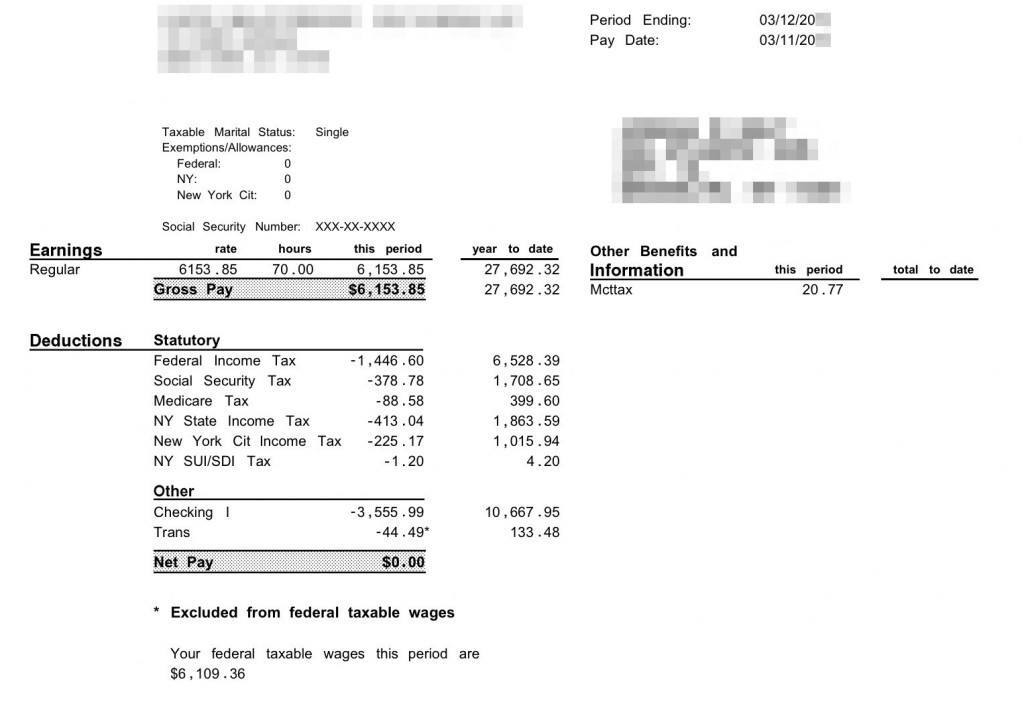

I thought readers might find it interesting to see an actual paystub from a Biglaw first-year associate $160,000 salary in NYC. I know that some readers are law school students who have not yet started working (possibly because they’ve been deferred). It can be helpful to get started early planning on how you will budget your income.

Paystub considerations

Before we dissect the paystub, there are a few factors that go into how it looks. In my experience, most firms pay bi-weekly. It’s nice to receive that extra paycheck twice a year, but it’s otherwise a pain for budgeting purposes since almost every bill you have is monthly. Some firms may monthly, which is much better for budgeting but eliminates that extra paycheck.

The other factor is your withholding elections. I’ve already argued you should be getting a big IRS refund. This means setting your withholdings to zero. You get less each pay period, but a spring bonus in the form of an IRS refund each year. I use the spring bonus to fund my Roth IRA each year.

An actual bi-weekly paystub

Earnings

When paid every two weeks, you can expect to receive $6,153.85 per paycheck. There’s nothing special here (except the extraordinary income), as $6,153.85 X 26 = $160,000.01.

Taxes

Federal Income Tax. Remember, by filing a W-4 and choosing zero exemptions I over-withheld taxes that year. Over-withholding means I received a Spring bonus from the IRS in the amount of approximately $5,000.

Social Security Tax. This represents 6.2% of federal taxable wages for this period. $6,109.36 X 6.2% = $378.78. In 2016, Social Security taxes apply to the first $118,500 earned. After you earn $118,500, you no longer pay the 6.2% tax (FICA).

Medicare Tax. This represents 1.45% of federal taxable wages for this period. $6,109.36 X 1.45% = $88.58. Medicare tax applies to all earned income with no limit. There is an additional tax of 0.9% that applies to income above $200,000 for single filers and $250,000 for married filers.

New York State and City Income Tax. It’s not cheap to live in NY. For single workers earning $160,000, New York state imposes a 6.65% income tax on income above $79,601. NYC imposes an additional 3.648% tax on income over $50,000.

NY SUI/SDI Tax. This tax relates to the State Disability Insurance (SDI). NY employers are required to purchase disability insurance and can charge an employee $0.60 per week to offset the policy premium, hence the $1.20 for this paycheck.

Mcttax. This is the Metropolitan Commuter Transportation Mobility Tax imposed on the law firm. The firm was kind enough to let me know that they’re paying this tax (I have no idea why). You’ll note it wasn’t actually subtracted from my salary.

Deductions

I’m sad to admit, but at the time my only available pre-tax deduction was the monthly NYC metro pass. I didn’t have access to a High Deductible Health Care Plan (so, did not have a corresponding Health Savings Account) and was not yet eligible for the firm’s 401K or other benefits.

Budget

If you found this interesting, you’ll probably like my Sample Budget: First-Year Associate that is updated to reflect the $[table “19” could not be loaded /]

starting salary for many first-year Biglaw lawyers.

Want to download the paystub as a PDF?

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is currently looking for additional lenders to add to Biglaw Investor’s JD Mortgage service which connects readers with lenders offering special mortgages for high-income professionals.

Im surprised you have them take so many taxes out. Im on the opposite end of the spectrum where I would rather owe taxes at the end of the year. As long as you use that money to invest and make a return it makes sense but dont get me wrong, its painful to have to write a check to the IRS every year.

🙂

It may make slight economic sense to invest the money throughout the year (although if you’re sticking it in a savings account, we’re probably only talking $10 worth of interest), but I think there’s a compelling case for young lawyers to forgo the money now and get it all back in the spring. After all, it’s easier to make one good decision to invest the $5000 tax return in a Roth IRA than it is to make 26 good decisions over the course of a year!

I agree with Alexander @ Cash Flow Diaries. With the relative ease that it takes to automate payroll deductions, why not set up automatic deductions to a savings account, whether bank or brokerage, instead of overwithholding? One good decision early on leading to 26 good decisions every year. Pay yourself first.

Why not do both? If you’re like most people, moving the extra money to a savings or brokerage account opens up the possibility of pulling that money back. When you overwithhold, there’s no opportunity to do so. Particularly, when you have a high income, I advocate finding as many different ways to force yourself to save as possible. Overwithholding plus splitting up your payroll is a winning combination.

You might also like:

https://www.biglawinvestor.com/how-to-choose-your-income-get-rich-slowly/

I also like the refund. It’s forced savings. I’ve become more badass over the years but until I’m super badass and can trust myself to save that money each paycheck, I’m going to keep my withholdings the way they are.

Exactly. If you’re saving too much money and tired of improving your badass-ity, then I can see why this strategy wouldn’t work.

Just to confirm, your bi-weekly take-home pay was $3555.99?

Confirmed.

That pay stub is wrong. It says 70hrs and most people work 80hr