One of the great benefits of making a little money in a side hustle or being paid as an independent contractor is that technically you’re operating as a separate business. It doesn’t matter if you’ve formed a corporation or an LLC. Sole proprietorships are businesses too, so if you’re generating any earned income outside of a typical W-2 job, congratulations! You probably own a business.

If you own a business, it’s not difficult to open a Solo 401(k) for your employees (i.e. you). Who doesn’t like more retirement accounts? They’re a great way to reduce the tax drag on a portfolio and helpful for taking advantage of the tax arbitrage between your high income earning years and your likely much lower income years in retirement.

What is a Solo 401(k)?

The Solo 401(k) is commonly referred to as an Individual 401(k) or sometimes the Self-Employed 401(k) or Personal 401(k). It’s not a new type of 401(k) plan but simply a traditional 401(k) plan covering a business owner with no W-2 employees (other than themselves or a spouse). A Solo 401(k) is much less burdensome than a traditional 401(k) plan you’d find at a company that has many employees (i.e. your Solo 401(k) isn’t subject to ERISA rules).

The Solo 401(k) is the most popular retirement plan for the self-employed, although surprisingly fairly new on the scene thanks to rule changes in 2001 which gave the Solo 401(k) all the attractive features of the regular employer 401(k) plan.

It’s a great account to have even if you’re only able to contribute a small amount each year. Keep in mind that you only have one employee contribution bucket (currently $18,000) that you can contribute across all of your 401(k) plans. However, there’s a different contribution limit on the employer side of equation, so you can continue contributing $18,000 to your work plan and then around 18-19% of your business profits to a Solo 401(k) up to a $54,000 limit.

Who are the best Solo 401(k) providers?

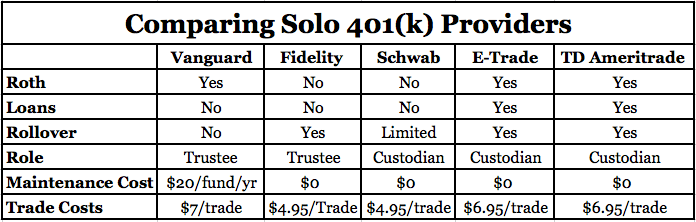

Selecting the right 401(k) provider takes a little legwork as there is no obvious choice. Each of the major solo 401(k) providers below have benefits/disadvantages such that you’re going to make a selection on what is right for you which could easily be different from what is right for someone else. In researching the article, it seemed clear that providing a solo 401(k) is a burdensome process for the administrator. Essentially you’re getting a 401(k) plan with all its complexity for very little cost (if any) and most firms offer it solely as a way to induce you to invest in their funds. For that reason, some providers are willing to deal with extra administrative burden (such as tracking Roth contributions or accepting rollovers) while others are not. Depending on your needs, you should select the provider that is right for you.

Vanguard Solo 401(k)

Vanguard is generally my preferred provider of investment accounts. Unfortunately, the Vanguard Solo 401(k) has a few critical flaws that make it a less than ideal choice for me. First, it charges a $20 per year fee for each Vanguard fund held in the account. This is a little surprising given that Vanguard is generally associated with the lowest fees. They waive this fee if you have more than $50,000 invested in Vanguard, so for me the fee isn’t an issue but I thought it worth pointing out all the same. More importantly, Vanguard still seems to be unwilling to accept incoming rollovers of IRA assets. That’s important to me because in the future if I leave a job, I may choose to rollover my 401(k) into a Traditional IRA and then will want to move my Traditional IRA into the Solo 401(k) to keep open the ability to make a Backdoor Roth IRA contribution. For that reason, I’m not able to select the Vanguard plan. Vanguard does offer pre-tax or Roth contributions and, of course, you have access to all the Vanguard funds. Strangely, you can’t access the Admiral funds in the solo 401(k), so expect to pay a little more for the Investor class shares. If incoming rollovers weren’t a big deal to me, I’d probably open a Solo 401(k) with Vanguard.

(Update: After thinking about this, I decided incoming 401(k) rollovers weren’t that important to me. I like the options in my current 401(k) and if I left my job I could always keep my current 401(k) provider or do a reverse rollover. Ultimately, I decided to open a Vanguard Solo 401(k) as keeping things simple is part of my Investment Policy Statement. It took 5 minutes on the phone plus another 15 minutes filling out forms.)

