Continuing our series on student loans, today’s article will look at the status of your student loan. The status of a student loan – whether it’s repayment, grace period, deferment, forbearance, delinquency or default – may seem obvious but it’s worth understanding the nuance of each situation and is an important step in student loan management.

Grace period

The grace period status is unique and occurs after graduation but before repayment. No payments are required during the grace period, presumably with an eye toward giving students a chance to find a job.

Grace periods can only be used once during the life of the loan. A recent law graduate with loans from undergraduate may find that his undergraduate loans will begin repayment sooner than his law school loans because he’s already used up some of his grace period for the undergraduate loans.

It’s even more difficult for a recent graduate to navigate grace periods because different types of loans have different grace periods. The grace period for Stafford loans is six months. The grace period for Perkins loans is nine months. Federal Grad PLUS loans technically do not have a grace period, but there is an automatic six-month post-enrollment deferment after you cease to be enrolled at least half-time. There is no grace period for Federal Parent PLUS loans because they are paid by the parent. Private loans typically have a six-month grace period, although some may be nine months. Another thing to keep in mind is that grace periods must be used before you obtain deferments.

As you can imagine, the piecemeal student loan systems means a typical recent law graduate will have various loans entering repayment at different times. It will be a challenge to understand, therefore you must take action yourself. I suggest putting together a list of your loans and marking when each will enter repayment. Don’t wait for the student loan services to send you a bill.

One final consideration during grace period is that loans will continue to accrue interest in most circumstances. You may want to consider beginning repayment earlier, if possible, or at least making payments to cover the interest accrued each month.

Repayment

The repayment status if straightforward. You are making payments on your loans. Student loans go into repayment after the grace period.

Obligations. You make at least the minimum monthly payments on your loans. If you fail to make the minimum monthly payments, the lender may charge late fees, register adverse credit information on your credit report or possibly put the loans into default.

Alternatives. If you are unable to pay, you may have the option of putting the loans into deferment or forbearance, especially if the loans are federal. If the loans are private, you’ll need to contact your lender to see what options are available.

Deferment

During a deferment period repayment of the principal and interest of your loan is temporarily delayed.

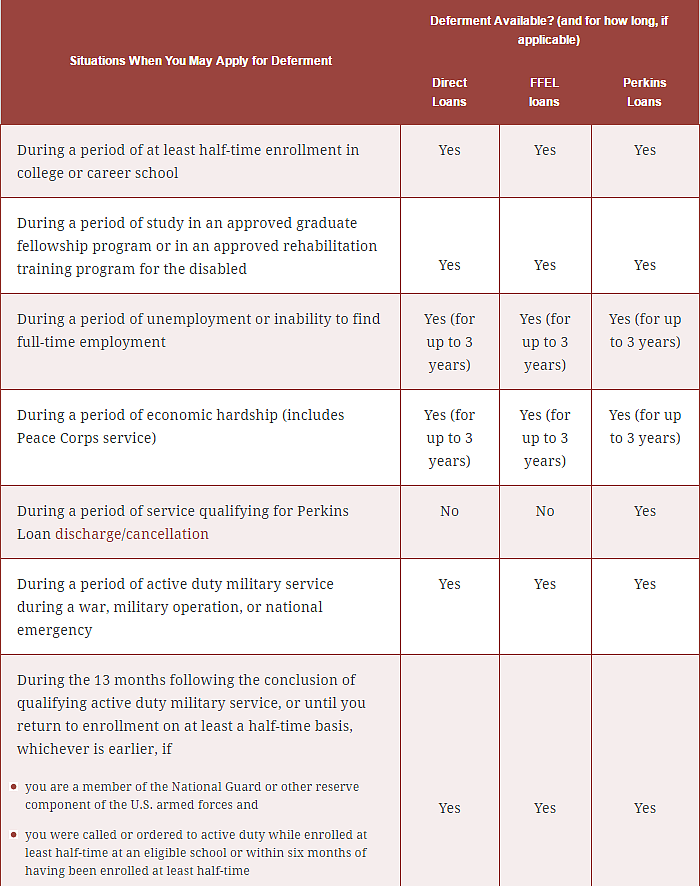

See the below table from the U.S. Department of Education covering deferment options. Except for subsidized loans, interest will continue to accrue during the deferment period.

Going back to school is the most common reason for loans entering deferment but several options are available.

Deferments are not automatic. You must submit a request to your loan servicer to obtain a deferment. From what I can tell, several of the deferment categories are “automatic” if you can prove other circumstances. For instance, you are eligible for the Economic Hardship Deferment if you are receiving welfare or in the Peace Corps. You are eligible for the Unemployment Deferment if you are receiving unemployment benefits. Note that both types of deferments only offer “three years” of deferment during the life of the loan.

Deferments, while helpful in terms of providing flexibility to the borrower, are essentially kicking the can down the road toward eventual student loan repayment. Since interest is continuing to accrue, it’s to your advantage to be paying as much as possible during a deferment period (unless of course you plan to enter a loan forgiveness program).

Forbearance

Forbearance covers situations where deferment isn’t available. There are two flavors: discretionary or mandatory. Discretionary forbearance is up to the lender. Mandatory forbearance covers situations like economic hardship, teaching service or serving in the National Guard.

Interest continues to accrue on all loan types during forbearance, including subsidized loans. This makes forbearance the worst possible option, short of delinquency. But let’s not kid ourselves, both forbearance and deferment are difficult situations to be in. If you had undergraduate student loans, you were likely in deferment on those loans during law school. If you did not make interest payments, take a look at those balances now to see how much they’ve grown over time.

Delinquency

Delinquency is when things start to get bad. You have fallen behind your student loan payments but the loans have not yet been placed into default.

Unfortunately, many recent law graduates may find themselves in delinquency when managing the various grace periods of undergraduate and graduate loans. It’s easy to not realize a loan payment is due, coupled with the fact that most borrowers are changing physical locations around this time (i.e. moving from law school to city of employment).

It’s imperative to avoid any student loans entering into delinquency. During this period, lenders have the option of charging late fees and making adverse entries in your credit report. You don’t want a black mark on your credit report regarding a student loan, especially for something as unnecessary as knowing when a payment is due.

From personal experience, I can also tell you that it’s good to check your credit report around the time you enter repayment. One of my loan servicers got a little trigger-happy and submitted a negative report to one credit bureau even though they were no longer servicing the loan! I got it fixed quickly, but it showed up again five years later on a different credit report (which I also got fixed).

You really have to stay on top of this bloated industry.

Default

If your loans are in default, you haven’t been making payments for quite some time. Federal loans typically go into default after nine months of delinquent payments. Private loans typically go into default much more quickly than federal loans, although it varies depending upon the terms of the private loans.

Upon default, the entire balance of the student loan is accelerated and due immediately. Federal loans in default may be sent to collections among other actions. In short, defaulting on your student loans has severe consequences worth an entire post of its own.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He is always negotiating better student loan refinancing bonuses for readers of the site.

I am in student debt (but will repay in full with 1 payment once my grace period is up). Have to take advantage of 0% interest rate.

Growing up, I’ve realized how much being in debt sucks and I’ve been looking to avoid all forms of debt if I can. Hoping that I can continue the streak.

You’re well ahead of just about everyone else if you’re going to pay off your debt in 1 payment. Why not do it now? How much are you making off the 0% interest rate? If you’ve got the money in a high-interest savings account earning 1% for six months, it’s not that much money. On $20K in debt that’s $100 in interest. Of course we never say no to free money in my household, but just food for thought that the $100 you’re earning isn’t entirely free – still having to think about the student loan debt, not freeing up your mind to concentrate on other stuff, etc.