Timing the market requires you to be right twice. You must be right when you buy and right when you sell. Good luck with that. It’s not going to happen. If you could time the market, you’d be famous and making millions of dollars leading a large hedge fund. Yet, I still talk to a lot of people who think they can time the market. What’s up with that?

Stop trying to time the market

Here’s some actual conversations I’ve had over the past couple of months with people about timing the market:

1) The Market Is At An All-Time High. “Why should I put my money in stocks today? The market is at an all-time high. I’m going to wait for it to cool off and then invest.”

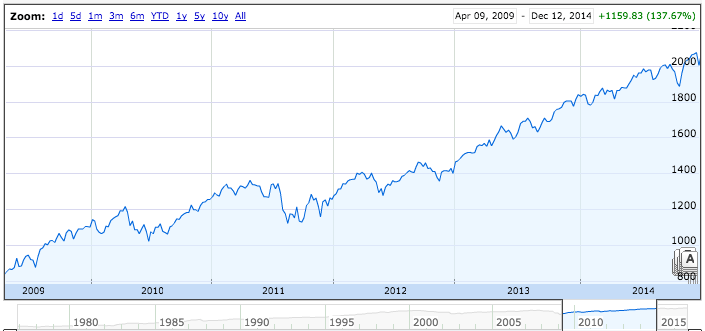

This one baffles me. Of course the market is at an all-time high. That’s how it works. Companies are always producing more goods and services and the economy is expanding. Take a look at the chart below with the historical view of the S&P 500 from 1976 through late November 2016. How many times would you say the market is at an all-time high? It looks like about 75% of the time to me. Therefore, this a terrible reason to not invest in stocks. Which brings me to the second argument.

2) I’ve been reading about the trouble with X and the results are going to hit the market pretty soon.

Lawyers are a smart bunch no doubt. They read things like the Economist, the New York Times and are generally informed about world events. This fact gathering is a bad idea for your investing career. Please stop immediately. The article you read in the Wall Street Journal about China’s currency problems does not give you special knowledge in the market. There are people who study Chinese currency all day long and they’re laughing at that article because they’ve known about those problems for years. I don’t believe that markets are perfectly efficient, but the market definitely already knows about the article you read in some popular press. Let it go.

But wait, were you the person that called the housing crises before it happened? Did you know that the market was overheated and the bubble was bound to burst? If so, I’d double-check your memory on that. In hindsight it’s human nature to connect the dots but going forward it’s impossible. The truth is that you and I have no idea what the market is going to do tomorrow. It could go up. It could go down. It could stay the same. Not exactly very helpful for predicting the future.

3) Everyone knows the market is going to tank/soar because of X news event.

This is another lie humans buy into and you need to look no further than a few weeks ago to see that you’re wrong. When Donald Trump unexpectedly won the presidency, everyone predicted the stock market would tank on the uncertainty of a Trump presidency. Smart investors talked up a “buying opportunity” and the DJIA futures showed a plunge of several percentage points. What happened the day after election? Stocks finished up. Of course we have no idea on the long-term effect of a Trump presidency on the stock market, but the idea that everyone knows the market is going to tank/soar based on a news event is rubbish.

4) Still think you can? Go play this game and good luck.

If you think you have the chops to time the market, it’s fun to play this game and see how well you can do. The game takes a random 10-year stretch from the stock market and you get to choose when to sell and when to buy back in. Good luck!

Time in the market matters

While it’s clear that you have no ability to time the market, you also need to think about the opportunity cost of sitting on the sidelines. For lawyers (a conservative bunch by nature) particularly, this cost often goes unnoticed but it’s very real. While you’re waiting for the right time to invest, your money is being silently destroyed by both inflation and the opportunity cost of missed bull markets.

Let’s say after the 2008-2009 stock market crash you made the right move and kept your current investments in the market. But for whatever reason, you decided to stop making future investments because you wanted to make sure you bought at the right time. When would you decide to buy back in?

As you can see, sitting on the sidelines cost you a serious amount of money. During the bull market run from mid-2009 to the end of 2014 stocks more than doubled at a growth rate of 137.67%. This would have been a bad time to be waiting on the right moment to invest.

However, if you were young and had a long investment horizon, it’s clear that the earlier you get into the market the better your returns over time. It turns out that time in the market really matters.

Let’s take one more random example and look back at the historical chart from 1976 where stocks returned 2052.3%.

Maybe the ‘70s made you skittish on investing with all the inflation, oil crises, etc. going on in the world and so you decided not to invest until it was morning in America again. If you look at the first chart, it doesn’t look like much happened between 1976-1984, so the damage couldn’t be that bad, right?

Yet, you would have given up $82,846 in growth on a $10,000 investment:

The time you spend in the market, including the ups, downs and the time when the market moves sideways really does matter. So stop trying to time the market and just jump in. You want your investments to spend as much time as possible in stocks and every day you delay shortens the horizon for the stock market to perform as it should.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

I do find myself trying to time the market. Even though I’ve heard many times from trusted mentors to just keep investing ignore the market. Yet I hesitate with my after tax brokerage account. Should I wait until stock is cheaper? Or should I just put the money in? Since this is money that is not automatically contributed every month, some days I just forget about. I just need to forget and take the plunge. I don’t plan to sell the index funds in decades anyways. My long term goal is to generate dividends so I can start building my passive financial nut.

Think about it this way. You’ve got two options. Either you make the investment automatic and it happens each month without any thought OR you spend mental energy each month weighing the consequences of whether it’s a good decision or a bad decision, because that’s just human nature. Maybe try it for 6 months automatic and see if you miss the mental anguish. I’ve definitely found over time that simple is the best solution (and often the hardest to achieve).

It’s funny, you always see the doom and gloom people constantly calling the next crash. The odds are much more likely that things go up, rather than down! If you’re just playing the numbers, investing now is the best bet.

I always look back at the folks from a few years ago who said that the market was too high and that they were waiting for the next crash. What they heck have they been doing then for the past 2 or 3 years?

The great thing about investing is that most of us simply don’t have huge sums of money to invest all at once. Just by the way our income works, most of us are going to be dollar cost averaging automatically. Most of us have decades of steady investing ahead of us.

Even if you pick the wrong time to start now, you’ll still probably be investing over the next few decades. That means if you picked the wrong time now, it’s not like you’ve invested every dollar you’ll ever invest! Some of your dollars are going to be invested at the “right time.” So you’ll “market time” it right just by accident if you’re steadily investing.

I like to think that I might be that one guy that could beat the market… ok, probably not, but wouldn’t that be great?! 🙂

I do time it somewhat though – when I have a little bit of cash, I usually wait until the market takes a small dip for the month and then throw it in there. It usually doesn’t mean much, but it still makes me feel like I got a deal.

— Jim