Capital gains can mean increased state and federal income tax payments for taxpayers. But if you’re thinking of selling some of your capital assets, there are a few things you should know.

For example, let’s say you’re moving from NYC to California. You want to sell a significant chunk of equities to come up with 20% down for a condo purchase in California. The question is: Is it better to sell the equities in New York before you move? Or wait until you’re in California?

It turns out the answer is clear: sell in New York! You’ll pay a higher rate for capital gains if you wait, which means it can cost extra money to sell your stock after establishing residency in California.

I don’t usually give much thought to state capital gains tax rates. For the most part, I’ve minimized all capital gains taxes by sheltering them in tax-protected accounts (like an IRA retirement account) or by taking advantage of tax-loss harvesting to manage capital losses and offset gains.

However, I think this is a common enough example of when you might pay a higher tax fee that it’s worth exploring in more detail.

Federal capital gains tax rate

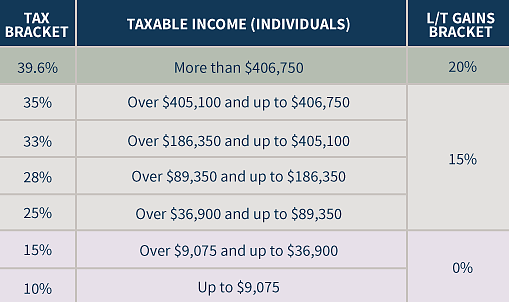

Most investors are aware of federal capital gains tax rates. Short-term capital gains are taxed at your marginal income tax rate. Long-term capital gains are taxed at either 0%, 15%, or 20%.

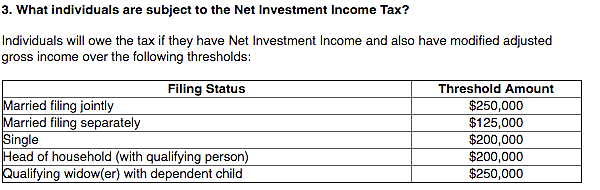

However, tax law requires an additional 3.8% Net Investment Income tax on unearned income. It’s to fund the Affordable Care Act and is only for certain income levels, according to the Internal Revenue Service (IRS) website.

State capital gains tax rate

A few states (California, New York, Oregon, Minnesota, New Jersey, and Vermont) have higher income tax rates—so it makes sense they have high taxes on capital gains, too.

In our example using California and New York, state capital gains are taxed at your ordinary income tax rate. There is no special tax rate for capital gains income. That’s largely a federal tax invention.

This means significant differences exist at the state level in “state capital gains tax rates.”

As is the case with federal capital gains tax rates, fluctuations in your taxable income can impact your final tax rate. For example, if you’re taking some time off between moves and jobs, your income will likely be lower that year.

Since lower income can result in a lower rate for taxes, it’s a great year to incur capital gains (assuming you planned on incurring them all along).

In fact, if you’re taking some time off, you should consider what other tax options might be available to you. Consult with an excellent tax accountant to see what your options are—some people are taking nearly $100,000 of investment income and not paying any taxes.

As with all things related to tax, a little planning goes a long way.

A hypothetical – married couple with $300,000 of personal income

To calculate the potential benefit or disadvantage of incurring capital gains in New York or California, let’s use the following facts in our hypothetical:

- Married Couple

- Married filing jointly tax return filing status

- Combined adjusted gross income of $300,000

- Sale of equities resulting in $50,000 of capital gains

Capital gains tax rate California

In California, they would pay the following tax on the $50,000 of capital gains:

- Federal capital gains tax: ($50,000 X 0.15) = $7,500

- Affordable Care Act tax: ($50,000 X 0.038) = $1,900

- California state tax: ($5,100 X 0.1038) + ($44,900 X 0.1138) = $5,639

- Total tax due: $15,039

- Effective capital gains tax rate: 30.08%

Capital gains tax rate New York

In New York, they would pay the following tax on the $50,000 of capital gains:

- Federal capital gains tax: ($50,000 X 0.15) = $7,500

- Affordable Care Act tax: ($50,000 X 0.038) = $1,900

- New York state tax: ($50,000 X 0.0685) = $3,425

- New York local tax: ($50,000 X 0.03648) = $1,824

- Total tax due: $14,649

- Effective capital gains tax rate: 29.30%

- Extra taxes paid by selling in California: $389

So, you could have an extra $389 in tax liability by selling the equities in California. That’s not too bad, but it would be worse if the capital gains are larger than $50,000 (which it might be, depending on your real estate market and how much you sell for a down payment).

