Invest in index funds? Nah, that’s boring. Suckers settle for average. I knew I needed to learn a few things about investing, so I started reading. After looking back through my Amazon orders (yes, this was before I realized NYC had a library), I can see that I read a lot of classics on investing in stocks.

I started with The Intelligent Investor, dabbled in Security Analysis, learned the importance of Quality of Earnings and even read Philip Fisher. Before I knew it, I was Understanding Options and learning a few Lessons For Corporate America from Warren Buffett. I was building a strong foundation in understanding the securities market! (Ed. – I get a tiny commission if you buy any of those books – thanks for helping support the site!)

The only problem was I still had no idea what I was doing. I invested in Cisco because I thought the stock was undervalued. I made a bit of money. I invested in Apple at half the value it’s trading at today and sold at close to the top. I made a lot of money on that investment. But I also lost some money in JC Penney and a Chinese real estate company.

To put it bluntly: I had no strategy except to make money. Not surprisingly, I hit a pretty big bump along the way. I’m grateful for that unfortunate turn of events though because it got me so much smarter going forward.

The $10,000 mistake

Back in the middle of 2014, I got a stock tip from a good friend of mine. He’s a smart guy, so I listened. Actually – he’s a very smart guy – so I thought if anyone knew about this industry it would be him. In fact, I still think he knows what he’s talking about, but the market does its own thing (more on that later).

After learning about the company, it seemed like a good bet. I started investing slowly. It was fun. My friend invested too, so we had camaraderie. We’d check the price of our investment, follow the news on Twitter and talk about the company’s products.

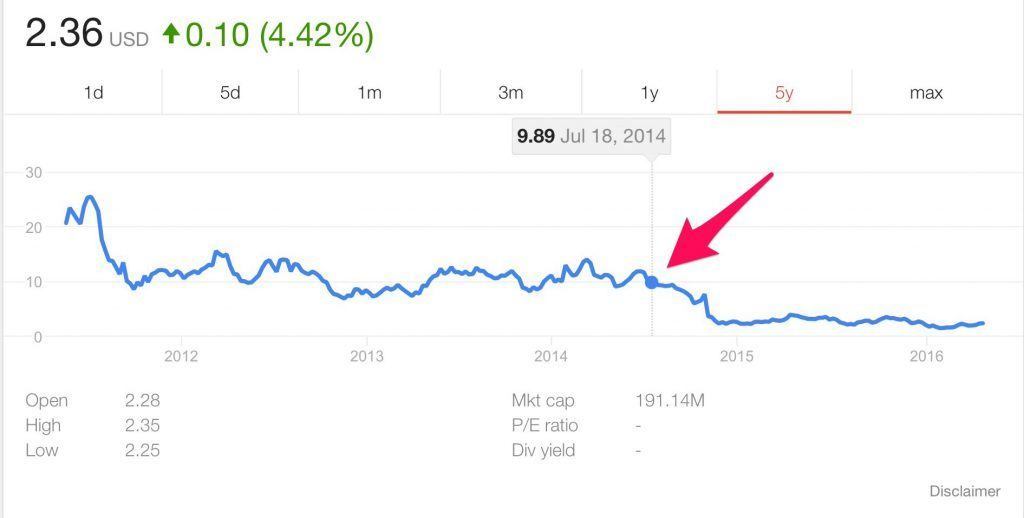

Not to give away the story, but I’m sure you can see where this is going. I kept investing and made my final investment right where the red arrow is pointing.

After the stock price plummeted, I lost about $10,000. It didn’t bother me (and still doesn’t), because I knew it was a risky bet going in. I didn’t panic and sell, which taught me a lesson about how I might handle future bear markets. Instead, I held onto the stock for another year and a half.

What did I learn?

I learned a few key important points from losing $10,000 on a single stock:

Risk Tolerance. My risk tolerance is pretty high. I never felt the need to sell. I didn’t lose any sleep after the paper loss. I regret losing the money, but do not regret making the investment.

To pick a stock you must be right about two things.

First, you have to know whether it will move up or down. I still think we’re right about it moving up. The market disagrees. Either way, it’s not enough to know whether a stock will move up or down.

Second, you also need to know when the stock will move. We could be right about the stock eventually moving up, but that might not happen for another 10 years. To be successful with individual stock investing, you must both predict its future movement AND when that movement will occur.

Investing in Individual Stocks Feels Like Gambling. It’s a lot of fun to invest in individual stocks. You get to track the market price and follow the news related to your company. In that sense, investing in individual stocks ate up too much of my free time. I became exhausted following the ups, downs and breaking news. In the end, I prefer simplicity. It’s less mentally taxing to own a boring low cost index fund.

Why I sold the stock

So, why did I sell the stock? It wasn’t easy. At first, I was reluctant to sell. The sunk cost fallacy froze me in place. That’s the tendency for humans to continue on a path because of previously incurred costs. You’re probably familiar with it when you’re motivated to attend an event you don’t want to attend because you’ve already paid $50 to go.

To overcome this, I used a simple thought experiment. If I had the market value of the stock (about $2,500 at the time) in cash, would I choose to invest it in this company? Said another way, would I recommend a friend who had $2,500 in cash to buy this stock?

The answer was clear. No way! And with that the spell was broken. I sold the stock and invested the $2,500 into a low cost index fund. I haven’t looked back since. Did it hurt to incur a loss of $10,000? Yes, it did. The United States taxpayers chipped in though to lesson the blow, which I appreciated – but still, it wasn’t easy.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Hey BI,

Nice topic and thanks for sharing your confession. I think every investor in the world will have made an investment that they wish they could take back – even Warren Buffett has some of those.

