Calculating your asset allocation can seem like a daunting task. What percentage of your portfolio should be in stocks? Bonds? Cash? The process of determining which mix of assets to hold in a portfolio is a personal one.

But your asset allocation is important because it has a big impact on your long-term returns. Keeping your portfolio in a 100% cash asset allocation is a sure recipe for disaster as your portfolio gets eaten up inflation. If you flip to the other end of the spectrum and go with 100% equities, you better be prepared for a bumpy ride as equity portfolios can get hammered during a down market. And even with 100% equities, would you be concerned that you’re not in alternative investment assets like real estate?

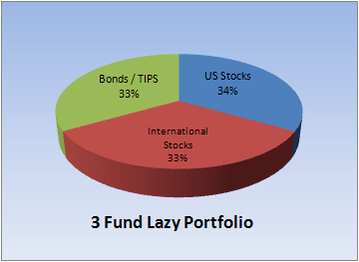

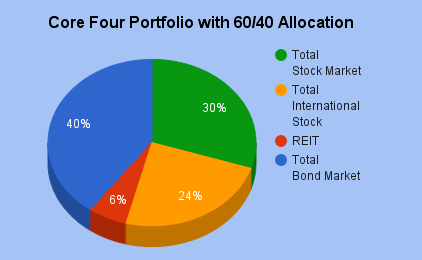

Luckily, the Bogleheads have come up with several simple yet powerful asset allocations. Some involve as little as three funds. Others are a little more complicated and tilt the portfolio toward small capitalization stocks and REIT exposure.

Here’s a few sample strategic asset allocation portfolios from the Bogleheads:

If you haven’t figured out your asset allocation yet, you might want to get started writing your Investment Policy Statement.

As I’ve written before, for quite awhile I’ve been rocking the three-fund portfolio during the accumulation stage of my career. I’m more interested in converting my income to assets than focused on trying to tilt the portfolio for an extra 0.5% gain. So far this has led to great results, since we’ve established that during the beginning and middle of your career your savings rate is more important than your rate of return.

However, recently I’ve started looking into real estate investments (more on that in an upcoming post) since it’s an asset class completely missing from my portfolio – or so I thought.

I’ve always tracked my asset allocation through a simple spreadsheet that essentially looks like this:

- VTSAX (Vanguard Total Stock Market) | 70% | US Equity

- VTIAX (Vanguard Total International Stock Market) | 20% | International Equity

- VBILX (Vanguard Intermediate-Term Bond Market) | 10% | US Bonds

Ever year, on my birthday, I adjust the asset allocation to get it back to the 70/20/10 mix I selected when I first decided to write it down.

There’s nothing wrong with this approach, although now I realize it’s not a very detailed look at my true asset allocation. It turns out that thinking of the portfolio as effectively a 90/10 mix of equity and bonds isn’t quite right.

Why?

Because the three index funds I hold in my portfolio pick up various other investments (like cash, real estate and alternative investments) that are part of my true asset allocation.

Do you want to know your true asset allocation?

If you’re interested in going deeper into your asset allocation, there’s a free tool I’ve been using for the past three months that gave me unprecedented insight into my own asset allocation.

