Nearly all employers offer some form of reimbursement for work-related expenses. And yet nearly all employees fail to take advantage of these reimbursements, usually through sloppy bookkeeping on their part.

I know this because for years I had a “good enough” system for making sure all of my work-related expenses were appropriately reimbursed. My “good enough” system broke down when things got really busy because I didn’t have time or energy to keep track of the receipts. If you have a “good enough” system yourself, then you’re leaving money on the table.

Taking the time to develop a trusted system to capture reimbursable expenses is worth the effort because the reimbursements are your money. This is cash that is paid back to you. There’s no additional income taxes, you’re just being reimbursed as if your employer paid for the expense in the first place.

I’m most familiar with the reimbursements offered by the Biglaw firms (those following the Cravath scale) but I think most of these apply to small and medium-sized firms as well, except for the taxi and meal expenses.

The large firms offer reimbursement for: (1) taxi rides home if you work after a certain time; (2) meals if you work late or if you work on the weekend; (3) bar association dues / membership fees; (4) professional development; (5) business travel; (6) mobile phone data plan; and (7) business development expenses.

How can you make sure you’re capturing 100% of those expenses?

Setting up a system

The YNAB approach

For this task, I use the online budgeting tool You Need A Budget. I’ve played with different ways for categorizing these transactions over the year. Here is my current system.

When an expense comes in that is reimbursable, I move it out of the current account (usually a credit card account) into an account that is called Firm.

Here’s me moving an Uber ride that will be reimbursed.

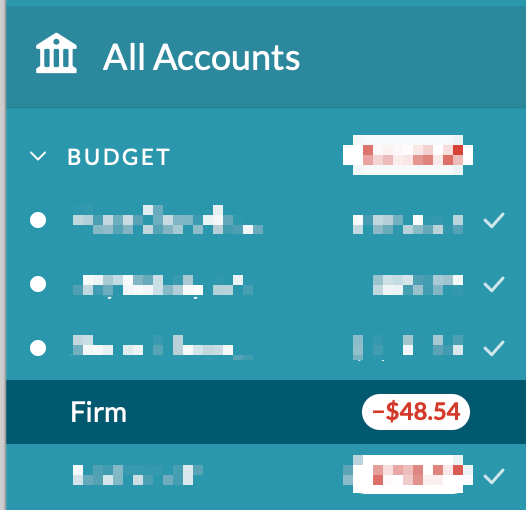

Now that the expense have been moved to the Firm account, the YNAB sidebar shows the Firm account (which is categorized by YNAB as a simple checking account) as showing a negative balance.

This account stays negative until I receive a direct deposit from my firm reimbursing this expense. When the reimbursement arrives, I move the deposit to the Firm account, bringing the Firm account to zero if I’ve been fully reimbursed.

At any given time, I can look at the Firm account and see how much I’m owed. I also tend to notice if a long time has gone by and that account hasn’t zeroed out, which is usually a sign of either a lagging reimbursement or a sign that I haven’t submitted a receipt.

If I didn’t submit something for reimbursement, it’s easy to find the transaction in the Firm account (since the account is only listing reimbursable expenses anyway). From there, I can do whatever I need to do to get it reimbursed.

The downside to this system is that it will cause some slight problems with your budgeting and reporting. On the budgeting side, it means your account balances won’t exactly match up. Since you’re moving income from a checking account into the Firm account, your checking account will show a lower balance in YNAB than it has in reality, while your credit card will also show a lower balance that is has in reality (because you are in effect netting the credit card payment instantly rather than whenever the credit card is paid off).

I find this inconvenience minimal since I use YNAB strictly for managing the money I’ve decided to spend. I don’t need to have the YNAB budget amounts match the actual amounts in the accounts because all of the money that is entered into YNAB is going to be spent anyway, so the account balances are meaningless along as the budget is good.

Work credit card

Another option is to open up a credit card specifically for reimbursable expenses. You’ll only use this card for work-related expenses, which means that any balance on the card means that you haven’t done your job of getting the expense reimbursed.