Fidelity Solo 401(k)

In recent years, Fidelity has begun to offer low-fee funds that rival and sometimes surpass Vanguard. For that reason, I’ve started to see them as a perfectly reasonable alternative to Vanguard if and when Vanguard isn’t available. In this case, the Fidelity Solo 401(k) accepts incoming IRA rollovers. That’s exactly what is missing from the Vanguard Solo 401(k), so it makes Fidelity an attractive option. Unfortunately, it seems like Fidelity doesn’t offer the entire package and some of you may not be happy with the results. They don’t have a Roth option and you can’t take out a loan against the 401(k), so if either are important to you then you should find a different provider.

Also, Fidelity doesn’t accept electronic contributions to the account. It might not be too annoying if you’re only planning on making one contribution a year but it’s strange that we’ve come this far with technology and Fidelity is still requiring paper checks. Read more at the Fidelity Solo 401(k) Plan Document.

Schwab Solo 401(k)

I have a brokerage account with Schwab. I used to own a few individual stocks, although now the account sits empty. They are a low-cost brokerage, so always a decent option when you’re looking for an account. Initially the Schwab Solo 401(k) only accepted rollovers from 401(k), 403(b) and 457(b) accounts but I now understand that they’ll accept rollovers from any type of account, including IRAs. They do not allow loans if that’s important to you. Read more at the Schwab Solo 401(k) Plan Document.

E-Trade Solo 401(k)

The ETrade Solo 401(k) is obviously a great plan if you’re looking for a brokerage to buy and sell individual stocks. They allow Roth contributions, accept IRA rollovers and also allow loans. This makes them an idea option if you’re looking for flexibility and low cost. I don’t have any personal experience with E-Trade so can’t say much about their customer service or their platform. However, they seem to tick all the boxes for a comprehensive plan. When researching this article, I frequently came across posts like this on the Bogleheads forum saying that E-Trade looked like the most flexible option, so why shouldn’t we go with it?

TD Ameritrade Solo 401(k)

The TD Ameritrade Solo 401(k) offers full brokerage services and commission-free ETFs from Vanguard. Unfortunately their site is a less clear on some of the other options (like Roth, rollovers, etc.) but it appears that they do allow Roth contributions and loans. The rollover portion is less clear (call them if interested and let me know) but I found reference in a Boglehead post that they do accept incoming IRA rollovers. If you have a Solo 401(k) with TD Ameritrade and know the answer, send me an email or let us know in the comments.

Comparing the best Solo 401(k) providers

Now that we’ve talked about the five major providers, I thought it’d be helpful to see a chart to see how each solo 401(k) provider compares with each other provider.

Remember that Vanguard’s fees are waived if you have more than $50,000 in assets with them. Also, most of the companies offer commission-free ETFs so you don’t necessarily have to pay the trading fees (particularly if you want to buy a product from one the solo 401(k) providers themselves).

Alternative Solo 401(k) providers

If you’re looking for something other than index funds or a brokerage account, there are several providers that will help you open a Solo 401(k) with “checkbook” control over your 401(k). These types of 401(k) plans can allow you to invest in alternative investments like real estate. I don’t have experience with these types of accounts but wanted to make sure you were aware that they existed. Here’s a big list of alternative solo 401(k) providers. I’d be interested to talk to anyone running their real estate empire out of a 401(k) or other tax advantaged account!

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

I’ve been using Fidelity for my Solo 401k to help reduce my own tax liability for my 1099 income.

If you’re in a high earning tax bracket and are earning money on the side, it’s doubly important to shelter as much as you can (ideally all of it if possible), since you’re getting hit with so many taxes on that extra income.

We just recently opened a Schwab solo 401k. Frankly at some point it goes to where your existing accounts sit when we’re talking about the big three of vanguard, fidelity, and Schwab.

Hi Biglawinvestor:

I am a real estate attorney in Miami and am a regular reader of your blog. My law firm offers a 401k(for which I contribute the max) but I also run a hard money lending business with my family (for which I am a principal investor). I want to set up a 401k or similar retirement vehicle for the hard money lending business. Any ideas? ERISA law is complicated and would appreciate some guidance. Thanks for your help and your great content.

