It’s indisputable that we’re living in the most prosperous time the world has ever seen. And while you might think that’s always the case, there are plenty of historical periods where the quality of life slipped backwards (for instance, did you know that 50 years ago cross-country flights were actually faster than they are now? But I digress …)

Not only are we living in the most prosperous time, we’re accelerating into even more prosperity in a way that is difficult for us to comprehend.

Consider someone born in England in 1281 (700 years before me). The average life expectancy at birth for a male child was 31.3 years. However, if the boy made it to 20 he could expect to live to 45 and if he made it to 30 there was a good chance he’d live into his 50s.

Consider that same child born in 1381. The average life expectancy hadn’t shifted very much at all. Nor would the child born in 1381 have a remarkably different life than someone born nearly 100 years earlier.

In fact, if you plucked the child born in 1281 and placed him into the 1381 world, I doubt he would notice much difference. His mind certainly wouldn’t explode from shock.

Yet, the average world life expectancy is 1950 was 48 years and by 2014 it had climbed to 71.5. Not only that, between 1950 and 2014 we saw an explosion in technological innovation: leisure flying became affordable; cellular phones; space travel; modern computers; GPS; the Internet, etc., etc. Back in 1950, US companies were marketing the arrival of long distance calling.

A child born in 1881 would certainly feel out of place if swapped with someone born in 1981. The blistering pace of innovation and prosperity make those two worlds unimaginable. So much so, that the 1881 person would look at the vast majority of the current middle class as incredibly wealthy.

What is the New Rich?

Coined by Tim Ferriss, the New Rich is growing group of people that recognize the advantages of the modern world in a way that many people have a hard time grasping. The New Rich understand that through sheer luck, they’re living in a time of unlimited prosperity in a way that boggles the mind.

Quite simply, you can live better than a king in the 1300s for the price of a middle class American lifestyle. Why do I say better? Because you can fly anywhere you want to in the world, chasing endless summers (or endless winters), all the while walking around with a collection of all of humanity’s written knowledge in your pocket, for the price of a few economy airfare tickets and a smartphone.

Think about it this way: would you trade your current life to be a king or queen in the 1300s? What choice do you think a king or queen would make? I’ll bet you $100 that while the king or queen might have enjoyed the trappings of royalty, they’d probably gladly give it all away to live twice as long and for the ability to watch cat videos on Youtube.

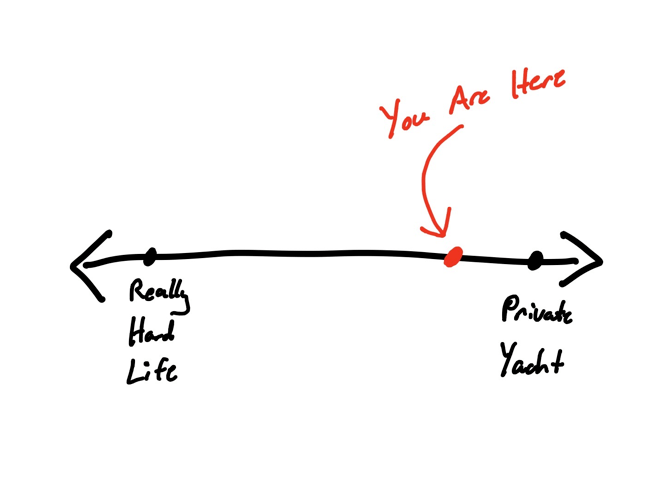

The New Rich also recognize that all of the modern luxuries aren’t that expensive. Sure, the New Rich can’t afford to rent a private yacht and tour the Caribbean. But the New Rich can afford to go to the Caribbean, something unimaginable only a couple of generations ago.

Essentially, we’re living in a world like this:

The New Rich recognize that for a small fraction of the price of the private yacht lifestyle, you can capture the majority of the luxury lifestyle thanks to rising world economic prosperity. Even better, it doesn’t cost as much as you think.

How much money do the New Rich have?

You’ll be forgiven if you think – like I did a few years ago – that the New Rich had $5,000,000 in the bank to support their lavish lifestyle. After all, if you’re making a six-figure income and feel like you’re barely scraping by, it’s understandable that you’d expect you’ll need millions of dollars in savings to replace lost income.