This is because the California tax system taxes income at 11.30% up to $508,500 and then at 12.30% above $1,000,000. New York (including the NYC tax) taxes income at 10.50% up to $500,000 and then at 10.73% up to $1,000,000.

If your combined income is higher than $500,000 and your capital gains are above $50,000, the tax difference may run into the $1,000s. I think it’s safe to say that a little tax planning in this area is easily worth your time.

What about states with no income taxes?

Not every state has income taxes. So, would the outcome be different if you moved to a state with no income tax (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming)?

As you’ll see from the calculations, a high-income earner moving to Texas or Florida would benefit greatly from waiting to sell any capital gains used for a down payment.

- Federal capital gains tax: ($50,000 X 0.15) = $7,500

- Affordable Care Act tax: ($50,000 X 0.038) = $1,900

- State tax: ($50,000 X 0) = $0

- Total tax due: $9,400

- Effective capital gains tax rate: 18.80%

- Extra taxes paid by selling in California: $5,639

I don’t know about you, but an extra savings of $5,639 seems like a significant amount of money to me.

Finding a great financial advisor can help you keep the most money in your pocket when making decisions like this. But if you want to see for yourself, here is a great calculator for estimating capital gains taxes.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He knows that the Bogleheads forum is a great resource for tax questions and is always looking for honest advisors that provide good advice for a fair price.

Nope – given no thought to it before but just moved to California and probably should pay attention now. States with no income taxes are looking pretty good! Thanks!

Does that mean you got a job in Silicon Valley? I remember reading on your blog that you were interviewing there. If so, congratulations! But, sorry about your taxes.

Something I’ve never considered. I can’t believe location mattered in capital gains taxes. I guess I’m getting spoiled living in a no state income tax state but that will soon change once I start working. Will have to play my cards right to transfer myself back to a no state income tax state!

First question – Why are you leaving a state that has no income tax? The job better be worth it! Glad you’re considering where to sell equities if you’re ever in such a scenario. It hadn’t occurred to me either until the friend posed the question.

I think the job is very worth it and it’s a short-term training program so I will hopefully return to good ol’ no income tax state after the program.

Now I better plan out my moves based on when I’ll sell my stocks.

Hey BI, that is very very interesting, and a very different way to Australia. We just have one federal tax (the capital gain gets added onto all your other income, wages, dividends etc) and that has the varying tax rates.

There are no state taxes.

Tristan

But how do you confuse people about their actual rate of taxation if you only have one tax? 🙂

What a great post, the information is well organized and very comprehensive. I can imagine the effort you put into this and especially appreciate you sharing it.

Isn’t there another issue unmentioned here?

Namely, how long you resided in a state–and which state considers you a resident for tax purposes. You may discover that you do NOT have a choice where to pay your taxes.

Also, if someone is bringing in $300,000 and can easily sell off $50,000 in assets, $389 is pocket change and not worth fretting about.

All this– let’s avoid taxes biz– is also so self-centered. We’re all in this together; plus, those low or no state tax states often have poorer educational systems, lower support services; weaker safety nets; and are not as good a place to live!

I’d take California or New York, any day, over Alabama and Mississippi!

I thought I covered the residency aspect in the second paragraph. I completely agree that it all comes down to your state of residency.

$389 may be pocket change but the larger point (as I see it) is that it’s easy to skip over the consequences of certain decisions that seem unrelated (i.e. moving to a new state and deciding on the optimal strategy for minimizing taxes). If you do want to minimize your taxes, it’s far better to be thinking about it throughout the year then sitting down in April and trying to pay as little as possible.