Our biggest mistake (hopefully ever, I’m glad we learned this lesson in our younger 20s, with small change, rather than a more expensive lesson!) was an investment in a law firm as a matter of fact. Slater & Gordon, the first listed law firm in the world was the one. Our initial investment wasn’t bad, but their purchase of parts of Quindell in the UK has been almost a total write off (literally, they did so in their last accounts). We’re down about 90% on our investment, though I actually think if they can weather this storm, they’ll recover quite a bit of what they’ve lost. I agree with your strategy to ignore sunken costs, and only look at where they’re going from. S & G would be a pretty risky investment, but it could pay off.

So our lessons were to be very careful of companies that have an acquisitive nature, and secondly to check the cash flow statement and ensure all earnings are being converted into cash. S & G has a lot of their earnings tied up in WIP. That was a useful lesson to learn too.

Tristan

That’s so interesting! I’m aware that Australia is one of the few jurisdictions where non-lawyers can own a law firm. In the US, for example, only lawyers can own a law firm, which means there is no equity to give away to institutional investors, a CTO, etc.

What’s your rationale for buying individual stocks rather than investing in the whole market? Have you written a post about that. Feel free to link it up here!

That’s interesting to me that we’re the rare case, I didn’t realise it was an actual law that law firms weren’t listing in other countries..

As for your question, yes we have done a topic on this, here it is:

https://dividendsdownunder.com/2016/03/24/index-funds-vs-stock-picking-in-australia/

Tristan

My biggest financial mistake was in real estate. Bought a house that was much bigger than I needed in an upscale neighborhood that was hard to sell into. Offered asking price in a slow market. Was influenced by our realtor and being insecure that we were young. Wanted to prove we had the money to be in that house. It was extremely dumb. We’re trying to sell it now but I think it will be a 10s of thousands of dollars mistake.

Thanks for posting that Julie. Too often we only hear the good stories about how someone made $100K on a house. Rarely do they reflect on the cost of ownership and the real results from the house purchase.

Hi BI,

Thank you for sharing. My biggest financial mistake was probably not to buy real estate here in Germany back in 2009 – I was very close.

My biggest loss was Fossil Inc, the Watch seller from US – fortunately it was not a huge position even when I bought more on the way down.

Greetings

valuetradeblog

nice Blog btw

Hi Valuetradeblog,

Thanks for sharing your biggest loss as well. What was your key takeaway from purchasing Fossil? Sometimes I wonder about whether I should have purchased a condo in NYC when I was younger (maybe around 2010-2011), but I think ultimately the flexibility afforded by renting has been healthier for me. Biglaw careers are not very stable, so I don’t think the added stress of a mortgage payment would have been helpful.

I saw your comments on physician on FIRE, which is how I found this blog. Looking through your posts and I really like what I see. Great blog!

Sorry for rubbing it in, but probably your second biggest mistake was not selling the losing position within one year to harvest the short-term loss, which could have been very useful in your high tax location.

There is another reason for index investing: you sell the losing index fund and buy a similar (not quite identical) fund the same day to harvest the loss. If the losing position miraculously recovers again, at least you participate on the upswing with the highly correlated other fund. That’s not so easy to do with individual stocks due to the wash sale rules.

Cheers!

Cool! Thanks for another great comment. Looks like we share a lot of the same interests.

Not sure that incurring a short term capital loss vs a long term capital loss would have made any difference.

Short term capital losses are first used to offset against short term capital gains (of which I had none).

The $10,000 long term capital loss incurred when I sold this stock was first applied against my long term capital gains (none) and then against my ordinary income up to the max of $3,000. It was super nice of the United States taxpayers to share in my loss! The carry-forward will be good for another couple of years too.

I’ve also taken advantage of tax-loss harvesting, which will be covered in future posts. I think it’s pretty magical that you can offset ordinary income taxes today in exchange for paying capital gains taxes tomorrow while not really altering your investment strategy.

Ah yes, forgot. The deduction applies to the LT losses as well,so I take that back. Glad you could write off the loss and let Uncle Sam chip in!

Thanks for sharing. Not everyone wants to publicly state how they didn’t do well on their blog but it’s great to read some of the mistakes that others have done to learn from them. I love the transparency!

We all make mistakes. It’s about learning from them going forward. The real shame is when you don’t try at all.

I got suckered into meeting with a “financial advisor” (i.e. salesperson) when I was a first year associate and she got me to sign up for a VUL policy with $1250 monthly premiums which I’ve dutifully paid. My husband tried to get me to cut our losses for the last year and a half but I was too stubborn. He ultimately prevailed on me by showing me an an article on the white coat investor about these policies. The surrender value today is around $30K but I’ve paid more than $50K into it. So I’m losing $20K on it. I never really understood the policy and that was the biggest mistake, I shouldn’t gotten involved in a financial instrument I didn’t understand; it always made me nervous but the salesperson was so persuasive.

Great question. When I married my wife she had a stock portfolio which included a couple of shares chosen by her father. Having performed some independent analysis it was fairly clear to me that the market value of the shares were well about the fair value -> c. 50% drops in the share price over the previous 6 months supported this. It was also increasingly clear that the companies would continue to decline in performance. The problem was the awkwardness of selling – my father in law was convinced that they would recover -> I believe he was in denial as he held the shares in his own portfolio and in his other child’s portfolio…..what would you have done in this scenario? I know what I did 😉

I also have the VUL policy and realise how much of a mistake it is. The hard part is going ahead with cancelling the policy and I would lose 10k. Thanks for the article.

Hello, what did you end up doing with that vul?