Let’s imagine a lawyer that’s bringing in $200,000 a year. Using the 4% Rule, you’d need a cool $5 million to replace that lifestyle, right?

Well, that’s obviously wrong and the same mistake I made. It doesn’t cost nearly $5 million to maintain a $200,000 lifestyle.

That’s because of a few reasons worth exploring, such as:

- Ordinary income is taxed at much higher rates than capital gains.

- In order to generate a $200,000 income, you need a host of services and assistance to keep your life going.

- You aren’t planning trips 6 months in advance and taking advantage of the best deals (who has time for that?), so spending is higher than normal.

- You might not have to live in that $3,000 city apartment if you don’t have to earn that $200,000 income.

- There’s a ton of things you’d do for yourself to keep expenses low if you weren’t working.

Even better, if you’re willing to move to a lower cost of living location, you can maintain the same $200K lifestyle on a fraction of the income. Is this an option for everyone? No. But are we living during a time when the option exists? Yes, we are.

Who are the New Poor?

The flip side of the New Rich is a group of people called the New Poor. The New Poor have average or above-average incomes but have found ways to spend their money on life’s consumption options. That’s totally fine. It’s their prerogative and we’re not here to judge.

But some people are starting to look at the trade-off and wondering if it’s worth it. Of course, that’s one of the great things about personal finance. It’s as much personal as it is about the numbers. Everyone has their own internal value on what they can get out of a dollar.

But what’s funny to me is that while putting together this article, I googled “the new rich” and expected to find all kinds of articles about how the “new rich” were building wealth that set them apart like no other generation.

Imagine my horror when I discovered that nearly every single article spoke of the “new rich” as those renting luxury condominiums and consuming everything they can. Paul F. Nunes called them “the new power brokers of consumption.” That’s not the New Rich. Those masters of the universe are the same that have been around for 100 years, finding new ways to be poor each year.

If you want to be part of the New Rich, no amount of consumption is going to get you there. The New Rich long ago recognized that the currency they trade in is time and experiences, not money and things. When you talk to almost anyone you can tell that they have a bit of the New Rich in them – the question is whether they want to embrace it? In my book, using your money to buy freedom is a smart move (ironically, it may lead you down the path of wanting to stay in your job when you’re no longer required to do so). But the New Rich have the option. It’s their choice.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He convinces the student loan refinancing companies to give you cashback bonuses for refinancing your student loans and looks forward to you discovering how easy it is to track your net worth with a free tool like Empower.

Love this post, has similar thoughts as another post on my blog that I did not write called ‘We Live Like Kings’, I am going to add a link to that post back to yours here. There is a revolution brewing in how we look at money, quality of life, and the connection between the two.

Such a good read. When I was reading about the New Rich, I had a friend in mind. The New Poor section, I had another friend in mind. And then the question was put on me…curses!

Depends on the day, for me. I want to feel like I am the New Rich, but then a bartender will turn to me and say, “That’ll be $9.60 for that beer.” And I am back being the poor again.

Short-term, I am somewhere in between. Long-term, I have no doubt that I can achieve this New Rich.

$9.60 will buy you a pretty nice six pack of craft beer to enjoy at home. With drinking, it’s like real estate. Price depends on location, location, location of imbibing.

You don’t have to time travel to feel New Rich, either. Fly in one of those slow airplanes to a second or third world country, and you’ll quickly see just how good the average American (or other first world country inhabitant) has it.

Cheers!

-PoF

Touche!

It’s so easy to forget how far society has come over the last few decades. From when I was a kid when a computer was an apple 2, Commodore 64, or TRS80. Mobile phones were as big as a brief case and cost as much as a house so no one had one. Now my four year old mid range purchased smart phone is better at both being a computer and a phone. Videoconferencing use to be some space aged concept, now it’s a fact of life with Skype and other systems. Today’s world is largely unrecognizable even to a kid of the 70s or 80s if they missed the ensuing in between years… and much of it can be had for pennies on the dollar if you can deal with not having the latest and greatest.

Very interesting post. It is so true how many of life’s luxury’s we all have today.

You don’t have to have a ton to enjoy some great life experiences.

It is quite amazing how fast technology is advancing. We are definitely in a period of exponential growth. Although the average life expectancy has probably leveled off, it will be interesting to see what things advancements in technology will improve.

It would be interesting to be king though!