The other thing to consider is that the tax is really a public policy tool. The government is incentivizing you to act a certain way (whether it’s saving for retirement or buying an electric car). Many times it’s both good for you personally and good for the greater good if you take them up on the offer. If you fight the incentives, you’ll pay more in taxes.

When it comes to states, they are competing with each other to attract residents. Of course $389 is hardly going to prevent someone from moving to California, but the higher tax burdens in states like New York and California definitely put pressure on their residents to look for other options.

Ryan Holiday has a good piece on this by pointing out why for certain people it’s essentially free to live in Texas.

Thanks for this info!

A question on this question.

How long does one need to reside in a state to qualify for the tax rate?

If I live in NY for 7/12 months of the year and then move to Florida (sell) and stay there for the remaining 5/12 months of that year, am I qualified for FL state tax and I owe nothing to NY for the 7/12 months I lived there?

I’d ask your CPA for advice on that and would be looking for someone who deals with questions like that every day. NY has some pretty stringent rules on residency precisely to handle people that spend a lot of time out of the state in sunny climates like Florida.

Is the capital gains tax due in the state you live when you sell, regardless of where you boutht the investment? I live in the Peoples Republic of California and hope to have large capital gains on my crypto investments that were purchased while I lived here. If I move to a no tax state like Texas, can I avoid the state tax upon sale?

I am having the same debate with my CPA. I happened to realize some serious gains from COVID related stock trading. Also, incidentally happen to be looking to relocate to a different country for work. State has a 183 days residency criteria (and a hefty short term cap gains rate!) . So, if i leave before July 3rd, unclear if short term capital gains realized already will be considered ‘state sourced’ income, even though i will not be a ‘resident’ based on significant presence test .

I just came across this page while researching an issue of selling real estate in New York. I hope you are still reading these comments, as I am having trouble finding a definite answer about whether I need to pay NYC resident tax on capital gains from the sale of rental real estate I sold in NYC. I used to live in NYC and owned rental property there. In mid 2018, I moved permanently out of the US and do not plan to live in the US again. I got in contract to sell my rental property a couple weeks before moving, but the closing did not happen until a month and a half after my move. I made a capital gain on the sale of this property. I know I need to pay NY state taxes on it, but do I also need to pay NYC taxes on it? I had ceased to be a NYC resident a month and a half after the sale closed, although I did get in contract to sell while I was still a NYC resident.

Oops sorry for the typo! I had ceased to be a NYC resident a month and a half *before* the sale closed! And to clarify, I am talking about NYC income tax and whether I need to include this capital gain as NYC source on IT-360.1

I just read that someone who moved from Ca 10 yrs ago is still being harassed by Ca about taxes.

I understand that Ca has a statutory law of 4 years to chase you down if they suspect you will return to Ca. They keep tabs on you especially if you are leaving behind family.

I want to sell some stock in a yr or two which amounts to $3,000,000. There is no way that I want to give Ca 14.2% tax. It’s enough I have to pay the Feds 28% and an additional 3.8% thanks to Obama! I have below poverty income presently. Otherwise I would probably have to have paid more in taxes. It’s not right to tax the only retirement money I have that would give me a better life.

I’m seriously thinking of moving to Florida long enough to establish residency. Who knows maybe I’ll stay there. I was born and raised here in Ca 72 years and this state and lack of leadership has sent our beautiful state to the dogs!!!

If you live in a state with income taxes and you go spend three or four months in Florida for the winter in a rental home, what if you sell equities while you are in florida?

I already know, (assume), california will try to get the taxes from you anyway. What about most other states? Will they not go after these taxes if you file a part year return for their state and don’t include the cap gains from those equities?

Can you define “establishing residency?” Is it the day you move to the state; or after a certain amount of time you have established residency but the start date is after that certain amount of time? And for example, what happens if you moved mid-year from California to Nevada, do they pro-rate or should you wait until the start of a new year?

Hi Biglawinvestor, thanks for an informative write up. Would you mind sharing your take on the “move from CA to TX or FL” scenarios? If the move is mid-year does prorating apply? Thank you.