I don’t know whether you can do that but I’d reach out to one of the “alternate” providers I linked to in the article. They are in the business of setting up checkbook 401(k)s which basically allow you to have checkbook access to your 401(k). If it can be done, I’m sure they would be happy to sell you their services. Let us know if you get this set up!

We use MySolo401k.net as a 401k for a side business we run so my husband can contribute. The fees seem reasonable and Mark Nolan, the Compliance Officer, responds to my email questions regarding the solo 401k within a business day. We have checkbook control at a local bank. We own true real estate and also crowdfund-type real estate investments in the 401k. We feel much more comfortable with real estate investments than stock (even mutual funds). We feel totally in control and our income is more predictable.

I use Schwab for mine and it’s been a pretty good experience overall. I really feel like erisa is such a pointless law and creates so much bad tech it’s ridiculous. I guarantee that’s why vangaurds fees are high in this space.

Schwab also only allows check contribution to a solo 401k. Did you find vanguard allows eft or is there a law somewhere. You can eft into any other Schwab account.

I have been using eTrade for a few years and everything was going well. But suddenly I’m having trouble making contributions. They think the cutoff date for certain types of contributions is Jan 30. In fact, that is only for people paid with W2’s (such as corporations) since that is the due date of the W2’s. Sole proprietors (and partnerships) have until the due date of the return for both employer and employee contributions. It’s right in the IRS documentation and I have confirmed it with 3 tax attorneys. But I can’t get eTrade to accept it. So now I may have to switch providers.

I just came across your blog. I am a former “Big Law”yer that has found a perfect home running my own RIA (Registered Investment Advisor).

I have had a TD Ameritrade solo 401(k) for several years. I am able to answer the questions you posed.

First, I am able to make normal pre-tax contributions or post-tax (Roth) contributions.

Second, I am able to take loans. Currently I have two loans against my 401(k).

Third, I am able to rollover from an IRA to my 401(k). I have done this once (and maybe twice, I might have done it on my wife’s side of the plan).

Fourth, even though it’s a “solo 401(k)” I am able to include my wife as part of the plan. She doesn’t work for me full-time but has done some part-time work for me in the past. We directed most of her pay into the 401(k) plan. She has also taken out two loans against her account.

Let me know if you have other questions about it.

Thanks Jeff. That’s great info and I appreciate you leaving the comment.

Were you also able to rollover from your 401k to an IRA (or only from an IRA to your 401k)? I’m wondering if they allow in-service withdrawals.

@Nia,

Yes in service withdrawals are allowed.

Hello, does your Solo 401K at TD Ameritrade allow you to:

1) Do After-Tax Contributions Above and Beyond the $19,500 Pre-Tax Contribution Limits (so that you can hit the IRS limit on total 401k contributions of $57,000 in 2020), AND

2) Do In Service Distributions Or Non-Hardship Withdrawals into a TD Ameritrade Traditional IRA, so I can then do a Mega Backdoor Roth IRA conversion from there?

Hi Jeff, could you please confirm if TD still allows 2 loans on the solo 401k. Couldn’t get a confirmation on this from TD reps.

Thanks

I am an independent contractor by myself and over 70 1/2 years young

Working

I have Vanguard

Is there an age limit to open a solo 401k pre tax to safe on taxes this year

So my biggest question with checkbook control in order to enable real estate holdings within your 401k, is once you turn 70 and a half and required minimum distributions are due, what then? Are you forced to sell your properties in order to pay the tax?

Nope, I don’t think so Mike. The required minimum distributions (RMDs) only mean that you have to distribute the asset out of your retirement account. There’s no requirement to sell the asset. So, if you want to keep your real estate holdings, you just have to transfer them from inside your retirement account to being held in your own name. Of course, that transfer will trigger income tax, which is the whole point of the RMDs anyway.

E-Trade now offers $0 commissions on most stock and ETF trades.

Fidelity reads the memo field on the paper check to know where to deposit funds. I have been contributing to three accounts under a solo option using my bank’s autopayment facility for years and have never had an issue. From my angle, it looks just like a wire transfer.