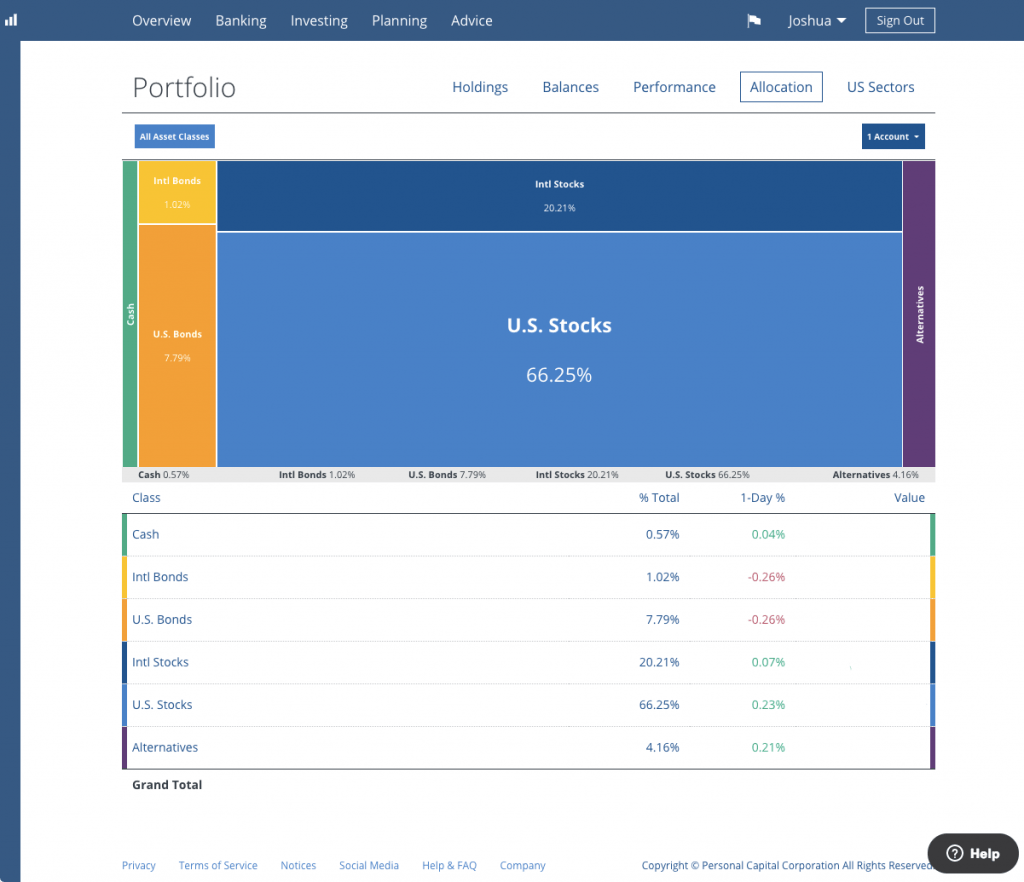

Here’s a look at that same 90/10 equity and bond mix in my actual 401(k).

When I first ran the report, I was expecting to see 70% in US Stocks, 20% in International Stocks and 10% in Bonds.

The actual report shows 66.25% in US Stocks, 20.21% in International Stocks, 8.81% in Bonds, 4.16% in Alternatives and 0.57% in Cash.

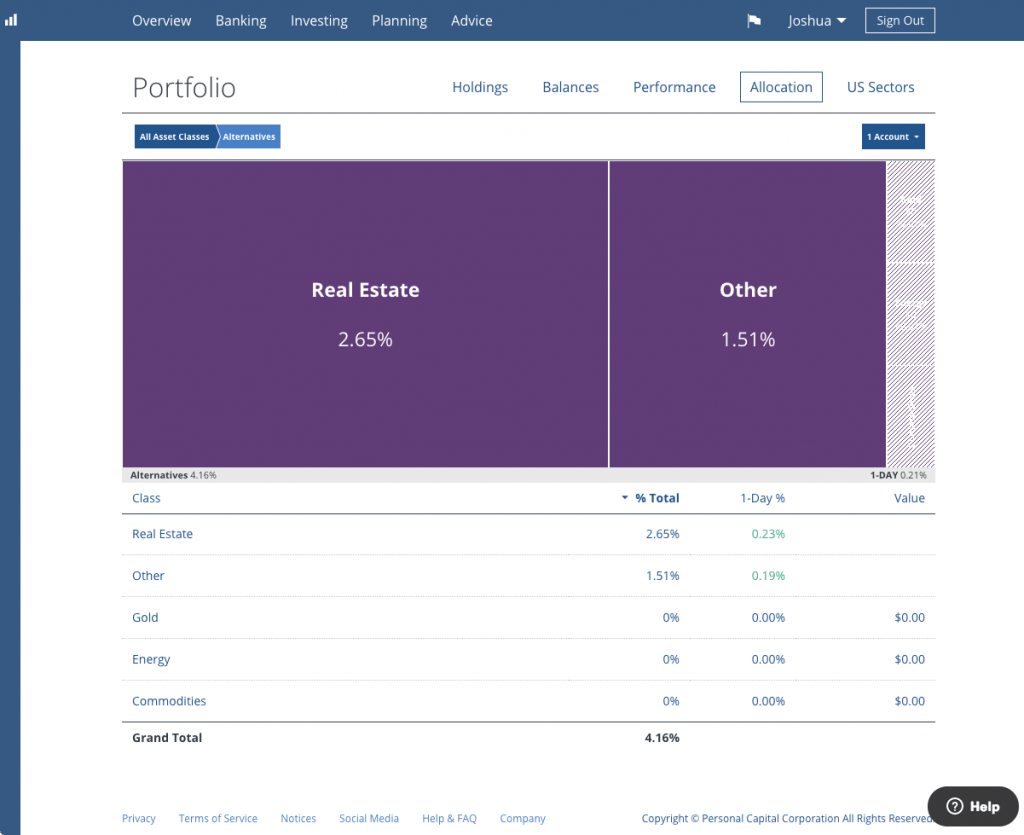

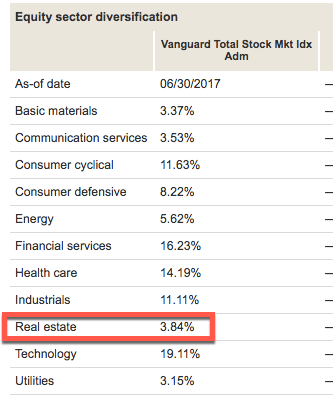

Clicking on the Alternatives box brought up the following chart.

Turns out 2.65% of my portfolio is already in real estate investments!

Intellectually, I knew this in the back of my mind. VTSAX has a small real estate component that it picks up thanks to holdings in publicly traded REITs. Yet, it’s easy to forget when you’re thinking at high level that VTSAX represents the total equity market.

There’s many other insights in the report, including that my US Stock position isn’t quite as high as I thought it was (66.25% vs 70%). There will be a few upcoming posts about how I’ve adjusted the asset allocation after months of using this tool and thinking about a few investment opportunities.

If you want to look at your own portfolio, it’s completely free to see your portfolio’s asset allocation. Thanks VC-funded FinTech companies!

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.