A lot of people prefer this method because it allows you to easily separate personal and work expenses. All you need to do is make sure that the credit card is paid off monthly via your checking account.

I’ve found two problems with this system that ultimately made me move away from it.

First, I would occasionally forget to put a firm expense on the credit card. This becomes a pain because it’s not like you can transfer it after the fact, so you’re stuck remembering about a handful of work expenses that showed up on your personal credit card.

Second, if the credit card is being paid off from your checking account automatically every month (which is how you should set it up), once a payment goes by, there’s really no way to reconcile whether you were reimbursed for the expense or not. If the point of the system is to prompt you to get all expenses reimbursed, the system fails because you may or may not have time to audit the reimbursements you’ve received to make sure the total matches with the credit card expenses paid.

Stacking paper receipts

Sure, you can stack your receipts on your desk. I see this all the time. If you have a reimbursable expense, you put the receipt on your desk and keep it there until you get reimbursed (at which point you can toss it).

The benefit of this system is that you have a visual reminder that a particularly expense has not yet been reimbursed. It’s also slightly easier to delegate, since you could potentially hand the stack of receipts to an assistant to help you process.

The downsides are obvious. We’re living in a world where there are less and less paper receipts. Do you really want to print out a receipt from Uber to keep on your desk? That sounds like a hassle to find the receipt and to print it out.

Types of expenses to capture

Here are expenses you should be capturing:

- Uber/Taxi Home from Work. Most firms will reimburse you if you leave the office after a certain time (e.g. 8:30pm). Learn your firm’s policy and take advantage when it makes sense. I find Uber convenient because Uber emails me a receipt at the end of the ride which I then forward to my assistant for reimbursement.

- Overtime Meals. If you work late (e.g. 7:30pm), often firms will reimburse you for a meal. In my experience, most firms set up an account with Seamless and allow you to order from using a client matter code. You may be able to carry in meals as well, though check your firm’s policy.

- Bar Association Dues/Membership. Anything associated with your license is likely reimbursable by your firm. Make sure to submit your membership to the American Bar Association, your license renewal fees, etc.

- Mobile Data Plan. In the old days, a firm handed you a Blackberry when you started and trained you to dread the flashing red light. With the death of Blackberries, many firms have switched to reimbursing you for the data plan while you use your own device. The reimbursement amount might be $60 a month regardless of how much you’re spending on your data plan.

- Professional Development. Some firms offer reimbursement for professional development. Professional develop expenses might include attending conferences or purchasing books or other items (like the ones I consistently recommend to corporate lawyers). These reimbursements are different from CLE credits. Many firms have a contract with a CLE provider like PLI. For professional development, I’ve found courses at places like CreativeLive and Udemy great for skill building. Keep in mind that your firm may cover professional development books you are already purchasing.

- Business Travel. Travel for work is a reimbursable expense. Make sure you capture all travel expenses.

- Business Development. Firms have different policies on business development expenses. Some firms will allow you to reimburse lunches and entertainment to encourage you to develop your own book of business or to strengthen relationships between the firm and its current clients. This means that your lawyer friends working at banks, private equity firms, corporations, etc. are fair game for lunch or evening events. Target events you wanted to attend anyway and pay for your friends to come. It’s a win/win situation for you and the firm.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is always negotiating better student loan refinancing bonuses for readers of the site.

So many reimbursable expenses!

Maybe I should consider a career in BigLaw?

Haha, I may have left out the part about taking on $200K in debt and spending three years in law school. But it’s amazing how many people do just that, end up in Biglaw and then get too busy to make sure they are taking advantage of these reimbursement opportunities.

Hi Josh, do you pay for the YNAB? The annual membership seems pricey compared to other alternatives.

What alternatives have you found? Feel free to DM in the chatbot on the bottom right-hand corner as I’d be interested in discussing. I’m still using YNAB 4 (the “old” version of YNAB where you paid for the software once). Every time I look at the budgeting landscape, I don’t really find too many great choices.