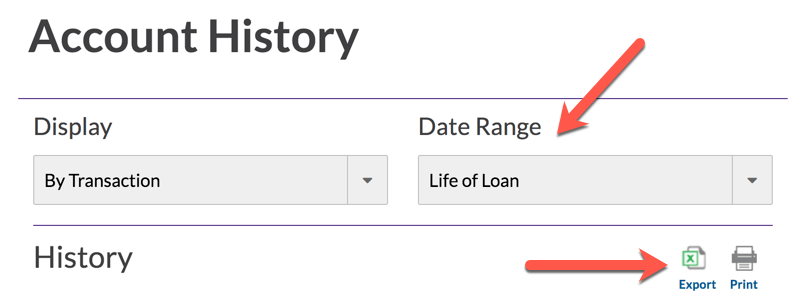

To continue building our spreadsheet, I first went to Navient and downloaded the payment information for each loan. Both Navient and FedLoan Servicing allow you to download previous payment information in Excel format, so I hope your servicer will allow you to do so too.

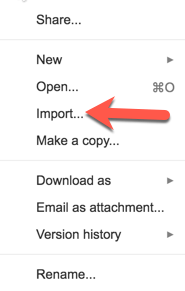

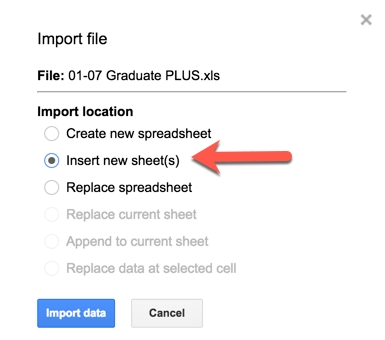

Once you have the data in an Excel or CSV format, import each file as its own tab into the Google sheet.

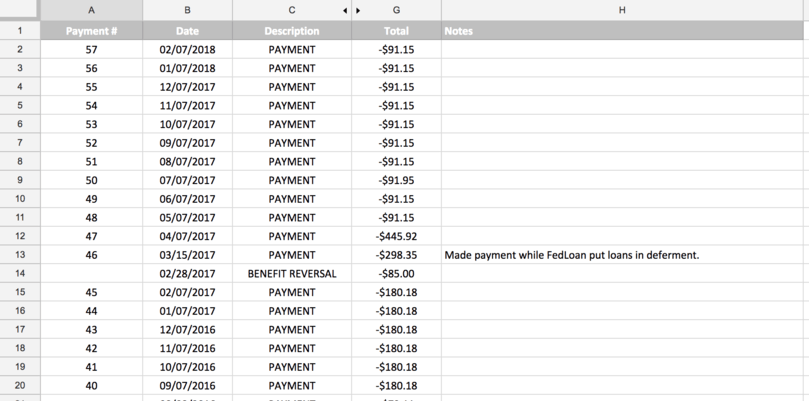

Now you should have a record of each loan in a separate tab of a Google sheet. I made some formatting changes and added two important columns: (1) the first is a simple count of payments; and (2) the second is a Notes field. What does in the Notes field? When we transferred my wife’s loans from Navient to FedLoan Servicing, apparently FedLoan Servicing put her loans in deferment (despite my instructions to the contrary) because it takes their systems up to 45+ days to record the transfer. How that’s even possible is beyond explanation. Regardless, I did not want the loans in deferment and made a timely payment anyway. I suspect at some point there will be an argument about whether that month counted as a qualifying payment, so I want a record to remember what happened five years from now.

So that’s it for us. Now we know how many qualifying payments we believe we’ve made. We’ll see if FedLoan Servicing agrees. If you’re pursuing loan forgiveness of any sort, I suggest you start creating your spreadsheet today. It doesn’t have to be perfect – just get started. Here’s what ours looks like:

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He is always negotiating better student loan refinancing bonuses for readers of the site.

I’m not a lawyer but I appreciated the pragmatism here! Thanks for the informative post!

Sadly, pragmatism is definitely required here. It’s a full-time second job managing loan forgiveness.

I graduated 1997. I believe I started payments to Sallie Mae. Sallie Mae then merged with Navient. When I look at lifetime payments. They only show I started making payments in 2006. There is 9 years of missing payments. I have tried to contact Navient and they can not give me a straight answer. Now they predict I will be paying until 2027. The loan was only for 7000.00. And my payoff balance is 5400.00 how does this happen. Is there anyone that can help me?

Have you tried to contact the ombudsman? Do you have records from the payments you made to Sallie Mae? I would first try to gather the evidence you need to show that you’ve made the payments and then submit it to Navient in one package and ask them to update their records to confirm payment has been made.

Unfortunately, a lot of people are in a similar situation to you. Also, check out this page:

https://feedback.studentaid.ed.gov/s/?language=en_US